Intro

Simplify tax season with our 5 easy W-2 form Excel templates. Download and edit pre-designed templates to streamline employee data management, tax reporting, and compliance. Easily generate and distribute accurate W-2 forms, reducing errors and stress. Perfect for small businesses, HR, and payroll professionals seeking efficient W-2 processing solutions.

Managing employee compensation and benefits can be a daunting task, especially during tax season. One crucial aspect of this process is generating accurate W-2 forms for your employees. In this article, we'll explore the importance of W-2 forms, their components, and provide you with 5 easy W-2 form Excel templates to simplify your payroll processing.

The Importance of W-2 Forms

A W-2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees and the Social Security Administration (SSA) by the end of January each year. This form reports an employee's income, taxes withheld, and other relevant compensation information for the previous tax year. W-2 forms are essential for employees to complete their tax returns, and for employers to demonstrate compliance with tax laws and regulations.

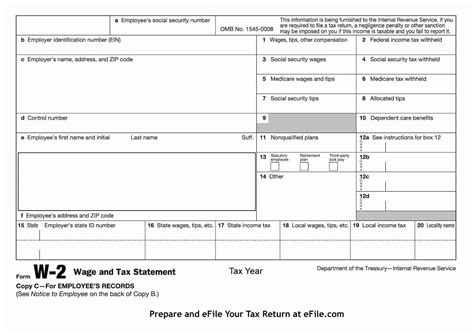

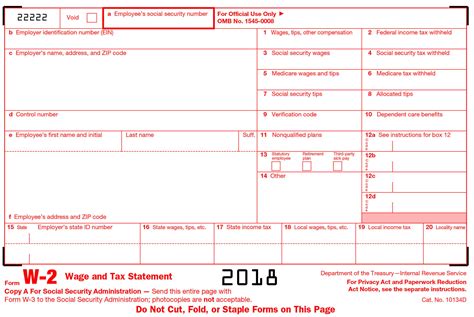

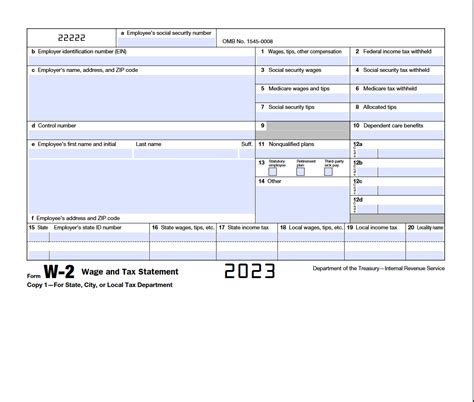

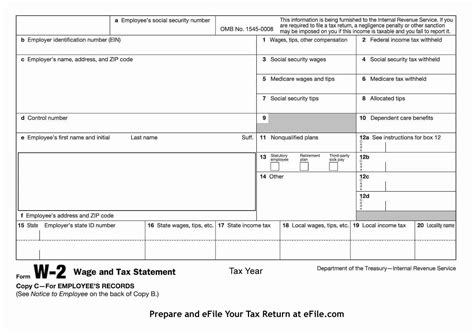

Components of a W-2 Form

A standard W-2 form contains the following information:

- Employee's name, address, and Social Security number

- Employer's name, address, and Employer Identification Number (EIN)

- Wages, tips, and other compensation

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

- Other relevant tax information, such as dependent care benefits and health savings account contributions

5 Easy W-2 Form Excel Templates

To help you generate accurate W-2 forms efficiently, we've created 5 easy-to-use Excel templates. These templates are designed to simplify your payroll processing and ensure compliance with tax regulations.

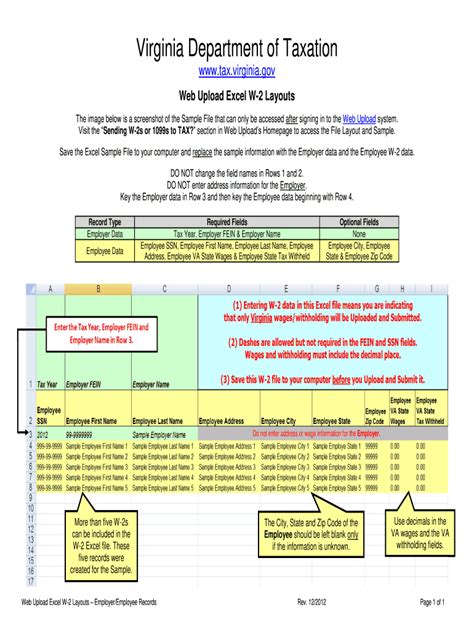

Template 1: Basic W-2 Form Template

This template provides a basic layout for generating W-2 forms. It includes the essential fields and calculations required for accurate reporting.

