Discover expert Navy Federal Life Tips for managing finances, insurance, and loans, with advice on credit scores, budgeting, and investment strategies.

In today's fast-paced world, managing one's finances effectively is crucial for achieving long-term stability and security. For members of the military and their families, navigating the complexities of financial planning can be particularly challenging. This is where Navy Federal Credit Union comes into play, offering a wide range of services and tools designed to make financial management easier and more accessible. With its rich history and commitment to serving the military community, Navy Federal has established itself as a trusted partner for those seeking to improve their financial well-being.

The importance of having a solid financial foundation cannot be overstated. It not only reduces stress and anxiety but also provides the freedom to pursue one's goals and aspirations without the burden of financial uncertainty. Whether it's saving for a home, planning for retirement, or simply managing daily expenses, having the right strategies and support can make all the difference. Navy Federal, with its extensive experience and expertise, is well-positioned to offer valuable insights and practical advice on how to achieve financial success.

For individuals looking to enhance their financial literacy and make informed decisions about their money, Navy Federal offers a wealth of resources and guidance. From budgeting and saving to investing and borrowing, the credit union's comprehensive approach to financial education empowers members to take control of their financial futures. Moreover, with its competitive rates, flexible terms, and personalized service, Navy Federal provides a supportive environment that fosters financial growth and stability.

Understanding Navy Federal

Navy Federal Credit Union is the largest credit union in the world, serving over 10 million members. It was established in 1933 with a mission to provide financial services to members of the U.S. military and their families. Today, Navy Federal offers a wide range of financial products and services, including checking and savings accounts, credit cards, loans, and investment services. With its strong commitment to member service and its extensive network of branches and ATMs, Navy Federal has become a trusted financial partner for the military community.

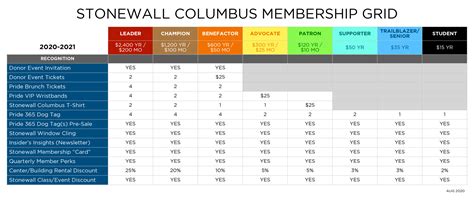

Benefits of Membership

Membership in Navy Federal Credit Union comes with numerous benefits, including competitive rates on loans and deposits, low fees, and personalized service. Members also have access to a range of financial tools and resources, including online banking, mobile banking, and financial education programs. Additionally, Navy Federal offers a variety of discounts and rewards programs, including cashback and travel rewards credit cards, and exclusive discounts on insurance and other financial products.Financial Planning Strategies

Effective financial planning is critical for achieving long-term financial stability and security. Navy Federal offers a range of financial planning strategies and tools to help members achieve their financial goals. These include budgeting and saving, investing and retirement planning, and managing debt and credit. By providing personalized financial guidance and support, Navy Federal helps members make informed decisions about their money and achieve their financial objectives.

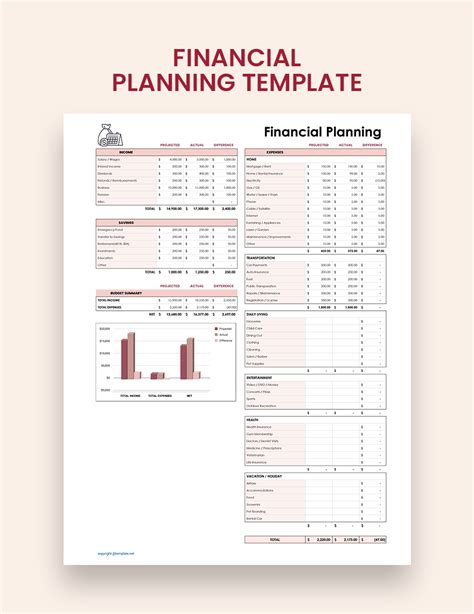

Creating a Budget

Creating a budget is an essential step in managing one's finances effectively. A budget helps individuals track their income and expenses, identify areas for cost savings, and make informed decisions about how to allocate their resources. Navy Federal offers a range of budgeting tools and resources, including online budgeting calculators and financial planning worksheets. By using these tools and working with a financial advisor, members can create a personalized budget that meets their unique financial needs and goals.Investing and Retirement Planning

Investing and retirement planning are critical components of long-term financial planning. Navy Federal offers a range of investment products and services, including brokerage accounts, mutual funds, and retirement accounts. By providing personalized investment guidance and support, Navy Federal helps members make informed decisions about their investments and achieve their long-term financial goals.

Retirement Savings Options

Navy Federal offers a range of retirement savings options, including traditional and Roth IRAs, and employer-sponsored retirement plans. By contributing to a retirement account, members can reduce their taxable income, grow their savings over time, and achieve a more secure retirement. Navy Federal's financial advisors can help members choose the right retirement savings option for their needs and goals.Managing Debt and Credit

Managing debt and credit is an essential part of maintaining good financial health. Navy Federal offers a range of tools and resources to help members manage their debt and credit, including credit counseling, debt consolidation loans, and credit monitoring services. By providing personalized guidance and support, Navy Federal helps members make informed decisions about their debt and credit and achieve their financial goals.

Improving Credit Scores

Improving credit scores is critical for achieving good financial health. Navy Federal offers a range of tools and resources to help members improve their credit scores, including credit monitoring services, credit counseling, and educational resources. By working with a financial advisor and using these tools, members can identify areas for improvement, make informed decisions about their credit, and achieve a better credit score over time.Financial Education and Literacy

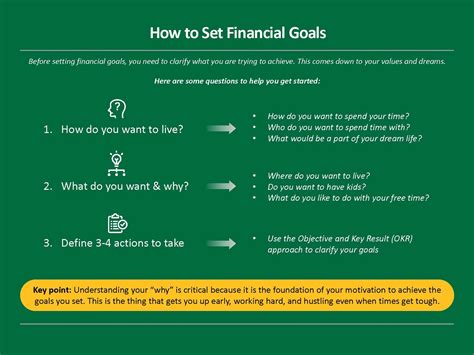

Financial education and literacy are critical components of achieving financial stability and security. Navy Federal offers a range of financial education programs and resources, including online courses, workshops, and webinars. By providing personalized financial guidance and support, Navy Federal helps members make informed decisions about their money and achieve their financial goals.

Financial Literacy Topics

Navy Federal's financial education programs cover a range of topics, including budgeting and saving, investing and retirement planning, and managing debt and credit. By providing comprehensive financial education, Navy Federal empowers members to take control of their financial futures and achieve their long-term financial goals.Conclusion and Next Steps

In conclusion, Navy Federal Credit Union offers a wide range of financial products and services designed to help members achieve their financial goals. By providing personalized financial guidance and support, Navy Federal empowers members to take control of their financial futures and achieve long-term financial stability and security. Whether you're looking to create a budget, invest in your future, or manage your debt and credit, Navy Federal has the tools and resources you need to succeed.

Final Thoughts

As a trusted financial partner for the military community, Navy Federal is committed to helping members achieve their financial goals. By providing comprehensive financial education, personalized guidance, and support, Navy Federal empowers members to make informed decisions about their money and achieve long-term financial stability and security. Whether you're just starting out or nearing retirement, Navy Federal has the expertise and resources you need to succeed.Navy Federal Image Gallery

We invite you to share your thoughts and experiences with Navy Federal Credit Union in the comments below. Whether you're a current member or just considering joining, we'd love to hear from you. Additionally, if you found this article helpful, please share it with your friends and family who may benefit from the information. By working together, we can achieve financial stability and security, and build a brighter future for ourselves and our loved ones.