Effective asset management is crucial for businesses of all sizes, as it enables them to keep track of their assets' value over time. One of the key components of asset management is depreciation, which represents the decrease in an asset's value due to wear and tear, obsolescence, or other factors. To help businesses streamline their asset tracking and depreciation calculations, an Excel template can be a valuable tool. In this article, we will explore the concept of depreciation, the benefits of using an Excel template for depreciation schedules, and provide a step-by-step guide on how to create a depreciation schedule template in Excel.

Understanding Depreciation

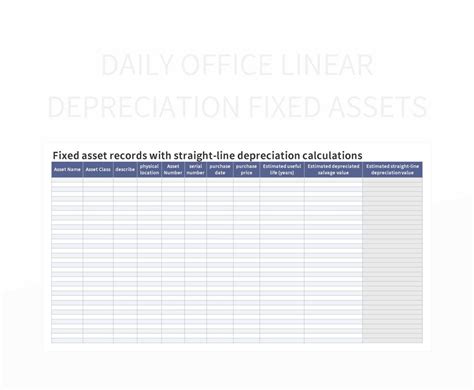

Depreciation is the process of allocating the cost of a tangible asset over its useful life. It represents the decrease in an asset's value due to various factors, such as usage, obsolescence, or physical deterioration. Depreciation is a non-cash expense, meaning it does not involve any actual cash outflows. Instead, it is an accounting entry that reflects the decrease in an asset's value over time. There are several methods of depreciation, including straight-line, declining balance, and units-of-production.

Benefits of Using an Excel Template for Depreciation Schedules

Using an Excel template for depreciation schedules offers several benefits, including:

- Simplified calculations: Excel templates can automate depreciation calculations, reducing the risk of errors and saving time.

- Improved accuracy: By using a template, businesses can ensure that their depreciation calculations are accurate and consistent.

- Customization: Excel templates can be customized to meet the specific needs of a business, including the type of assets, depreciation method, and useful life.

- Flexibility: Excel templates can be easily updated or modified as business needs change.

- Cost-effective: Excel templates are a cost-effective solution compared to purchasing specialized asset management software.

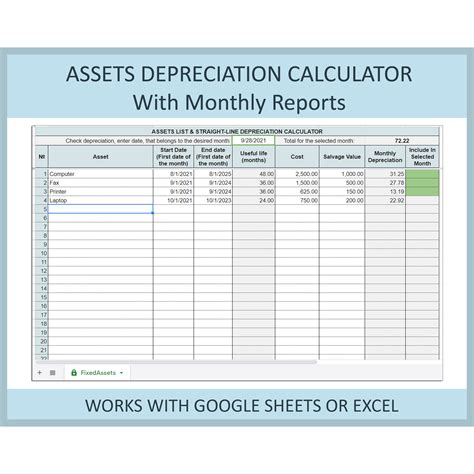

Creating a Depreciation Schedule Template in Excel

Creating a depreciation schedule template in Excel is a straightforward process that involves several steps:

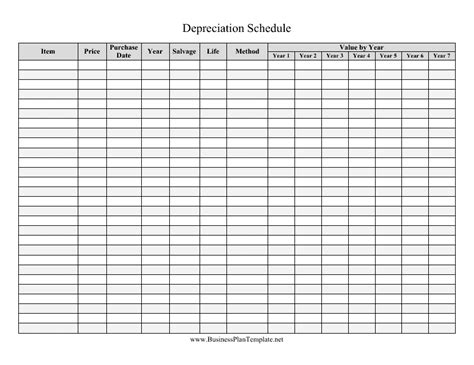

Step 1: Set up the template structure

- Create a new Excel workbook and set up a template structure that includes the following columns:

- Asset ID

- Asset Description

- Purchase Date

- Purchase Price

- Useful Life

- Depreciation Method

- Annual Depreciation

- Accumulated Depreciation

- Net Book Value

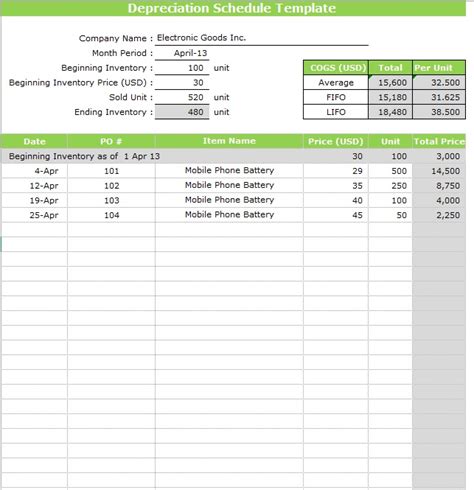

Step 2: Enter asset data

- Enter the asset data into the template, including the asset ID, description, purchase date, purchase price, useful life, and depreciation method.

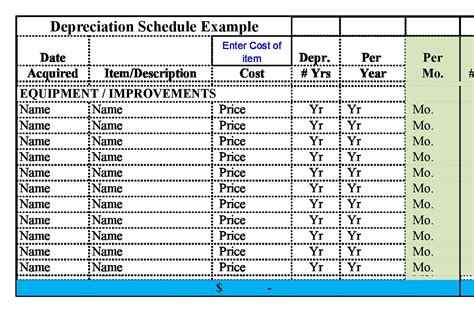

Step 3: Calculate annual depreciation

- Calculate the annual depreciation for each asset using the chosen depreciation method.

- For straight-line depreciation, the formula is: Annual Depreciation = (Purchase Price - Residual Value) / Useful Life

- For declining balance depreciation, the formula is: Annual Depreciation = (Purchase Price - Accumulated Depreciation) x Depreciation Rate

Step 4: Calculate accumulated depreciation

- Calculate the accumulated depreciation for each asset by adding the annual depreciation to the previous year's accumulated depreciation.

Step 5: Calculate net book value

- Calculate the net book value for each asset by subtracting the accumulated depreciation from the purchase price.

Tips and Variations

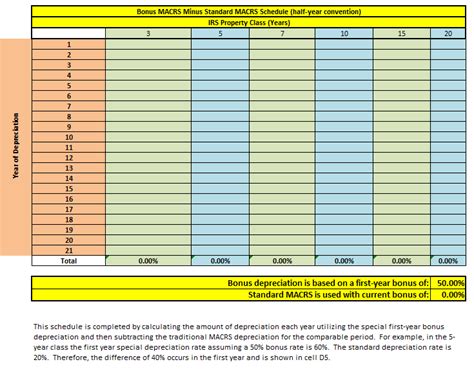

- Use multiple depreciation methods: Businesses can use multiple depreciation methods, such as straight-line and declining balance, to calculate depreciation for different assets.

- Use different useful lives: Businesses can use different useful lives for different assets, depending on the asset's expected lifespan.

- Use residual values: Businesses can use residual values to represent the asset's expected value at the end of its useful life.

- Use Excel formulas: Businesses can use Excel formulas, such as the

VLOOKUPandINDEX-MATCHfunctions, to automate depreciation calculations and reduce errors.

Gallery of Depreciation Templates

Depreciation Template Gallery

Conclusion

A depreciation schedule template can be a valuable tool for businesses looking to streamline their asset tracking and depreciation calculations. By following the steps outlined in this article, businesses can create a customized depreciation schedule template in Excel that meets their specific needs. Remember to use multiple depreciation methods, different useful lives, and residual values to ensure accurate calculations. Don't hesitate to reach out if you have any questions or need further assistance. Share your thoughts on depreciation templates in the comments below!