Intro

Get instant access to 5 easy 1099 pay stub templates for freelancers and independent contractors. Create accurate pay stubs with ease using our free templates, perfect for tax filing and record-keeping. Say goodbye to tedious calculations and hello to streamlined payroll processing with our customizable and printable 1099 pay stub templates.

Creating a 1099 pay stub can be a daunting task, especially for small business owners or freelancers who are new to managing their finances. However, with the right tools and templates, you can easily create accurate and professional pay stubs. In this article, we will explore five easy 1099 pay stub templates that you can use now to streamline your financial management.

Why Use a 1099 Pay Stub Template?

Before we dive into the templates, let's discuss why using a 1099 pay stub template is essential for your business. A pay stub template helps you to:

- Create accurate and professional pay stubs quickly

- Ensure compliance with IRS regulations

- Reduce errors and discrepancies

- Improve record-keeping and financial management

- Enhance transparency and trust with your contractors or employees

Benefits of Using a 1099 Pay Stub Template

Using a 1099 pay stub template offers numerous benefits, including:

- Time-saving: Templates save you time and effort in creating pay stubs from scratch.

- Accuracy: Templates help you avoid errors and ensure that your pay stubs are accurate and compliant with IRS regulations.

- Professionalism: Templates give your pay stubs a professional look, which enhances your business image and credibility.

- Customization: Templates allow you to customize your pay stubs to suit your business needs and branding.

5 Easy 1099 Pay Stub Templates to Use Now

Here are five easy 1099 pay stub templates that you can use now to create accurate and professional pay stubs:

1. Microsoft Excel 1099 Pay Stub Template

Microsoft Excel offers a free 1099 pay stub template that you can download and use. This template is easy to use and customize, and it includes all the necessary fields and formulas to calculate taxes and deductions.

2. Google Sheets 1099 Pay Stub Template

Google Sheets also offers a free 1099 pay stub template that you can use. This template is cloud-based, so you can access it from anywhere and collaborate with others in real-time.

3. Adobe PDF 1099 Pay Stub Template

Adobe PDF offers a free 1099 pay stub template that you can download and use. This template is easy to customize and includes all the necessary fields and formulas to calculate taxes and deductions.

4. QuickBooks 1099 Pay Stub Template

QuickBooks offers a 1099 pay stub template that you can use to create accurate and professional pay stubs. This template is integrated with QuickBooks accounting software, so you can easily track and manage your finances.

5. FreshBooks 1099 Pay Stub Template

FreshBooks offers a 1099 pay stub template that you can use to create accurate and professional pay stubs. This template is integrated with FreshBooks accounting software, so you can easily track and manage your finances.

Creating a 1099 Pay Stub from Scratch

If you prefer to create a 1099 pay stub from scratch, here's a step-by-step guide to help you get started:

- Gather necessary information: Collect the necessary information, including the contractor's name, address, Social Security number, and payment details.

- Choose a template or design: Choose a template or design your pay stub to include all the necessary fields and formulas.

- Calculate taxes and deductions: Calculate taxes and deductions using the IRS guidelines and formulas.

- Add payment details: Add payment details, including the payment date, amount, and method.

- Review and verify: Review and verify the pay stub for accuracy and completeness.

