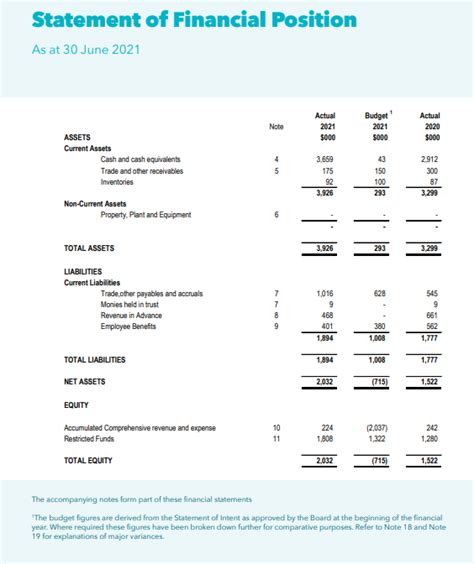

As a small business owner, managing your finances effectively is crucial for the success and growth of your company. One of the most important financial statements that can help you achieve this is a balance sheet. A balance sheet provides a snapshot of your business's financial position at a specific point in time, showcasing its assets, liabilities, and equity. In this article, we will discuss the importance of a balance sheet for small businesses, its components, and provide a free printable balance sheet template to help you get started.

A balance sheet is a fundamental financial statement that provides stakeholders, including investors, creditors, and management, with a comprehensive view of a company's financial situation. It is called a balance sheet because it presents a balanced view of a company's financial position, where the total value of assets equals the total value of liabilities plus equity.

Components of a Balance Sheet

A balance sheet typically consists of three main components: assets, liabilities, and equity.

Assets

Assets represent the resources owned or controlled by a business, which are expected to generate future economic benefits. Common examples of assets include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Property, plant, and equipment

- Investments

- Intangible assets, such as patents and copyrights

Liabilities

Liabilities represent the debts or obligations that a business owes to others, which must be settled in the future. Common examples of liabilities include:

- Accounts payable

- Short-term loans

- Long-term debt

- Taxes owed

- Accrued expenses

Equity

Equity represents the ownership interest in a business, which is the residual interest in assets after deducting liabilities. Common examples of equity include:

- Common stock

- Retained earnings

- Dividends

Benefits of Using a Balance Sheet Template

Using a balance sheet template can provide several benefits to small business owners, including:

- Improved financial management: A balance sheet template helps you organize and track your financial data, enabling you to make informed decisions about your business.

- Enhanced accountability: A balance sheet template ensures that you are aware of your business's financial obligations and can plan accordingly.

- Increased transparency: A balance sheet template provides stakeholders with a clear view of your business's financial situation, which can help build trust and credibility.

- Simplified financial reporting: A balance sheet template makes it easier to prepare financial reports, such as annual reports and tax returns.

