Intro

Discover how food stamps verify income levels. Learn about the income-based eligibility requirements for SNAP benefits, how income is calculated, and what documents are needed for application. Understand the nuances of income limits, deductions, and expenses that affect food stamp eligibility. Get the facts on food stamp income checks.

The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a government program designed to help low-income individuals and families purchase food. One of the primary requirements for eligibility is meeting a certain income level. But, can food stamps check your income level? In this article, we will delve into the details of how SNAP verifies income and what factors are considered.

The Importance of Verifying Income

Verifying income is crucial to ensure that only eligible individuals and families receive SNAP benefits. The program is designed to support those who are struggling financially, and verifying income helps to prevent abuse and ensure that benefits are distributed fairly. By checking income levels, the government can also adjust benefit amounts accordingly, ensuring that those who need it most receive the most assistance.

How SNAP Verifies Income

To verify income, SNAP uses a combination of documentation and automated systems. Here are the steps involved in the process:

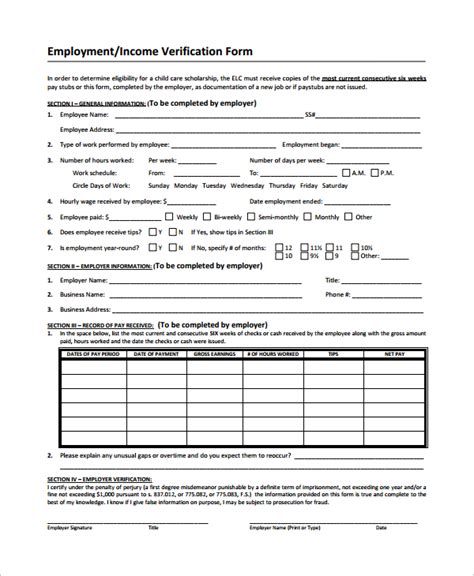

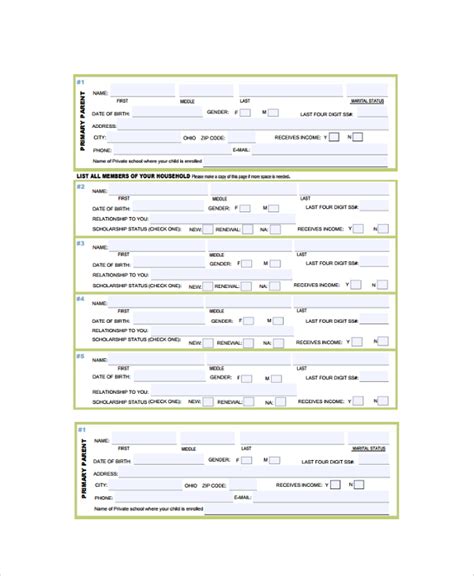

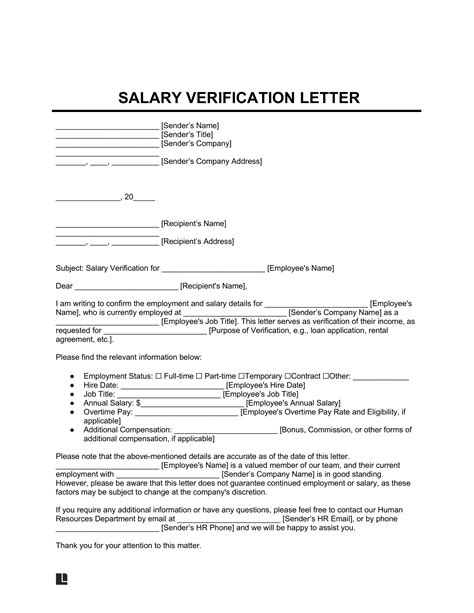

- Application and Eligibility Interview: When an individual or family applies for SNAP, they must provide documentation, such as pay stubs, W-2 forms, or tax returns, to verify their income. A caseworker will review the application and conduct an eligibility interview to assess the applicant's financial situation.

