Boost financial stability with 5 Navy Federal Loan Tips, covering loan options, interest rates, and repayment terms, to help you make informed decisions on personal loans, credit scores, and debt management.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular services offered by Navy Federal is its loan program, which provides members with access to competitive rates and flexible terms on personal loans, auto loans, mortgages, and more. If you're considering taking out a loan with Navy Federal, here are a few things you should know.

The loan process at Navy Federal is designed to be quick and easy, with online applications and fast approval times. This means that you can get the money you need in no time, without having to jump through a lot of hoops. Additionally, Navy Federal offers a variety of loan options, so you can choose the one that best fits your needs and budget. Whether you're looking to consolidate debt, finance a large purchase, or cover unexpected expenses, Navy Federal has a loan that can help.

Navy Federal's commitment to its members is evident in its loan program, which is designed to provide affordable and flexible financing options. With competitive interest rates and flexible repayment terms, you can borrow money with confidence, knowing that you're getting a good deal. Plus, as a member of Navy Federal, you'll have access to a range of tools and resources to help you manage your loan and stay on top of your finances.

Understanding Navy Federal Loans

Types of Navy Federal Loans

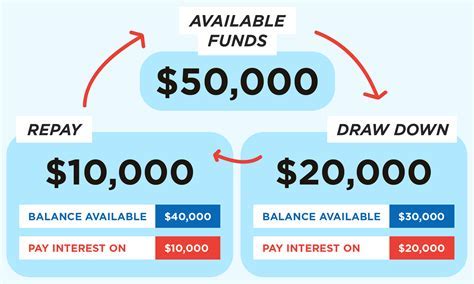

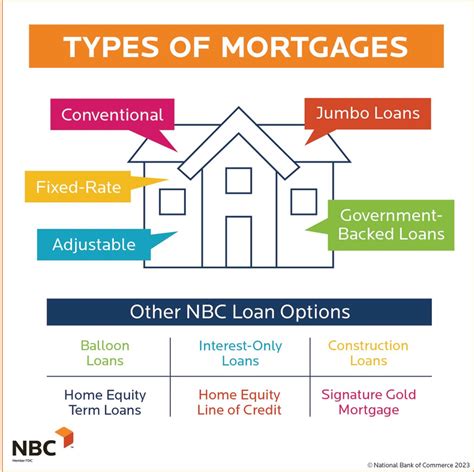

Navy Federal offers several types of loans, including: * Personal loans: These loans can be used for a variety of purposes, such as consolidating debt, financing a large purchase, or covering unexpected expenses. * Auto loans: These loans are specifically designed for financing the purchase of a new or used vehicle. * Mortgages: These loans are used to finance the purchase of a home and offer competitive interest rates and flexible repayment terms. * Home equity loans: These loans allow you to borrow money using the equity in your home as collateral.Navy Federal Loan Benefits

Competitive Interest Rates

Navy Federal's competitive interest rates can help you save money on your loan. With lower interest rates, you'll pay less over the life of the loan, which can help you stay within your budget. Plus, with flexible repayment terms, you can choose a repayment schedule that works for you, whether that's a shorter or longer repayment period.Navy Federal Loan Tips

Managing Your Loan

Managing your loan is crucial to ensuring that you repay it on time and avoid any unnecessary fees or penalties. Navy Federal offers a range of online tools and resources to help you manage your loan, including online banking and mobile banking apps. With these tools, you can check your balance, make payments, and view your loan history, all from the convenience of your computer or mobile device.Navy Federal Loan Application Process

Required Documents

In addition to the online application, you may need to provide some supporting documents, such as: * Identification, such as a driver's license or passport * Proof of income, such as a pay stub or W-2 form * Proof of employment, such as a letter from your employer * Proof of residency, such as a utility bill or lease agreementNavy Federal Loan Repayment Options

Payment Methods

Navy Federal offers several payment methods, including: * Online payments: You can make payments online through the Navy Federal website or mobile banking app. * Mobile payments: You can make payments using your mobile device, either through the Navy Federal mobile banking app or by texting a payment to Navy Federal. * Automatic payments: You can set up automatic payments to be deducted from your account on a regular basis.Navy Federal Loan Customer Service

Contact Information

You can contact Navy Federal's customer service team at: * Phone: 1-888-842-6328 * Email: [memberservices@navyfederal.org](mailto:memberservices@navyfederal.org) * Online chat: Available through the Navy Federal websiteNavy Federal Loan Image Gallery

If you're considering taking out a loan with Navy Federal, we hope this article has provided you with some helpful information and tips. Remember to choose a loan that fits your needs and budget, and don't hesitate to reach out to Navy Federal's customer service team if you have any questions or need help with a payment. With competitive interest rates, flexible repayment terms, and excellent customer service, Navy Federal is a great option for anyone looking for a loan. We encourage you to share your thoughts and experiences with Navy Federal loans in the comments below, and don't forget to share this article with anyone who may be in the market for a loan.