Intro

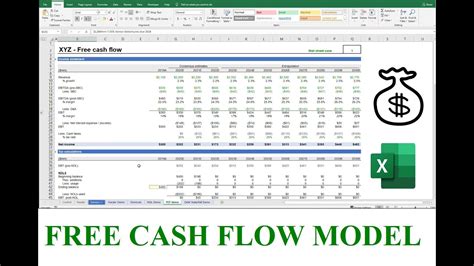

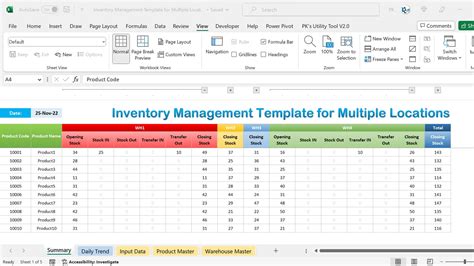

Boost your financial forecasting with our free 13-Week Cash Flow Model Excel Template download. Easily predict and manage your businesss liquidity with this customizable spreadsheet, featuring rolling forecasts, cash inflow/outflow tracking, and scenario analysis. Streamline your cash flow management and make informed decisions with this essential financial tool.

Maintaining a healthy cash flow is crucial for any business to operate efficiently and make informed financial decisions. A 13-week cash flow model is a valuable tool that helps companies manage their short-term liquidity and make strategic decisions about investments, funding, and expenses. In this article, we will delve into the importance of a 13-week cash flow model, its benefits, and provide a free Excel template for download.

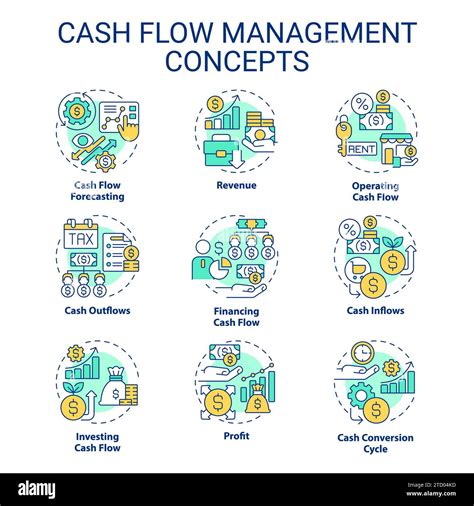

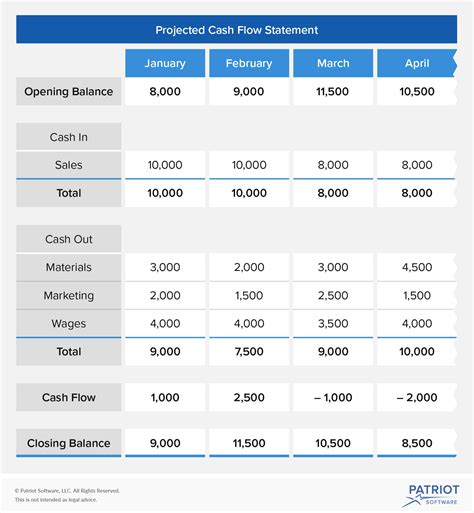

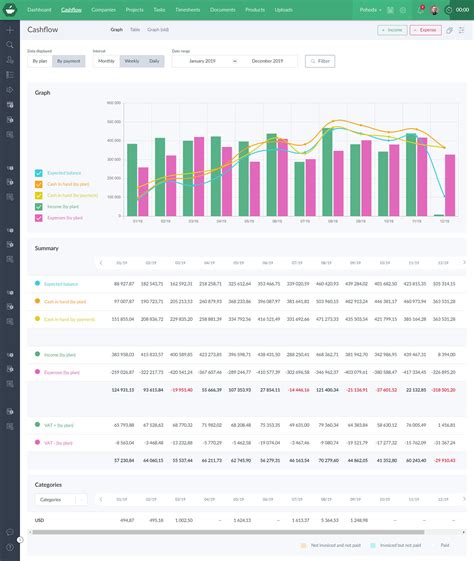

The 13-week cash flow model is a rolling forecast that outlines a company's projected inflows and outflows of cash over a 13-week period. This model is particularly useful for businesses with irregular or seasonal cash flows, as it helps identify potential cash shortfalls and enables them to take corrective action.