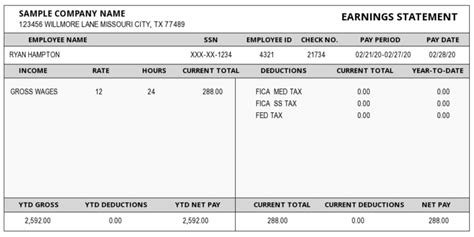

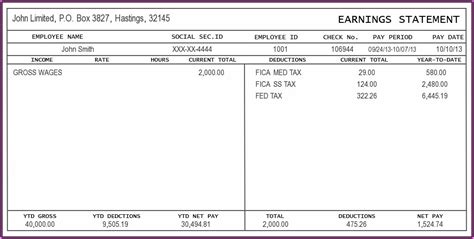

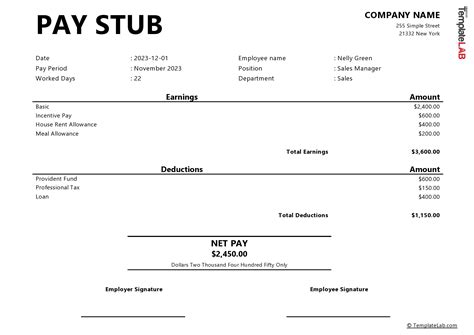

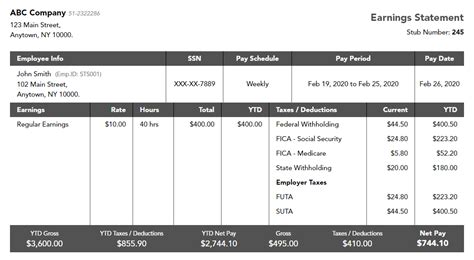

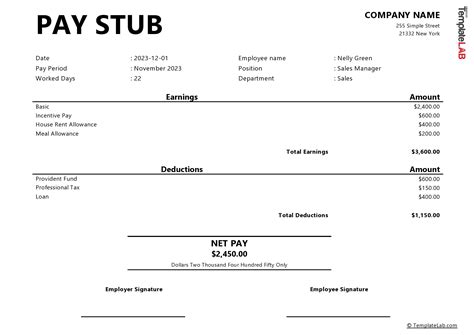

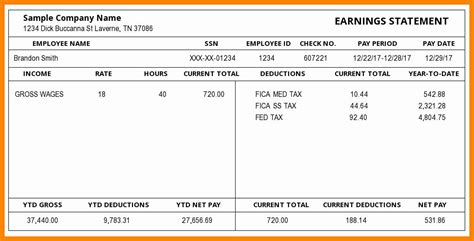

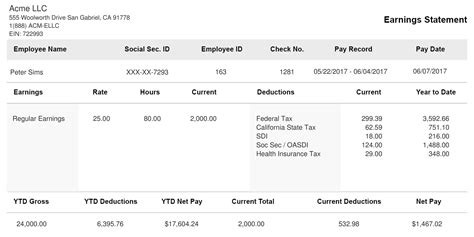

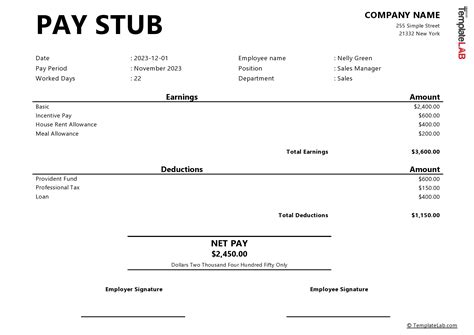

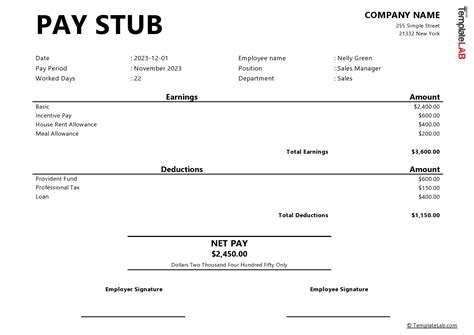

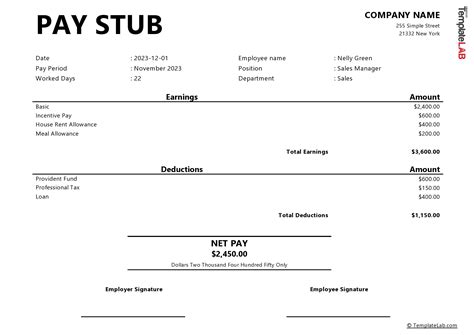

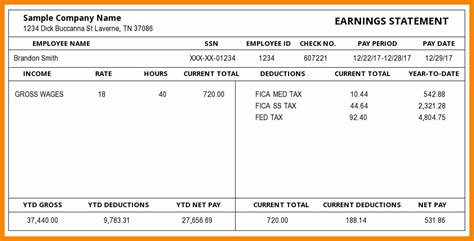

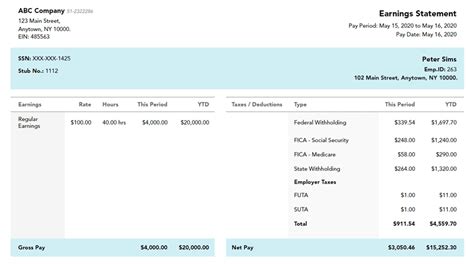

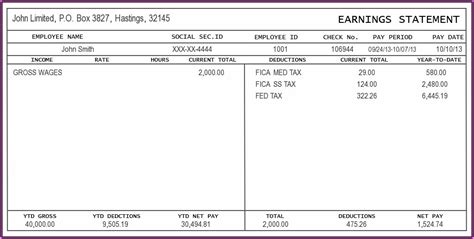

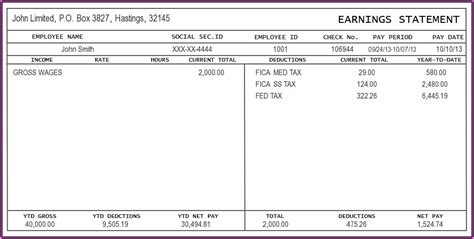

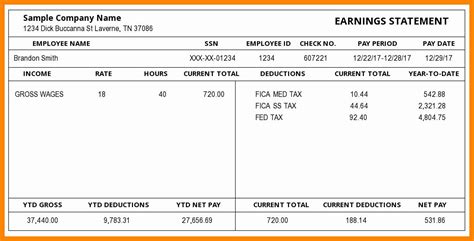

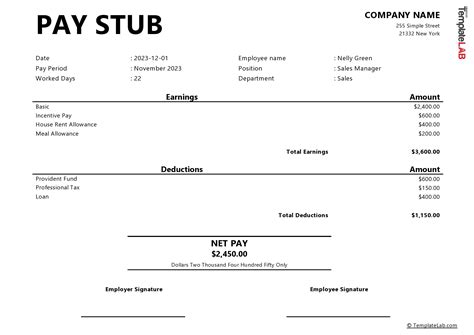

1099 Pay Stub Template Gallery

Conclusion

Creating a 1099 pay stub can be a challenging task, but with the right templates and tools, you can easily create accurate and professional pay stubs. The five easy 1099 pay stub templates we discussed in this article are perfect for small business owners and freelancers who want to streamline their financial management. Whether you choose to use a template or create a pay stub from scratch, remember to follow the IRS guidelines and regulations to ensure compliance and accuracy.