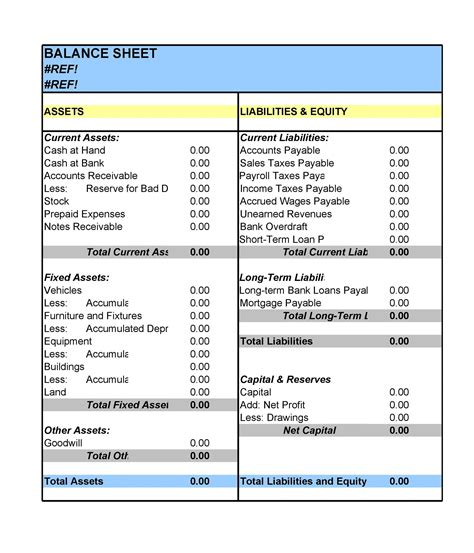

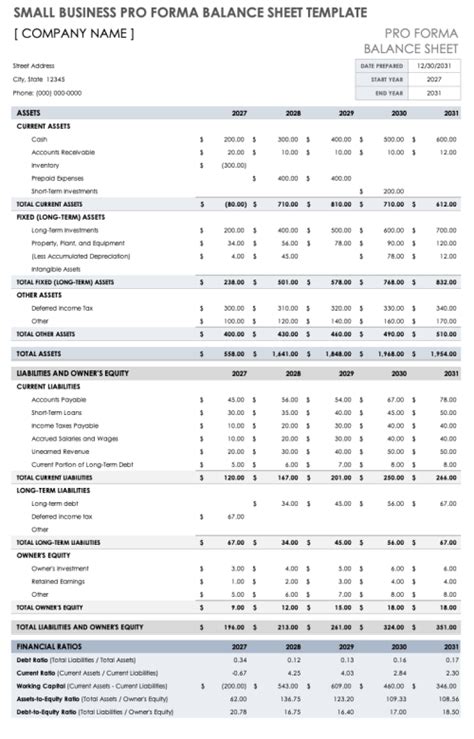

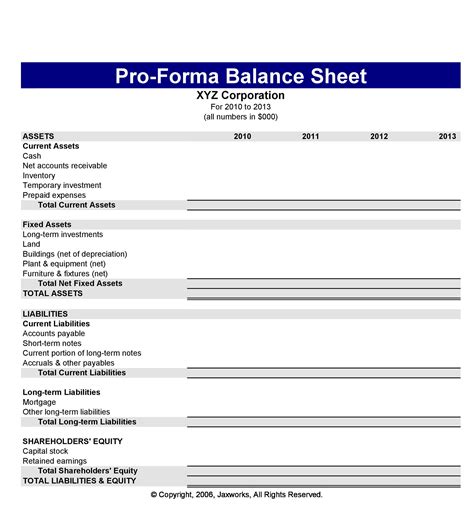

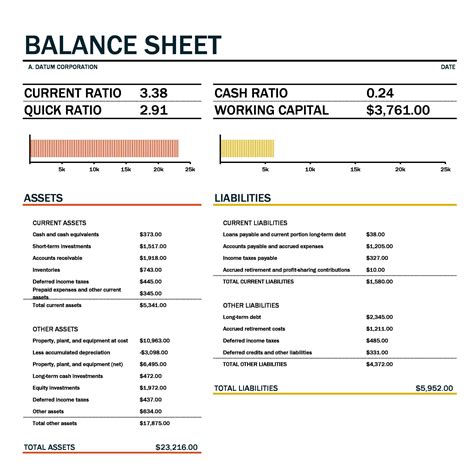

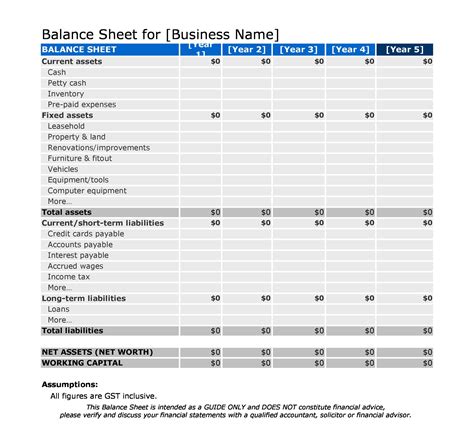

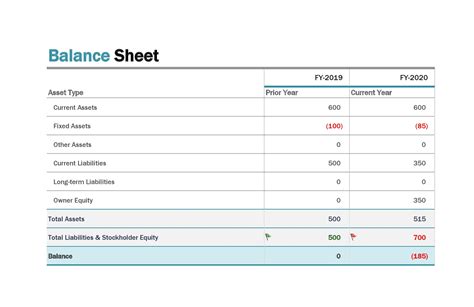

Free Printable Balance Sheet Template

To help you get started with creating a balance sheet for your small business, we are providing a free printable balance sheet template. This template is designed to be user-friendly and easy to understand, with clear instructions and examples.

You can download the template by clicking on the link below:

[Insert link to downloadable template]

How to Use the Balance Sheet Template

Using the balance sheet template is easy. Simply follow these steps:

- Download the template and save it to your computer.

- Open the template in a spreadsheet program, such as Microsoft Excel or Google Sheets.

- Enter your business's financial data into the template, using the examples and instructions provided.

- Review and analyze your balance sheet to identify areas for improvement and make informed decisions about your business.

