Explore Navy Federal mortgage options, including VA loans, conventional mortgages, and refinancing, with competitive rates and flexible terms, tailored to military members and veterans, offering exclusive benefits and savings.

The process of buying a home can be both exciting and overwhelming, especially when it comes to navigating the various mortgage options available. For members of the military, veterans, and their families, Navy Federal Credit Union offers a range of mortgage products designed to meet their unique needs. With a deep understanding of the challenges and opportunities that come with military service, Navy Federal has established itself as a trusted partner in the home-buying journey. In this article, we will delve into the world of Navy Federal mortgage options, exploring the benefits, features, and requirements of each, to help you make an informed decision about your home financing needs.

As a member of Navy Federal, you gain access to a comprehensive suite of mortgage products, each tailored to address specific aspects of military life, such as frequent relocations, variable income, and the desire to own a home. Whether you're a first-time buyer, looking to upgrade, or seeking to refinance your current mortgage, Navy Federal's mortgage options are designed to provide flexibility, affordability, and peace of mind. From conventional loans to government-backed mortgages, and from fixed-rate to adjustable-rate loans, the choices can seem daunting. However, by understanding the specifics of each option, you can better navigate the process and find the perfect fit for your financial situation and long-term goals.

The importance of choosing the right mortgage cannot be overstated. It's a decision that will impact your financial health for years to come, affecting everything from your monthly budget to your ability to achieve other financial goals, such as saving for retirement or your children's education. Navy Federal's commitment to its members is evident in the care and detail they bring to their mortgage offerings, ensuring that each product is not only competitive but also aligned with the unique challenges and opportunities of military life. By leveraging their expertise and the benefits of their mortgage options, you can turn the dream of homeownership into a reality, even in the face of the uncertainties that can come with military service.

Navy Federal Mortgage Products

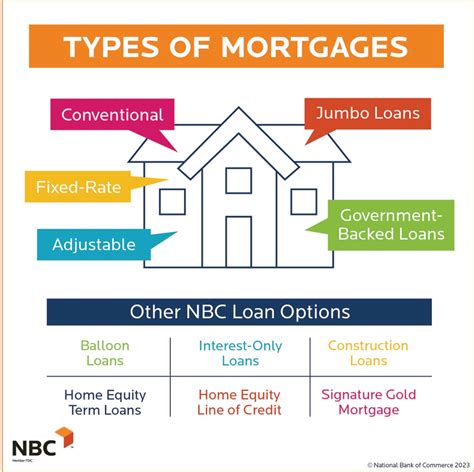

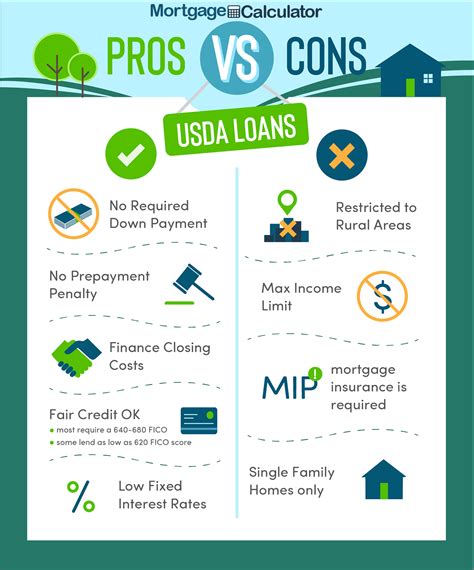

Navy Federal Credit Union offers a diverse range of mortgage products, each designed to cater to different needs and preferences. These include conventional loans, VA loans, FHA loans, USDA loans, and jumbo loans, among others. Conventional loans are ideal for those who wish to avoid mortgage insurance or have a significant down payment. VA loans, on the other hand, are exclusively for veterans, active-duty personnel, and surviving spouses, offering favorable terms such as no down payment requirement and lower interest rates. FHA loans are perfect for first-time buyers or those with less-than-perfect credit, as they require a lower down payment and have more lenient credit score requirements. USDA loans are designed for borrowers who wish to purchase homes in rural areas, offering zero down payment options and lower mortgage insurance premiums.

Benefits of Navy Federal Mortgage Options

The benefits of choosing Navy Federal for your mortgage needs are numerous. Members enjoy competitive interest rates, lower fees, and more flexible repayment terms compared to traditional lenders. Additionally, Navy Federal's mortgage products are designed with the military lifestyle in mind, offering features such as no origination fees on many loans, reduced funding fees for VA loans, and the ability to use a gift of equity from a family member towards the down payment. These benefits can significantly reduce the upfront and ongoing costs associated with homeownership, making it more accessible and sustainable for military families.Application and Approval Process

The application and approval process for Navy Federal mortgages is streamlined to ensure efficiency and minimal hassle. Potential borrowers can apply online, by phone, or in person at a branch, whichever is most convenient. The process typically begins with a pre-approval, which provides an estimate of how much you can borrow based on your income, credit score, and other financial factors. Once you've found a home and are ready to proceed, you'll submit a formal application, which will require documentation such as pay stubs, bank statements, and identification. Navy Federal's team of experienced mortgage professionals will guide you through each step, ensuring that you understand the process and can make informed decisions about your mortgage.

