Intro

Discover competitive Travis Credit Union savings rates, featuring high-yield savings accounts, money market rates, and certificate rates, helping you maximize savings and achieve financial goals with flexible banking options.

Travis Credit Union is a not-for-profit financial cooperative that offers a wide range of financial services to its members, including savings accounts with competitive interest rates. Savings rates are an essential aspect of personal finance, as they can help individuals grow their wealth over time. In this article, we will delve into the world of Travis Credit Union savings rates, exploring their benefits, types of savings accounts, and how they compare to other financial institutions.

The importance of savings rates cannot be overstated. A high-yield savings account can earn individuals a significant amount of interest on their deposits, which can be used to achieve long-term financial goals, such as buying a house, funding education, or retiring comfortably. Moreover, savings rates can also serve as a benchmark for other financial products, such as loans and credit cards. By understanding the intricacies of savings rates, individuals can make informed decisions about their financial lives.

Savings rates are influenced by various factors, including economic conditions, monetary policy, and market trends. The Federal Reserve, the central bank of the United States, plays a crucial role in shaping savings rates through its decisions on interest rates. When the Federal Reserve lowers interest rates, banks and credit unions often follow suit, which can lead to lower savings rates. Conversely, when interest rates rise, savings rates tend to increase, making it more attractive for individuals to save.

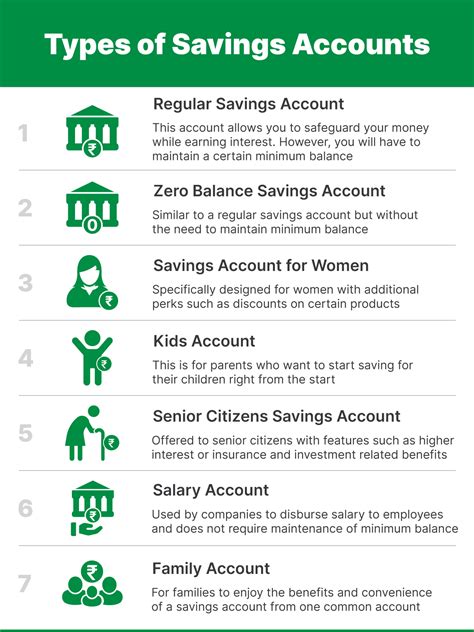

Types of Savings Accounts

Travis Credit Union offers various types of savings accounts to cater to different financial needs and goals. These accounts include:

- Share Savings Account: A basic savings account that requires a minimum balance of $1 to open and earn interest.

- Money Market Savings Account: A savings account that earns a higher interest rate than a traditional savings account, but may require a higher minimum balance.

- Youth Savings Account: A savings account designed for minors, which can help them develop good savings habits from an early age.

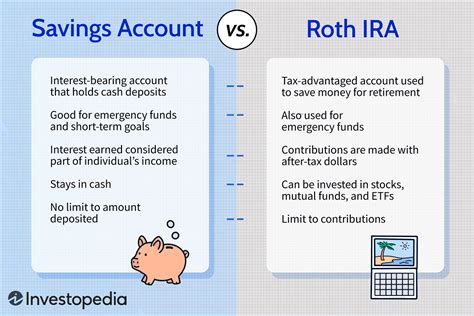

- IRA Savings Account: A savings account specifically designed for retirement savings, which offers tax benefits and potentially higher interest rates.

Each type of savings account has its unique features, benefits, and requirements. By choosing the right savings account, individuals can optimize their savings strategy and achieve their financial objectives.

Benefits of High-Yield Savings Accounts

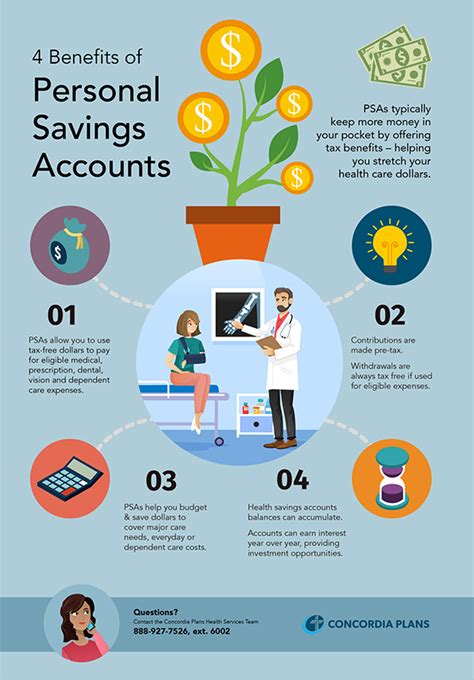

High-yield savings accounts, such as those offered by Travis Credit Union, provide several benefits to savers. These benefits include:

- Higher Interest Rates: High-yield savings accounts earn higher interest rates than traditional savings accounts, which can result in more significant interest earnings over time.

- Liquidity: High-yield savings accounts typically offer easy access to funds, allowing individuals to withdraw their money when needed.

- Low Risk: High-yield savings accounts are generally low-risk investments, as they are insured by the National Credit Union Administration (NCUA) or the Federal Deposit Insurance Corporation (FDIC).

- Flexibility: High-yield savings accounts can be used for various financial purposes, such as emergency funds, short-term savings, or long-term investments.

By taking advantage of high-yield savings accounts, individuals can potentially earn more interest on their savings, achieve their financial goals, and enjoy greater peace of mind.

How to Choose the Best Savings Account

Choosing the best savings account can be a daunting task, given the numerous options available. However, by considering the following factors, individuals can make an informed decision:

- Interest Rate: Look for savings accounts with competitive interest rates that can help grow your savings over time.

- Fees: Be aware of any fees associated with the savings account, such as maintenance fees, overdraft fees, or ATM fees.

- Minimum Balance Requirements: Consider the minimum balance requirements for the savings account, as well as any potential penalties for falling below the minimum balance.

- Accessibility: Evaluate the ease of access to your funds, including online banking, mobile banking, and ATM networks.

- Customer Service: Assess the quality of customer service provided by the financial institution, including phone support, email support, and in-person support.

By carefully evaluating these factors, individuals can select the best savings account for their unique financial needs and goals.

Travis Credit Union Savings Rates Comparison

Travis Credit Union savings rates are competitive with other financial institutions, offering attractive interest rates on various savings accounts. Here's a comparison of Travis Credit Union savings rates with other credit unions and banks:

- Travis Credit Union: Offers a range of savings accounts with interest rates between 0.10% APY and 2.50% APY, depending on the account type and balance.

- Other Credit Unions: May offer similar interest rates, ranging from 0.05% APY to 3.00% APY, depending on the credit union and account type.

- Banks: Typically offer lower interest rates, ranging from 0.01% APY to 1.50% APY, depending on the bank and account type.

It's essential to note that interest rates can fluctuate over time, and individual results may vary. By regularly reviewing and comparing savings rates, individuals can ensure they're getting the best possible return on their savings.

Gallery of Savings Accounts

Savings Accounts Image Gallery

In conclusion, Travis Credit Union savings rates offer competitive interest rates on various savings accounts, making them an attractive option for individuals looking to grow their savings. By understanding the benefits, types, and requirements of savings accounts, individuals can make informed decisions about their financial lives. Whether you're looking to save for a short-term goal or a long-term investment, Travis Credit Union savings rates can help you achieve your financial objectives. We invite you to share your thoughts on savings rates and accounts in the comments below, and don't forget to share this article with others who may benefit from this information.