Benefits of a 13-Week Cash Flow Model

A 13-week cash flow model offers several benefits to businesses, including:

- Improved cash flow management: By forecasting cash inflows and outflows, companies can better manage their liquidity and make informed decisions about investments and expenses.

- Enhanced financial planning: A 13-week cash flow model helps businesses identify potential cash shortfalls and take corrective action, reducing the risk of financial distress.

- Increased transparency: The model provides a clear and concise picture of a company's cash flow, enabling stakeholders to make informed decisions.

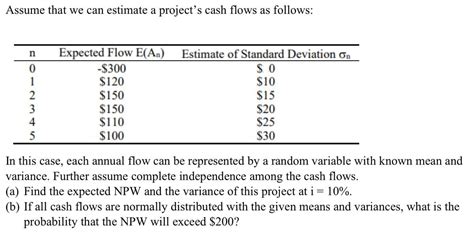

Key Components of a 13-Week Cash Flow Model

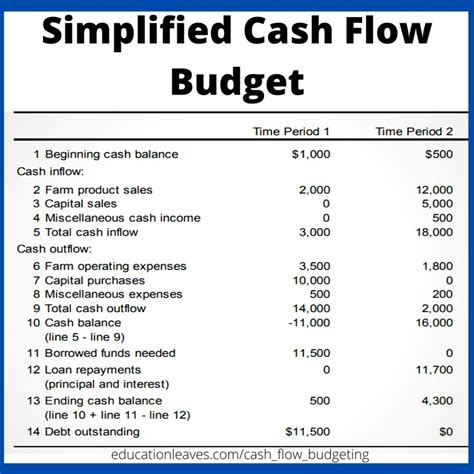

A 13-week cash flow model typically consists of the following components:

- Cash inflows: This includes projected revenue, accounts receivable, and other sources of cash.

- Cash outflows: This includes projected expenses, accounts payable, and other uses of cash.

- Beginning cash balance: The starting cash balance for the 13-week period.

- Ending cash balance: The projected cash balance at the end of the 13-week period.

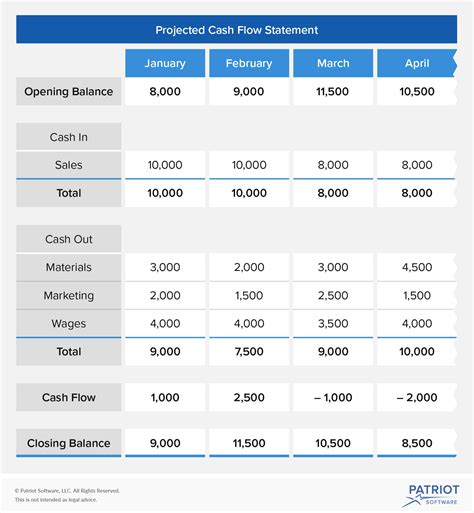

How to Create a 13-Week Cash Flow Model in Excel

Creating a 13-week cash flow model in Excel is a relatively straightforward process. Here's a step-by-step guide:

- Set up a new Excel spreadsheet: Create a new Excel spreadsheet and set up the following columns: Week, Cash Inflows, Cash Outflows, Beginning Cash Balance, and Ending Cash Balance.

- Enter historical data: Enter historical data for cash inflows and outflows for the past 13 weeks.

- Forecast cash inflows and outflows: Use historical data to forecast cash inflows and outflows for the next 13 weeks.

- Calculate beginning and ending cash balances: Calculate the beginning and ending cash balances for each week.

Excel Template for 13-Week Cash Flow Model

To make it easier for you to create a 13-week cash flow model, we've created a free Excel template that you can download and use.

Download 13-Week Cash Flow Model Excel Template

Best Practices for Using a 13-Week Cash Flow Model

To get the most out of a 13-week cash flow model, follow these best practices:

- Regularly update the model: Update the model regularly to reflect changes in cash inflows and outflows.

- Use historical data: Use historical data to inform your forecasts and improve the accuracy of the model.

- Monitor cash flow closely: Monitor cash flow closely and take corrective action if cash shortfalls are projected.

Conclusion

A 13-week cash flow model is a powerful tool that helps businesses manage their short-term liquidity and make informed financial decisions. By following the steps outlined in this article and using our free Excel template, you can create a 13-week cash flow model that will help you improve your cash flow management and achieve your financial goals.

Cash Flow Model Image Gallery

We hope this article has provided you with a comprehensive understanding of the 13-week cash flow model and its benefits. If you have any questions or need further assistance, please don't hesitate to comment below.