Intro

Discover the impact of food stamps on your credit score. Learn how government assistance programs, like SNAP, affect your credit report and financial health. Understand the relationship between food stamps, credit utilization, and creditworthiness. Get the facts on how food stamps may influence your credit score and overall financial stability.

Receiving food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), is a vital assistance for many individuals and families who struggle to make ends meet. However, there's often a lingering concern about how this benefit might impact one's credit score. In this article, we'll delve into the relationship between food stamps and credit scores, providing you with a comprehensive understanding of what to expect.

Food stamps are designed to help individuals and families with limited income purchase food. The program is administered by the United States Department of Agriculture (USDA) and is funded by the federal government. While food stamps can provide essential support, it's natural to wonder whether participating in the program might have any unintended consequences on one's financial health, particularly when it comes to credit scores.

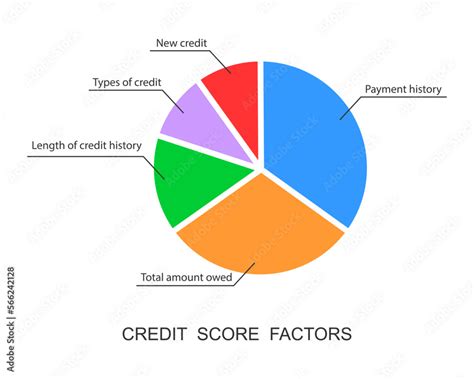

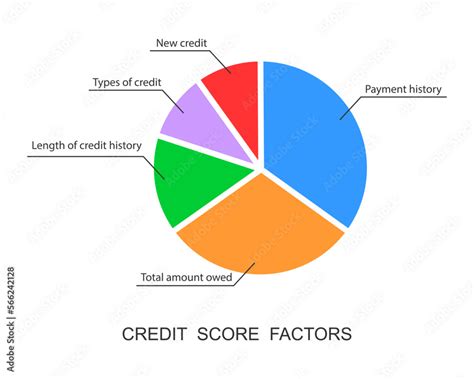

How Credit Scores Work

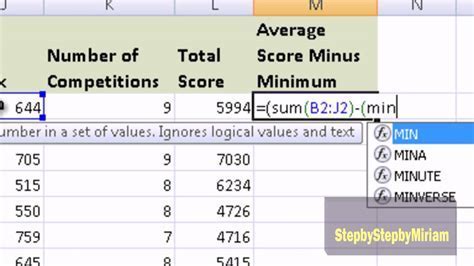

Before we explore the relationship between food stamps and credit scores, it's essential to understand how credit scores are calculated. Credit scores are three-digit numbers that represent an individual's creditworthiness. The most widely used credit score is the FICO score, which ranges from 300 to 850. The score is calculated based on information in your credit reports, including:

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

Factors That Affect Credit Scores

Several factors can impact your credit score, including:

- Late payments

- High credit utilization

- Credit inquiries

- Public records (e.g., bankruptcies, foreclosures)

- Credit account closures

Do Food Stamps Affect Credit Scores?

The good news is that receiving food stamps does not directly affect your credit score. The SNAP program is not considered a form of credit, and participation in the program is not reported to the three major credit bureaus (Equifax, Experian, and TransUnion). This means that using food stamps will not:

- Lower your credit score

- Increase your credit utilization

- Trigger credit inquiries

- Appear as a public record

However, it's essential to note that other factors related to your financial situation might indirectly impact your credit score. For example, if you're struggling to make ends meet and relying on food stamps, you might also be experiencing financial difficulties that could lead to late payments or high credit utilization.

Indirect Effects on Credit Scores

While food stamps themselves do not affect credit scores, other factors related to your financial situation might have an indirect impact. For instance:

- If you're struggling to pay bills, you might be more likely to miss payments, which can lower your credit score.

- If you're using credit cards to cover essential expenses, you might accumulate debt, which can negatively impact your credit utilization ratio.

- If you're experiencing financial difficulties, you might be more likely to apply for credit, which can result in credit inquiries and potentially lower your credit score.

Managing Your Finances While Receiving Food Stamps

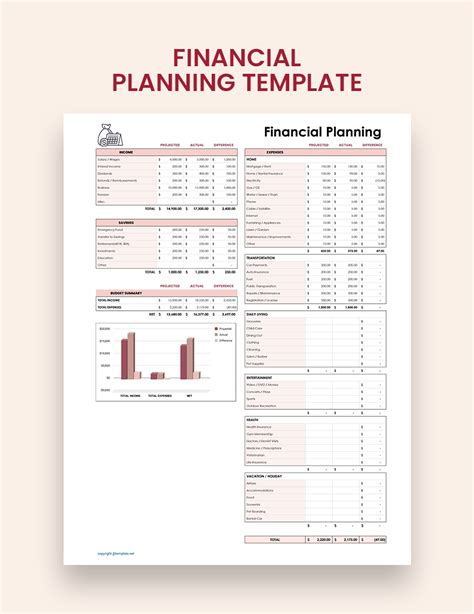

While receiving food stamps might not directly affect your credit score, it's essential to manage your finances effectively to avoid indirect consequences. Here are some tips to help you maintain good credit habits:

- Create a budget: Track your income and expenses to ensure you're making the most of your resources.

- Prioritize payments: Make timely payments on essential bills, such as rent/mortgage, utilities, and minimum payments on debts.

- Use credit responsibly: Avoid accumulating debt and keep credit utilization below 30%.

- Monitor your credit report: Check your credit report regularly to ensure there are no errors or inaccuracies.

Conclusion

In conclusion, receiving food stamps does not directly affect your credit score. However, it's essential to manage your finances effectively to avoid indirect consequences. By creating a budget, prioritizing payments, using credit responsibly, and monitoring your credit report, you can maintain good credit habits and ensure a healthy financial future.

Gallery of Food Stamps and Credit Scores

Food Stamps and Credit Scores Image Gallery

Frequently Asked Questions

Q: Do food stamps affect my credit score? A: No, receiving food stamps does not directly affect your credit score.

Q: Can I use food stamps to improve my credit score? A: No, food stamps are not considered a form of credit and cannot be used to improve your credit score.

Q: How can I manage my finances while receiving food stamps? A: Create a budget, prioritize payments, use credit responsibly, and monitor your credit report to maintain good credit habits.

Q: What are some indirect effects of food stamps on credit scores? A: Struggling to make ends meet, accumulating debt, and experiencing financial difficulties can indirectly impact your credit score.

Q: Can I apply for credit while receiving food stamps? A: Yes, but be cautious of credit inquiries and high credit utilization, which can negatively impact your credit score.