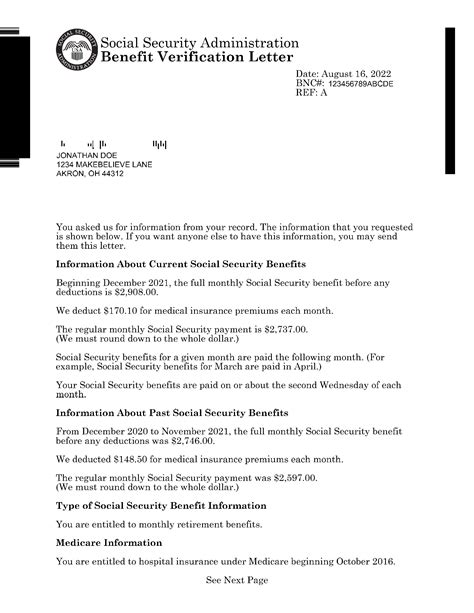

- Automated Income Verification: SNAP uses automated systems to verify income information. These systems, such as the State Wage Information System, can access wage data from the Social Security Administration, the Internal Revenue Service, and other government agencies.

- Document Review: Caseworkers review the documentation provided by applicants to ensure accuracy and completeness. They may also request additional documentation if necessary.

- Verification through Third-Party Sources: In some cases, SNAP may verify income through third-party sources, such as employers or financial institutions.

What Factors Are Considered in Income Verification?

When verifying income, SNAP considers various factors, including:

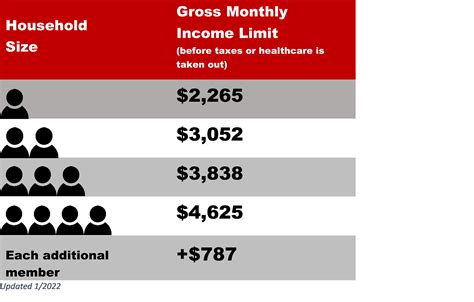

- Gross Income: SNAP considers an individual's or family's gross income, which includes income from all sources, such as wages, salaries, tips, and self-employment income.

- Deductions: Certain deductions, such as income taxes, Social Security taxes, and child support payments, are subtracted from gross income to determine net income.

- Exempt Income: Some types of income, such as Supplemental Security Income (SSI) or veterans' benefits, are exempt from consideration.

- Income from All Household Members: SNAP considers the income of all household members, including children, when determining eligibility.

Can SNAP Check Your Bank Account?

SNAP may request access to an applicant's bank account information to verify income and expenses. However, this is not a standard practice, and caseworkers will only request this information if necessary to determine eligibility.

Can SNAP Check Your Tax Returns?

SNAP may request access to an applicant's tax returns to verify income. In fact, many states use automated systems to access tax return data from the Internal Revenue Service.

Benefits of Accurate Income Verification

Accurate income verification is essential to ensure that SNAP benefits are distributed fairly and efficiently. Here are some benefits of accurate income verification:

- Prevents Abuse: Verifying income helps prevent abuse of the program by ensuring that only eligible individuals and families receive benefits.

- Ensures Fair Distribution: Accurate income verification ensures that benefits are distributed fairly, with those who need it most receiving the most assistance.

- Reduces Waste: By verifying income, SNAP can reduce waste and ensure that benefits are not misallocated.

Common Challenges in Income Verification

Despite the importance of income verification, there are common challenges that arise during the process. Here are some of the most common challenges:

- Incomplete or Inaccurate Documentation: Applicants may provide incomplete or inaccurate documentation, which can delay or prevent eligibility determination.

- Technical Issues: Technical issues, such as system glitches or data breaches, can compromise the accuracy of income verification.

- Lack of Standardization: Different states and localities may have varying income verification procedures, which can create confusion and inconsistencies.

Conclusion

In conclusion, food stamps can check your income level through a combination of documentation and automated systems. Verifying income is crucial to ensure that SNAP benefits are distributed fairly and efficiently. While there are common challenges in income verification, the benefits of accurate income verification far outweigh the drawbacks. By understanding the income verification process, individuals and families can ensure that they receive the benefits they need to support their nutritional well-being.

Income Verification Image Gallery

FAQs

- What is the purpose of income verification in SNAP? The purpose of income verification in SNAP is to ensure that only eligible individuals and families receive benefits by verifying their income and expenses.

- What types of income are considered in SNAP? SNAP considers all types of income, including wages, salaries, tips, and self-employment income.

- Can SNAP check my bank account? SNAP may request access to an applicant's bank account information to verify income and expenses.

- How often is income verification required? Income verification is typically required at the time of application and may be required again during the certification period.

- What are the consequences of providing false or inaccurate income information? Providing false or inaccurate income information can result in termination of benefits, fines, or even prosecution.