Intro

Discover 5 Nevada paycheck tips to optimize salary, wages, and benefits, including tax deductions, payroll laws, and employee rights, to ensure accurate compensation and financial planning.

The state of Nevada, known for its vibrant cities, rich history, and diverse economy, is home to a large and dynamic workforce. As an employee in Nevada, understanding your paycheck and the laws that govern it is essential for managing your finances effectively. In this article, we will delve into five key Nevada paycheck tips that every employee should know, ensuring you are well-informed and empowered to navigate the complexities of your compensation.

Nevada's economy is thriving, with major industries in hospitality, healthcare, technology, and manufacturing. This growth translates into a wide range of job opportunities for residents and newcomers alike. However, with the variety of employment options comes the need for clarity on payroll laws and regulations. Employees must be aware of their rights and how to ensure they receive fair and accurate compensation for their work.

The importance of understanding paycheck laws in Nevada cannot be overstated. Not only does it help employees verify the accuracy of their pay, but it also protects them from potential wage theft or misclassification. Moreover, being knowledgeable about Nevada's payroll regulations can help employees make informed decisions about their career and financial planning. Whether you are a long-time resident or just starting your career in the Silver State, these insights are crucial for navigating the workforce with confidence.

Understanding Nevada Paycheck Laws

Nevada paycheck laws are designed to protect employees by setting standards for minimum wage, overtime pay, and the timing and method of wage payments. For instance, as of the last update, Nevada's minimum wage is set at $10.50 per hour for employees who do not receive health benefits, and $9.50 per hour for those who do. Understanding these laws is the first step in ensuring that your paycheck accurately reflects your earnings.

Minimum Wage and Overtime

Nevada requires that most employees be paid at least the minimum wage for all hours worked. Additionally, employees who work more than 40 hours in a workweek are generally entitled to overtime pay, which is 1.5 times their regular rate of pay. There are exceptions for certain types of employees, such as those who are exempt under federal law, but for most workers, these protections apply.Calculating Your Paycheck

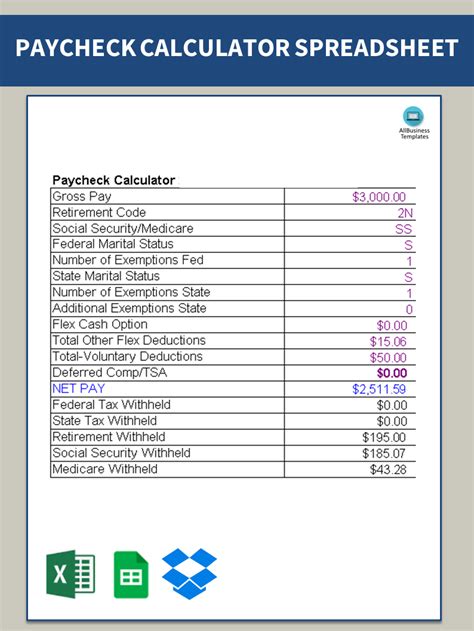

Calculating your paycheck involves understanding your hourly wage, the number of hours you work, and any deductions that are taken out of your pay. In Nevada, employers are allowed to deduct certain amounts from your paychecks, such as taxes, health insurance premiums, and contributions to retirement plans, but these deductions must be lawful and, in some cases, authorized by the employee.

Deductions and Withholding

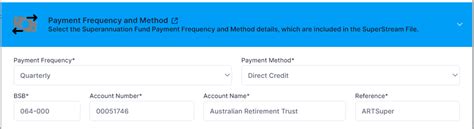

It's essential to review your pay stub to ensure that all deductions are correct and authorized. This includes federal, state, and local taxes, as well as any voluntary deductions you've agreed to, like health insurance premiums or 401(k) contributions. Employees have the right to request changes to deductions and should do so if they notice any inaccuracies.Pay Frequency and Method

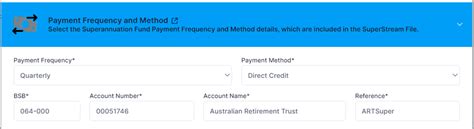

Nevada law requires that employees be paid at least twice a month, with no more than 8 days between paydays. Employers can pay employees by cash, check, or direct deposit, but they must follow specific rules regarding the timing and method of payment. Employees should be aware of their employer's pay schedule and payment method to plan their finances accordingly.

Direct Deposit and Pay Cards

Many employers in Nevada offer direct deposit as a convenient way to pay employees. This method allows wages to be deposited directly into an employee's bank account, eliminating the need for paper checks. Some employers also use pay cards, which are prepaid debit cards loaded with an employee's wages. While these methods can be convenient, employees should understand any associated fees and ensure they have easy access to their wages.Disputing Paycheck Errors

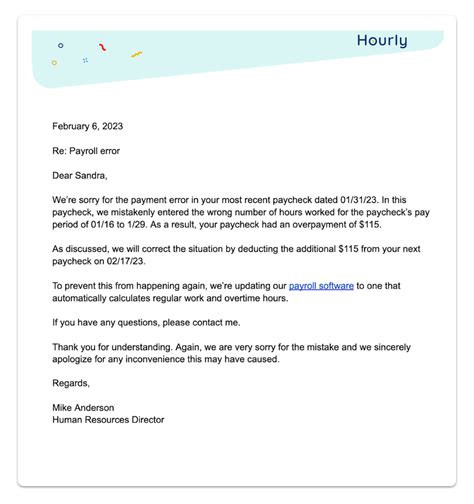

If you believe there's an error with your paycheck, such as underpayment or incorrect deductions, you have the right to dispute it. The first step is usually to contact your employer's HR or payroll department to report the issue. If the problem cannot be resolved internally, you may need to file a claim with the Nevada Office of the Labor Commissioner.

Filing a Wage Claim

Filing a wage claim involves providing detailed information about the dispute, including your employment dates, hours worked, and the specific issues with your pay. The Labor Commissioner's office will then investigate your claim and work to resolve the dispute. It's crucial to act promptly, as there are time limits for filing wage claims in Nevada.Final Paychecks in Nevada

When employment ends, whether due to termination, resignation, or layoff, employees are entitled to receive their final paycheck promptly. In Nevada, the timing of the final paycheck depends on the circumstances of the employment separation. For example, if an employee quits, the final paycheck is due within 3 days, but if an employee is fired, the paycheck is due immediately.

Severance Pay and Benefits

Some employees may be entitled to severance pay or continuation of benefits after their employment ends. While Nevada law does not require severance pay, employers may offer it as part of their compensation package or as a condition of a separation agreement. Understanding your rights regarding final pay and any post-employment benefits is vital for a smooth transition.Nevada Paycheck Image Gallery

In conclusion, navigating the complexities of Nevada paycheck laws and regulations requires a comprehensive understanding of the state's employment laws, payroll regulations, and the rights and responsibilities of both employees and employers. By following these five Nevada paycheck tips and staying informed about changes in labor laws, employees can better manage their finances, protect their rights, and contribute to a fair and prosperous workforce in the state of Nevada. We invite you to share your thoughts and experiences regarding paycheck laws in Nevada, and to explore more topics related to employment and finance in our future articles. Your engagement and feedback are invaluable in helping us provide the most relevant and useful information to our readers.