Requirements and Eligibility

To be eligible for a Navy Federal mortgage, you must be a member of the credit union. Membership is open to all branches of the military, veterans, Department of Defense civilians, and their families. Each mortgage product has its specific requirements, such as minimum credit scores, debt-to-income ratios, and down payment amounts. For example, VA loans require a certificate of eligibility, which confirms your military status and entitlement to the loan guaranty. Understanding these requirements upfront can help you prepare and increase your chances of approval.Mortgage Rates and Terms

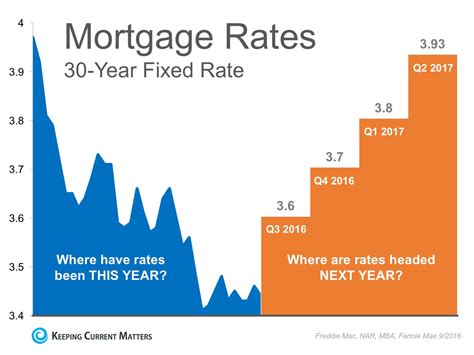

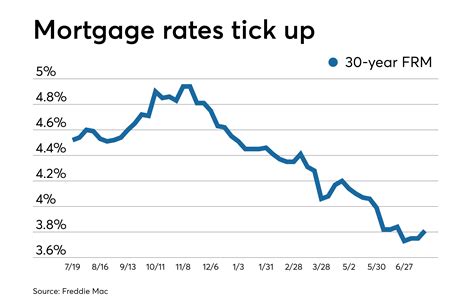

Navy Federal offers competitive mortgage rates that can help you save on your monthly payments and over the life of the loan. The rates available will depend on the type of loan you choose, your credit score, the loan term, and the current market conditions. Fixed-rate loans provide the stability of consistent monthly payments, while adjustable-rate loans may offer lower initial rates but come with the risk of rate increases over time. The terms of your mortgage, including the length of the loan and the repayment schedule, are also crucial considerations. Navy Federal's flexible terms can help you tailor your mortgage to your financial situation, whether you prefer a shorter loan term to pay less in interest or a longer term for more manageable monthly payments.

Refinancing Options

For those already in a mortgage, refinancing can be a viable option to lower monthly payments, tap into home equity, or switch from an adjustable-rate to a fixed-rate loan. Navy Federal's refinancing options are designed to be straightforward and beneficial, with competitive rates and terms. Whether you're looking to reduce your monthly mortgage payment, consolidate debt, or fund home improvements, refinancing through Navy Federal can provide the financial flexibility you need. It's essential to weigh the costs and benefits of refinancing, considering factors such as closing costs, the potential for lower interest rates, and the impact on your overall financial situation.Home Equity Loans and Lines of Credit

In addition to mortgage products, Navy Federal offers home equity loans and lines of credit, which allow you to tap into the equity you've built in your home. These products can be used for a variety of purposes, such as home renovations, paying off high-interest debt, or covering unexpected expenses. Home equity loans provide a lump sum, while home equity lines of credit (HELOCs) offer a revolving line of credit that you can draw upon as needed. Both options come with competitive rates and flexible repayment terms, making them attractive for borrowers who need access to funds but wish to leverage the value of their home.

Financial Education and Resources

Navy Federal is committed to empowering its members with the knowledge and tools necessary to make informed financial decisions. Through their website, branches, and customer service, members can access a wealth of information on mortgage options, application processes, and financial planning. This commitment to financial education reflects Navy Federal's broader mission to support the financial well-being of its members, recognizing that informed decision-making is key to achieving long-term financial stability and success.Conclusion and Next Steps

As you navigate the complex world of mortgages, it's clear that Navy Federal Credit Union stands out as a dedicated and knowledgeable partner for military families and individuals. By offering a range of mortgage products, competitive rates, and personalized service, Navy Federal helps make the dream of homeownership a reality. Whether you're just starting to explore your options or are ready to apply, the resources and expertise available through Navy Federal can guide you every step of the way. Remember, choosing the right mortgage is a critical decision that deserves careful consideration and planning. With Navy Federal by your side, you can feel confident in your ability to find the perfect mortgage to fit your unique needs and circumstances.

Gallery of Navy Federal Mortgage Options

Navy Federal Mortgage Image Gallery

We invite you to share your thoughts and experiences with Navy Federal mortgage options in the comments below. Whether you're a seasoned homeowner or just beginning your journey, your insights can help others make more informed decisions about their mortgage needs. Additionally, if you found this article helpful, please consider sharing it with friends, family, or colleagues who may benefit from the information. By supporting one another and leveraging the resources available through Navy Federal, we can work together to achieve our financial goals and secure a brighter future for ourselves and our loved ones.