Intro

Discover Citibank Interest Rates Today, including savings, loans, and credit card rates, to make informed financial decisions and maximize your earnings with competitive APR, yields, and terms.

The world of banking and finance is constantly evolving, with interest rates playing a crucial role in shaping the economic landscape. As one of the largest and most established financial institutions globally, Citibank offers a wide range of financial products and services to its customers. In this article, we will delve into the current Citibank interest rates, exploring the various types of accounts and loans offered by the bank, as well as the factors that influence these rates.

Citibank, with its rich history dating back to 1812, has become a household name, synonymous with trust, reliability, and innovative financial solutions. The bank's extensive network of branches and ATMs, coupled with its cutting-edge online banking platform, makes it an attractive option for individuals and businesses alike. Whether you're looking to save, invest, or borrow, Citibank's competitive interest rates and flexible terms can help you achieve your financial goals.

From savings accounts and certificates of deposit (CDs) to personal loans and mortgages, Citibank's diverse product portfolio is designed to cater to the unique needs of its customers. The bank's interest rates are regularly reviewed and updated to reflect changes in the market, ensuring that customers can take advantage of the best possible rates. In this article, we will examine the current Citibank interest rates, highlighting the benefits and features of each product, as well as providing valuable insights and tips to help you make informed decisions about your financial future.

Citibank Savings Account Interest Rates

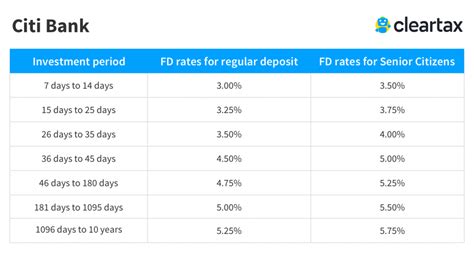

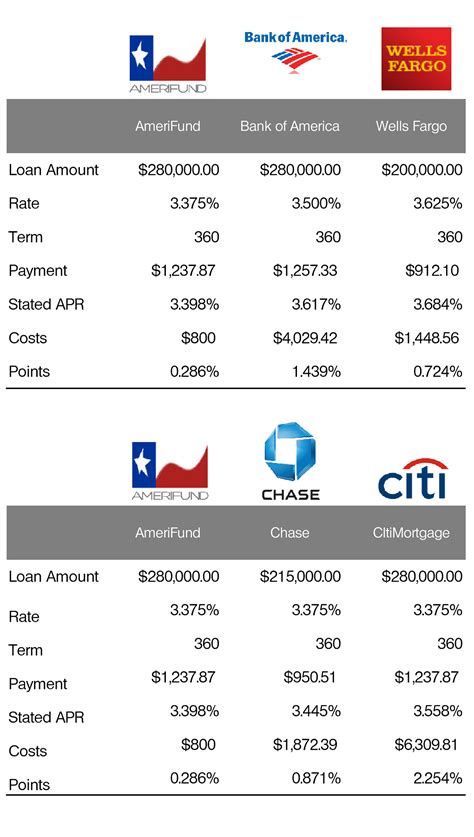

Citibank CD Interest Rates

Citibank Personal Loan Interest Rates

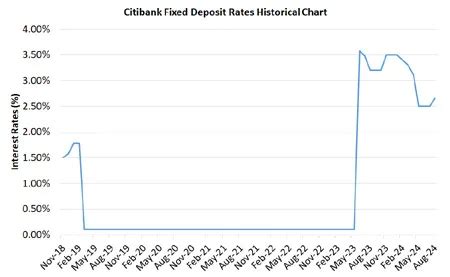

Citibank Mortgage Interest Rates

Citibank Credit Card Interest Rates

Factors Influencing Citibank Interest Rates

Several factors can influence Citibank interest rates, including: * Federal Reserve monetary policy * Market conditions * Economic indicators * Creditworthiness of borrowers * Competition from other financial institutionsCitibank Interest Rate Calculator

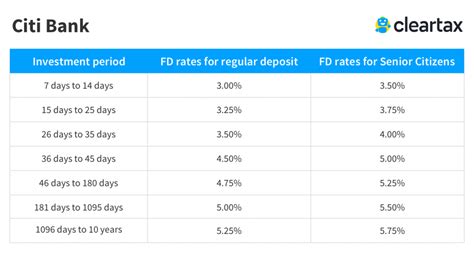

Citibank Interest Rate History

Gallery of Citibank Interest Rates

Citibank Interest Rates Image Gallery

In conclusion, Citibank interest rates are an essential aspect of the bank's financial products and services. By understanding the current interest rates and how they are influenced by various factors, customers can make informed decisions about their financial future. Whether you're looking to save, invest, or borrow, Citibank's competitive interest rates and flexible terms can help you achieve your goals. We invite you to share your thoughts and experiences with Citibank interest rates in the comments below, and don't forget to share this article with your friends and family who may be interested in learning more about Citibank's financial products and services.