Intro

For many homeowners, taking out a Home Equity Line of Credit (HELOC) can be a convenient way to tap into the equity they've built in their home. A HELOC provides a revolving line of credit that allows borrowers to draw funds as needed, and the interest rates are often lower compared to other types of credit. However, managing HELOC payments can be complex, especially when making extra payments. In this article, we'll explore six ways to calculate HELOC payments with extra payments, helping you understand how to make the most of your loan.

Understanding HELOC Payments

Before diving into the calculation methods, it's essential to understand how HELOC payments work. Unlike traditional mortgages, HELOCs have a draw period and a repayment period. During the draw period, typically 5-10 years, you can draw funds from the line of credit, and interest rates may be lower. After the draw period ends, the repayment period begins, and you'll need to start making principal and interest payments.

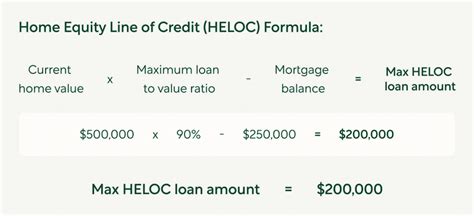

Calculating HELOC Payments

Calculating HELOC payments involves considering the outstanding balance, interest rate, and repayment term. To make extra payments, you'll need to determine how much you can afford to pay each month. Here are six ways to calculate HELOC payments with extra payments:

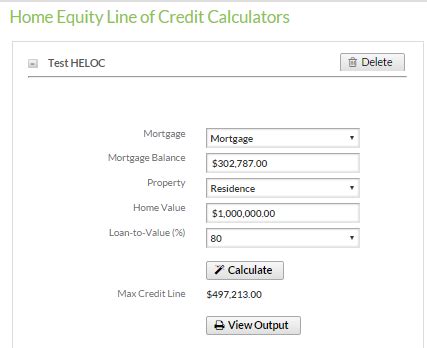

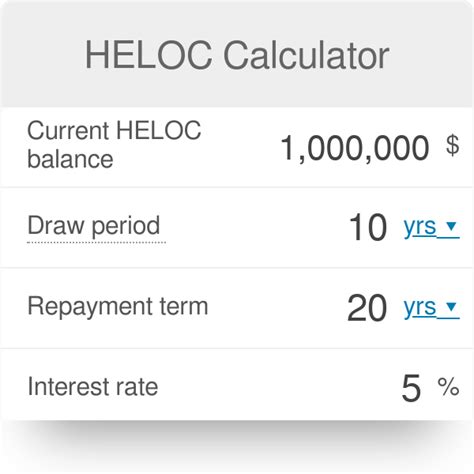

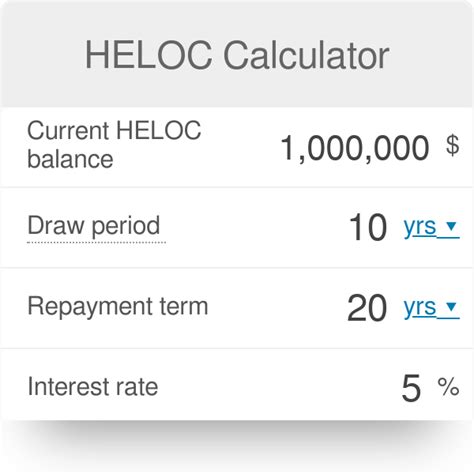

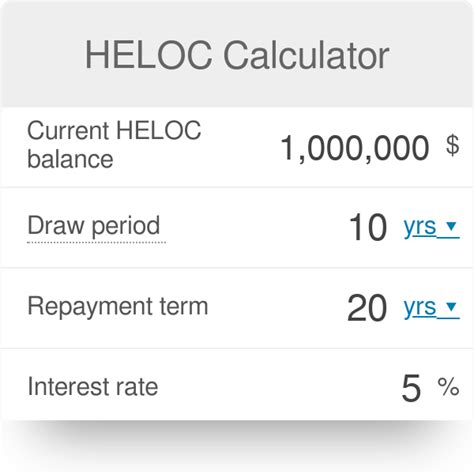

Method 1: Using a HELOC Calculator

Online HELOC calculators can simplify the process. These tools typically require you to input the outstanding balance, interest rate, and repayment term. You can then enter the amount of extra payment you'd like to make each month. The calculator will provide you with an updated amortization schedule, showing how much you'll save in interest and how soon you'll pay off the loan.

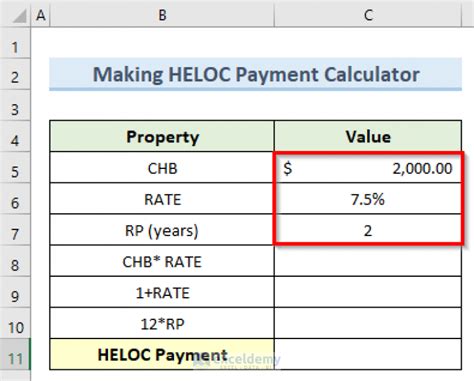

Method 2: Creating a Custom Amortization Schedule

You can create a custom amortization schedule using a spreadsheet or a table. Start by listing the outstanding balance, interest rate, and repayment term. Then, calculate the monthly payment amount using the formula: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where M is the monthly payment, P is the principal, i is the monthly interest rate, and n is the number of payments.

To make extra payments, simply add the extra amount to the monthly payment. Recalculate the amortization schedule, and you'll see the updated payoff period and interest savings.

Method 3: Using a HELOC Payment Formula

You can use a HELOC payment formula to calculate the monthly payment amount. The formula is: M = P x (i / 12) / (1 - (1 + i/12)^(-n)), where M is the monthly payment, P is the principal, i is the annual interest rate, and n is the number of payments.

To make extra payments, multiply the monthly payment by the number of payments you want to make, and add the extra amount. This will give you the total amount paid, which you can then use to calculate the updated amortization schedule.

Method 4: Considering Bi-Weekly Payments

Making bi-weekly payments can help you pay off your HELOC faster. To calculate the bi-weekly payment amount, divide the monthly payment by two. Since you're making 26 payments per year, you'll make an extra payment each year, which can help reduce the principal balance faster.

Method 5: Using a Debt Snowball Approach

The debt snowball approach involves making minimum payments on all debts except the one with the smallest balance. Apply as much money as possible towards the smallest balance until it's paid off. Then, move on to the next smallest balance, and so on.

To apply this approach to your HELOC, focus on making extra payments towards the principal balance. As you pay off more of the principal, the interest charges will decrease, freeing up more money in your budget to make additional payments.

Method 6: Automating Extra Payments

Automating extra payments can help you stay on track and make the most of your HELOC. Set up automatic transfers from your checking account to your HELOC account, specifying the extra amount you want to pay each month. This way, you'll ensure that you're consistently making extra payments without having to think about it.

Gallery of HELOC Payment Calculators

HELOC Payment Calculators

Wrapping Up

Managing HELOC payments can be complex, but by using one or a combination of these six methods, you can make extra payments and pay off your loan faster. Remember to consider your financial goals, interest rates, and repayment terms when determining the best approach for your situation. By taking control of your HELOC payments, you can save money in interest and build a stronger financial future.

We'd love to hear from you! What methods have you used to calculate your HELOC payments? Share your experiences and tips in the comments below.