- Download: Basic W-2 Form Template

- Features:

- Employee and employer information fields

- Wages, tips, and other compensation fields

- Federal income tax, Social Security tax, and Medicare tax withheld fields

- Automatic calculations for total wages and taxes withheld

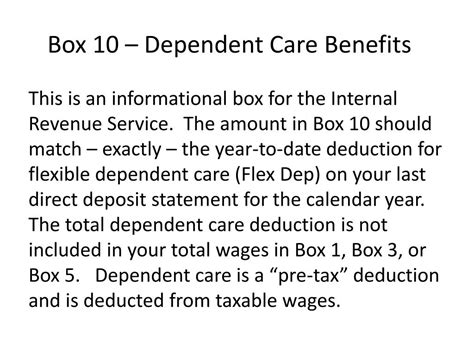

Template 2: W-2 Form with Dependent Care Benefits

This template is designed for employers who offer dependent care benefits to their employees. It includes additional fields to report these benefits.

- Download: W-2 Form with Dependent Care Benefits

- Features:

- Dependent care benefits field

- Automatic calculation for dependent care benefits

- Fields for employee and employer information, wages, and taxes withheld

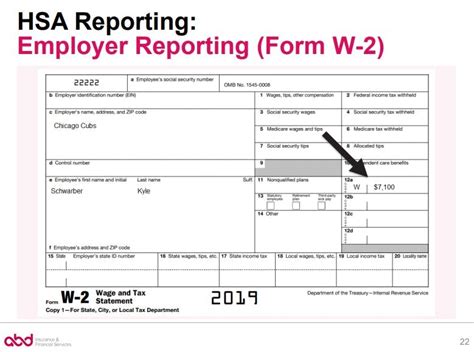

Template 3: W-2 Form with Health Savings Account Contributions

This template is suitable for employers who offer health savings account (HSA) contributions to their employees. It includes fields to report HSA contributions.

- Download: W-2 Form with Health Savings Account Contributions

- Features:

- HSA contributions field

- Automatic calculation for HSA contributions

- Fields for employee and employer information, wages, and taxes withheld

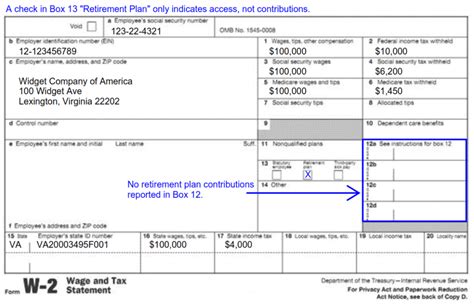

Template 4: W-2 Form with Retirement Plan Contributions

This template is designed for employers who offer retirement plan contributions to their employees. It includes fields to report these contributions.

- Download: W-2 Form with Retirement Plan Contributions

- Features:

- Retirement plan contributions field

- Automatic calculation for retirement plan contributions

- Fields for employee and employer information, wages, and taxes withheld

Template 5: W-2 Form with Multiple Income Types

This template is suitable for employers who need to report multiple income types, such as wages, tips, and commissions.

- Download: W-2 Form with Multiple Income Types

- Features:

- Multiple income type fields (wages, tips, commissions, etc.)

- Automatic calculations for total wages and taxes withheld

- Fields for employee and employer information

Tips for Using W-2 Form Excel Templates

To ensure accurate and efficient W-2 form generation, follow these tips:

- Verify employee and employer information for accuracy

- Double-check calculations for total wages and taxes withheld

- Use the correct template for your specific payroll needs

- Keep templates up-to-date with the latest tax regulations and forms

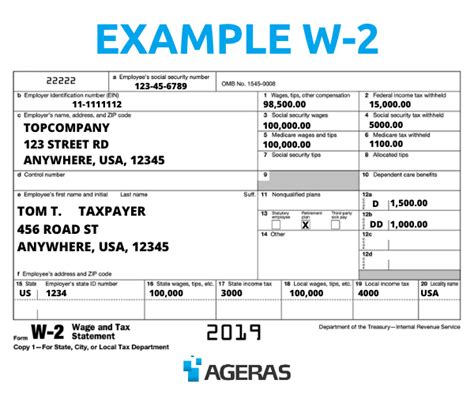

Gallery of W-2 Form Excel Templates

W-2 Form Excel Template Gallery

Conclusion

Generating accurate W-2 forms is a critical aspect of payroll processing. By using our 5 easy W-2 form Excel templates, you can simplify your payroll processing, ensure compliance with tax regulations, and provide your employees with the necessary information to complete their tax returns. Remember to verify employee and employer information, double-check calculations, and use the correct template for your specific payroll needs.

Share Your Thoughts!

Do you have any experience with generating W-2 forms? What challenges have you faced, and how have you overcome them? Share your thoughts and tips in the comments below!