Intro

Maximize your credit score with our free Credit Card Utilization Tracker Spreadsheet Template. Monitor your debt-to-credit ratio, track payments, and identify areas for improvement. Optimize your credit utilization ratio, reduce debt, and boost creditworthiness with this simple, customizable template. Say goodbye to overspending and hello to financial stability.

Managing credit card debt can be a daunting task, but having the right tools can make all the difference. A credit card utilization tracker spreadsheet template is a powerful tool that can help you keep track of your credit card balances, payments, and utilization ratios. In this article, we will explore the importance of tracking credit card utilization, the benefits of using a spreadsheet template, and provide a comprehensive guide on how to create and use a credit card utilization tracker spreadsheet template.

Why Track Credit Card Utilization?

Tracking credit card utilization is crucial for maintaining good credit health. Credit utilization ratio is the percentage of available credit being used, and it accounts for 30% of your credit score. A high credit utilization ratio can negatively affect your credit score, making it harder to obtain credit in the future. By tracking your credit card utilization, you can:

- Monitor your credit utilization ratio and ensure it remains below the recommended 30%

- Identify areas for improvement and make adjustments to your spending habits

- Avoid overspending and reduce the risk of debt accumulation

- Improve your credit score over time

Benefits of Using a Credit Card Utilization Tracker Spreadsheet Template

A credit card utilization tracker spreadsheet template offers several benefits, including:

- Easy tracking and monitoring of credit card balances and payments

- Automatic calculation of credit utilization ratios

- Customizable templates to fit your specific needs

- Ability to set alerts and reminders for payments and due dates

- Improved financial organization and reduced stress

How to Create a Credit Card Utilization Tracker Spreadsheet Template

Creating a credit card utilization tracker spreadsheet template is a straightforward process. Here's a step-by-step guide:

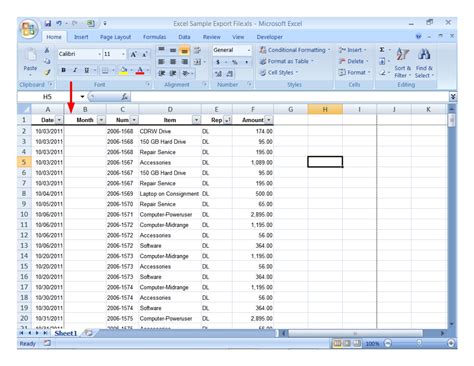

- Choose a spreadsheet software: You can use Google Sheets, Microsoft Excel, or any other spreadsheet software that you prefer.

- Set up the template: Create a new spreadsheet and set up the following columns:

- Credit Card Name

- Credit Limit

- Balance

- Payment Due Date

- Payment Amount

- Credit Utilization Ratio

- Enter your data: Fill in the columns with your credit card information, including the credit limit, balance, and payment due date.

- Calculate the credit utilization ratio: Use the formula = (Balance / Credit Limit) x 100 to calculate the credit utilization ratio.

- Set up alerts and reminders: Use the spreadsheet software to set up alerts and reminders for payments and due dates.

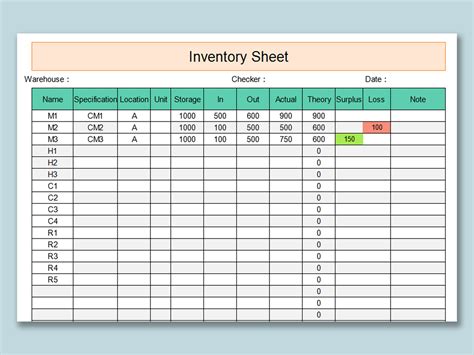

Example of a Credit Card Utilization Tracker Spreadsheet Template

| Credit Card Name | Credit Limit | Balance | Payment Due Date | Payment Amount | Credit Utilization Ratio |

|---|---|---|---|---|---|

| Card 1 | $1,000 | $300 | 15th | $50 | 30% |

| Card 2 | $2,000 | $500 | 25th | $100 | 25% |

| Card 3 | $3,000 | $800 | 10th | $150 | 27% |

Using Your Credit Card Utilization Tracker Spreadsheet Template

Once you have created your credit card utilization tracker spreadsheet template, it's essential to use it regularly to track your credit card utilization. Here are some tips:

- Update your data regularly: Ensure that your spreadsheet is up-to-date by regularly updating your credit card balances, payments, and due dates.

- Monitor your credit utilization ratio: Keep an eye on your credit utilization ratio and ensure it remains below the recommended 30%.

- Adjust your spending habits: If you notice that your credit utilization ratio is high, adjust your spending habits to reduce your balances.

- Review your spreadsheet regularly: Regularly review your spreadsheet to identify areas for improvement and make adjustments as needed.

Conclusion

Tracking credit card utilization is a crucial aspect of maintaining good credit health. A credit card utilization tracker spreadsheet template is a powerful tool that can help you monitor your credit card balances, payments, and utilization ratios. By following the steps outlined in this article, you can create and use a credit card utilization tracker spreadsheet template to improve your financial organization and reduce stress.

Gallery of Credit Card Utilization Tracking Images

Credit Card Utilization Tracking Image Gallery

FAQ

Q: What is credit card utilization? A: Credit card utilization is the percentage of available credit being used.

Q: Why is it important to track credit card utilization? A: Tracking credit card utilization is important to maintain good credit health and avoid overspending.

Q: How can I track credit card utilization? A: You can track credit card utilization using a spreadsheet template or a credit card utilization tracking software.

Q: What is the recommended credit utilization ratio? A: The recommended credit utilization ratio is 30% or less.

Q: How can I reduce my credit utilization ratio? A: You can reduce your credit utilization ratio by paying down your balances, increasing your credit limit, or avoiding new credit inquiries.