Intro

Optimize your finances with these 7 expert tips tailored for military personnel. Learn how to navigate unique financial challenges, from managing deployment income to leveraging tax benefits and education assistance. Discover strategies for saving, investing, and building credit to secure your financial future, even in uncertain times.

Serving in the military can be a challenging and rewarding experience, but it can also bring unique financial challenges. Military personnel often face deployments, relocations, and uncertain income, making it essential to manage their finances carefully. Here are 7 financial tips specifically designed for military personnel to help them navigate these challenges and achieve long-term financial stability.

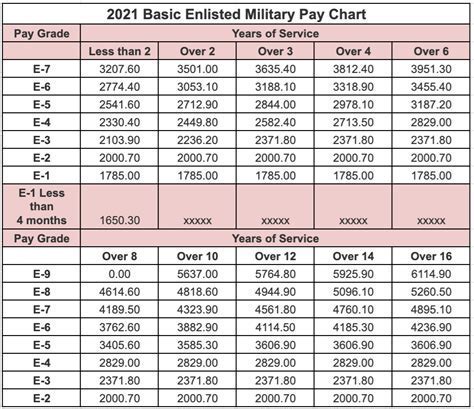

Understanding Military Pay and Benefits

Military personnel receive a range of pay and benefits, including basic pay, allowances, and special pays. Understanding these different components is crucial to managing your finances effectively. Basic pay is the standard salary for military personnel, while allowances provide additional compensation for expenses such as housing, food, and clothing. Special pays, such as hazardous duty pay or combat pay, can also significantly impact your overall income.

Military Pay Charts

To make sense of military pay, it's essential to familiarize yourself with the military pay charts. These charts outline the basic pay rates for different ranks and time-in-service. By understanding how your pay will increase over time, you can plan your finances more effectively.

Creating a Budget for Military Life

Creating a budget is essential for anyone, but it's particularly challenging for military personnel due to the unpredictability of their income and expenses. Start by tracking your income and expenses to understand where your money is going. Make a list of your essential expenses, such as rent, utilities, and food, and then allocate your income accordingly.

50/30/20 Rule

A simple way to allocate your income is to use the 50/30/20 rule. Allocate 50% of your income towards essential expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. This will help you prioritize your spending and ensure you're saving enough for the future.

Tackling Debt and Credit

Debt and credit can be significant challenges for military personnel, particularly those who have experienced financial hardship during their service. Start by checking your credit report to understand your current credit situation. Make a list of your debts, including the balance and interest rate for each, and prioritize them based on the interest rate.

Debt Snowball Method

A popular way to tackle debt is to use the debt snowball method. This involves paying off your debts one by one, starting with the smallest balance first. Make minimum payments on all your debts except the smallest one, which you'll pay off as quickly as possible. Once you've paid off the smallest debt, move on to the next one, and so on.

Building an Emergency Fund

An emergency fund is essential for anyone, but it's particularly crucial for military personnel who may face unexpected expenses or deployments. Aim to save 3-6 months' worth of living expenses in an easily accessible savings account. This will provide a safety net in case of unexpected expenses or financial hardship.

High-Yield Savings Account

Consider opening a high-yield savings account to earn interest on your emergency fund. This will help your savings grow over time, providing an added layer of financial security.

Investing for the Future

Investing is an essential part of building long-term wealth, and military personnel have access to a range of investment options. Consider contributing to a Thrift Savings Plan (TSP), which offers low fees and a range of investment options. You can also consider investing in a taxable brokerage account or working with a financial advisor to create a personalized investment plan.

TSP Contribution Limits

The TSP has contribution limits, so make sure to understand how much you can contribute each year. You can also consider contributing to a Roth IRA or traditional IRA to supplement your retirement savings.

Taking Advantage of Military Benefits

Military personnel have access to a range of benefits, including education assistance, home loan guarantees, and healthcare benefits. Take advantage of these benefits to improve your financial situation and achieve your long-term goals.

GI Bill Benefits

The GI Bill provides education assistance to military personnel, including tuition reimbursement and living stipends. Consider using the GI Bill to pursue higher education or vocational training.

Seeking Financial Counseling

Finally, don't be afraid to seek financial counseling if you're struggling to manage your finances. Military personnel have access to a range of financial counseling resources, including the Military Financial Readiness Program and the National Foundation for Credit Counseling.

Military Financial Readiness Program

The Military Financial Readiness Program provides financial counseling and education to military personnel. Consider taking advantage of this program to improve your financial literacy and achieve your long-term goals.

Military Financial Tips Image Gallery

By following these 7 financial tips, military personnel can improve their financial stability, achieve their long-term goals, and enjoy a more secure financial future. Remember to stay informed, plan carefully, and seek financial counseling when needed to make the most of your military service.