Discover Navy Federal Routing Transit Number for secure transactions, direct deposits, and wire transfers, ensuring accurate payment processing with routing numbers and transit codes.

The Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, serving over 10 million members. As a member of Navy Federal, it's essential to understand the various aspects of banking with the credit union, including the Navy Federal routing transit number. In this article, we'll delve into the importance of the routing transit number, its uses, and how to find it.

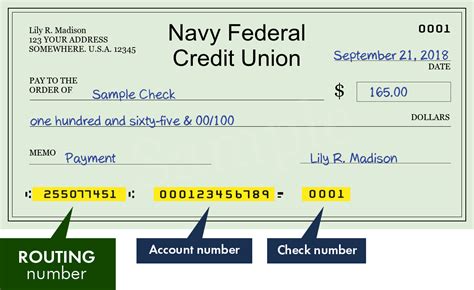

The Navy Federal routing transit number, also known as the ABA number or RTN, is a nine-digit code that identifies the financial institution and facilitates transactions between banks. This unique code is crucial for various banking activities, such as direct deposits, wire transfers, and automatic payments. Understanding the Navy Federal routing transit number is vital for members who want to manage their finances efficiently and avoid any potential issues with transactions.

The Navy Federal routing transit number is 256074974. This code is used for all types of transactions, including direct deposits, wire transfers, and automatic payments. It's essential to note that the routing transit number may vary depending on the location and type of transaction. However, for Navy Federal members, the above-mentioned code is the standard routing transit number used for most transactions.

Navy Federal Routing Transit Number Uses

The Navy Federal routing transit number has several uses, including:

- Direct deposits: The routing transit number is used to deposit funds directly into a member's account, such as payroll, Social Security benefits, or tax refunds.

- Wire transfers: The routing transit number is used to facilitate wire transfers between banks, allowing members to send and receive funds quickly and securely.

- Automatic payments: The routing transit number is used to set up automatic payments for bills, loans, and other transactions, ensuring that payments are made on time and without any issues.

- Check ordering: The routing transit number is used to order checks, which can be used for various transactions, such as paying bills or making purchases.

Benefits of Using the Navy Federal Routing Transit Number

The Navy Federal routing transit number offers several benefits to members, including: * Convenience: The routing transit number allows members to manage their finances efficiently, making it easy to set up direct deposits, wire transfers, and automatic payments. * Security: The routing transit number ensures that transactions are secure and accurate, reducing the risk of errors or fraud. * Speed: The routing transit number facilitates fast and secure transactions, allowing members to access their funds quickly and easily.How to Find the Navy Federal Routing Transit Number

Finding the Navy Federal routing transit number is relatively easy. Members can find the routing transit number on:

- Checks: The routing transit number is printed on the bottom left corner of checks.

- Online banking: Members can log in to their online banking account and find the routing transit number under the account information section.

- Mobile banking app: Members can access the mobile banking app and find the routing transit number under the account information section.

- Navy Federal website: Members can visit the Navy Federal website and find the routing transit number under the FAQs or account information section.

Tips for Using the Navy Federal Routing Transit Number

Here are some tips for using the Navy Federal routing transit number: * Always verify the routing transit number before setting up transactions to ensure accuracy and avoid any potential issues. * Use the correct routing transit number for the type of transaction, as different transactions may require different routing transit numbers. * Keep the routing transit number secure to prevent unauthorized access to accounts.Navy Federal Routing Transit Number for Wire Transfers

The Navy Federal routing transit number for wire transfers is the same as the standard routing transit number, which is 256074974. However, members may need to provide additional information, such as the recipient's name, account number, and address, to facilitate the wire transfer.

Domestic vs. International Wire Transfers

Domestic wire transfers typically require the standard routing transit number, while international wire transfers may require additional information, such as the SWIFT code. The SWIFT code for Navy Federal is NFBUUS33.Navy Federal Routing Transit Number for Direct Deposits

The Navy Federal routing transit number for direct deposits is the same as the standard routing transit number, which is 256074974. Members can provide the routing transit number and account number to their employer or benefits provider to set up direct deposits.

Benefits of Direct Deposits

Direct deposits offer several benefits, including: * Convenience: Direct deposits allow members to receive their funds quickly and easily, without the need to visit a branch or ATM. * Security: Direct deposits reduce the risk of lost or stolen checks, ensuring that funds are deposited securely into the member's account. * Speed: Direct deposits facilitate fast access to funds, allowing members to use their money as soon as it's deposited.Navy Federal Routing Transit Number for Automatic Payments

The Navy Federal routing transit number for automatic payments is the same as the standard routing transit number, which is 256074974. Members can provide the routing transit number and account number to their billers or service providers to set up automatic payments.

Benefits of Automatic Payments

Automatic payments offer several benefits, including: * Convenience: Automatic payments allow members to make payments quickly and easily, without the need to write checks or visit a branch. * Security: Automatic payments reduce the risk of late payments, ensuring that bills are paid on time and without any issues. * Speed: Automatic payments facilitate fast and secure transactions, allowing members to access their funds quickly and easily.Navy Federal Routing Transit Number Image Gallery

In conclusion, the Navy Federal routing transit number is an essential aspect of banking with the credit union. Understanding the routing transit number and its uses can help members manage their finances efficiently and avoid any potential issues with transactions. By following the tips and guidelines outlined in this article, members can ensure that their transactions are secure, accurate, and fast. If you have any questions or concerns about the Navy Federal routing transit number, feel free to comment below or share this article with others who may find it helpful. Remember to always verify the routing transit number before setting up transactions to ensure accuracy and avoid any potential issues.