Intro

Discover how to accurately report food stamps on your taxes with our expert 5-tip guide. Learn how Supplemental Nutrition Assistance Program (SNAP) benefits impact your tax return, and avoid common mistakes that could lead to an audit. Get clarity on tax implications, income, and deductions to ensure a smooth filing process.

As tax season approaches, many individuals who receive government assistance, such as food stamps, may wonder how this affects their tax return. Reporting food stamps on your taxes can be a bit complex, but with the right guidance, you can navigate the process with ease. In this article, we will provide you with 5 tips to help you report food stamps on your taxes accurately.

What are Food Stamps?

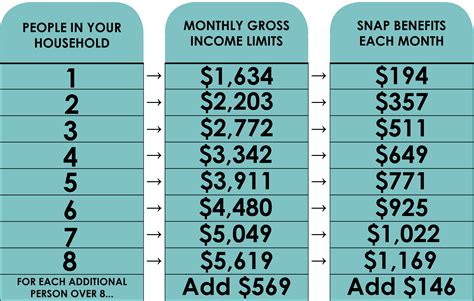

Before we dive into the tips, let's quickly define what food stamps are. Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), are a government program that provides financial assistance to low-income individuals and families to purchase food. The program is designed to help recipients purchase food at grocery stores, farmers' markets, and other approved retailers.

Tip 1: Understand How Food Stamps are Taxed

Food stamps are not considered taxable income by the Internal Revenue Service (IRS). According to the IRS, SNAP benefits are not subject to federal income tax. This means that you do not need to report food stamps as income on your tax return. However, it's essential to understand that while food stamps are not taxable, other forms of government assistance, such as unemployment benefits, may be taxable.

Tip 2: Keep Accurate Records

To report food stamps on your taxes accurately, it's crucial to keep accurate records of your SNAP benefits. You should keep a record of the amount of benefits you received, the dates you received them, and any other relevant information. This will help you to ensure that you are reporting the correct amount of benefits on your tax return.

Tip 3: Understand the Difference Between Food Stamps and Other Government Assistance

As mentioned earlier, food stamps are not taxable, but other forms of government assistance may be taxable. For example, unemployment benefits, Social Security benefits, and veterans' benefits may be subject to federal income tax. It's essential to understand the difference between these programs and food stamps to ensure that you are reporting them accurately on your tax return.

Tip 4: Report Food Stamps on the Correct Form

If you need to report food stamps on your tax return, you will need to use Form 1040. On this form, you will report the amount of SNAP benefits you received in the "Other Income" section. However, as mentioned earlier, food stamps are not taxable, so you will not need to report them as income.

Tip 5: Seek Professional Help if Needed

Reporting food stamps on your taxes can be complex, and if you are unsure about how to report them, it's always best to seek professional help. A tax professional can guide you through the process and ensure that you are reporting your SNAP benefits accurately. Additionally, if you have any other questions or concerns about your tax return, a tax professional can provide you with the guidance you need.

Gallery of Food Stamps and Taxes

Food Stamps and Taxes Image Gallery

Final Thoughts

Reporting food stamps on your taxes can be complex, but with the right guidance, you can navigate the process with ease. Remember to keep accurate records of your SNAP benefits, understand the difference between food stamps and other government assistance, and seek professional help if needed. By following these tips, you can ensure that you are reporting your food stamps accurately on your tax return.