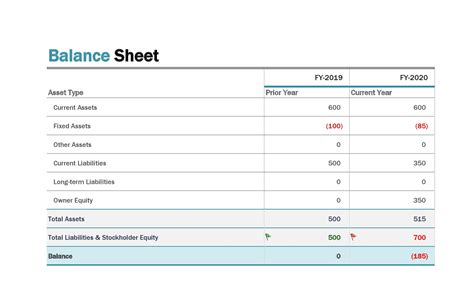

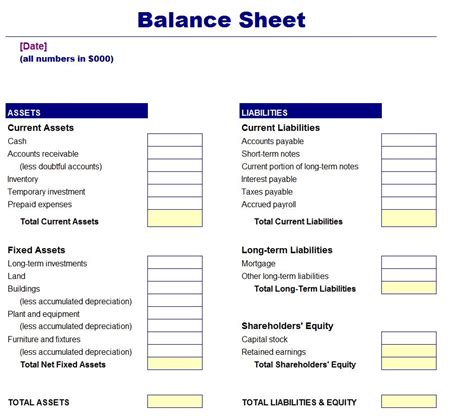

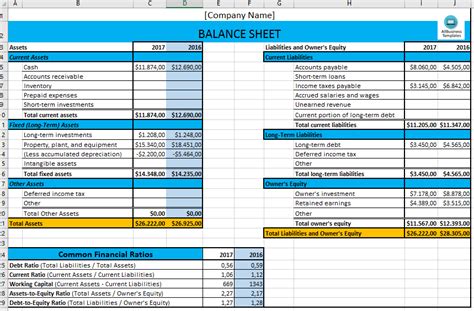

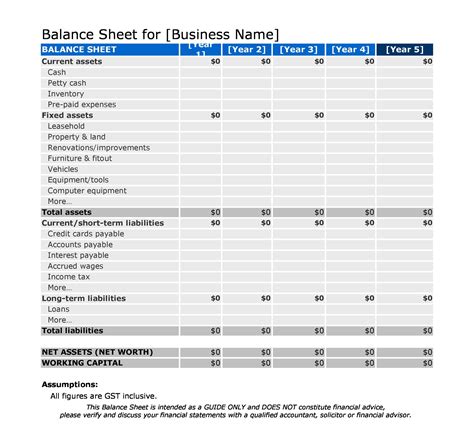

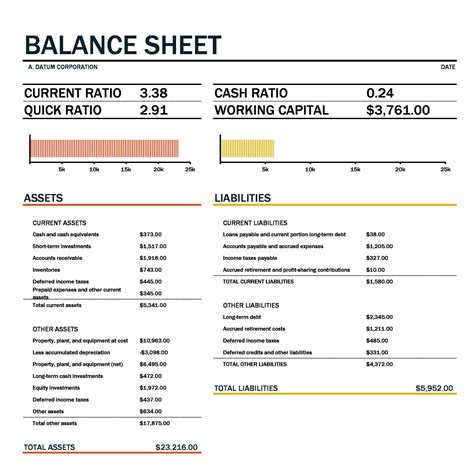

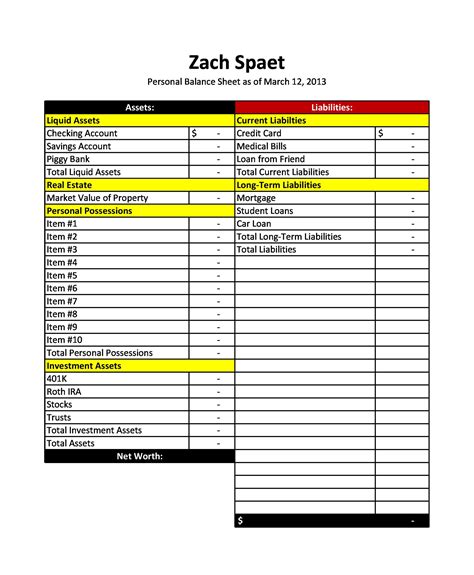

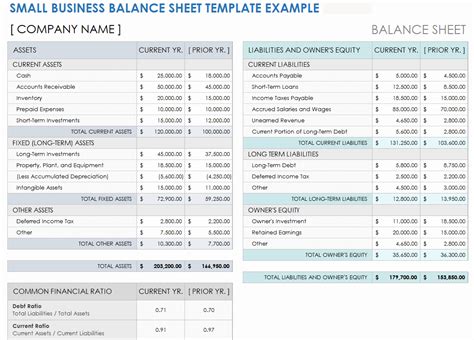

Gallery of Balance Sheet Templates

Balance Sheet Templates Gallery

By using a balance sheet template, you can streamline your financial management and make informed decisions about your small business. Remember to regularly review and update your balance sheet to ensure that it accurately reflects your business's financial situation.