Intro

Discover how Mtu Credit Union empowers members to achieve financial success with personalized banking solutions, competitive loan rates, and expert financial guidance. Experience the benefits of member-owned banking, including secure online services, investment opportunities, and community support, making it your trusted partner in achieving long-term financial stability and success.

In today's fast-paced and ever-changing financial landscape, having a reliable partner by your side can make all the difference. Mtu Credit Union is one such partner that has been dedicated to helping its members achieve financial success for years. With a focus on serving the unique needs of its community, Mtu Credit Union has established itself as a trusted and dependable financial institution.

The importance of having a credit union like Mtu cannot be overstated. Unlike traditional banks, credit unions are member-owned and not-for-profit, which means they are driven by a commitment to serving the best interests of their members rather than maximizing profits. This approach enables Mtu Credit Union to offer more competitive rates, lower fees, and a more personalized level of service that sets them apart from larger financial institutions.

Benefits of Choosing Mtu Credit Union

Mtu Credit Union offers a wide range of benefits that make it an attractive option for those looking for a more personalized and community-focused banking experience. Some of the key benefits include:

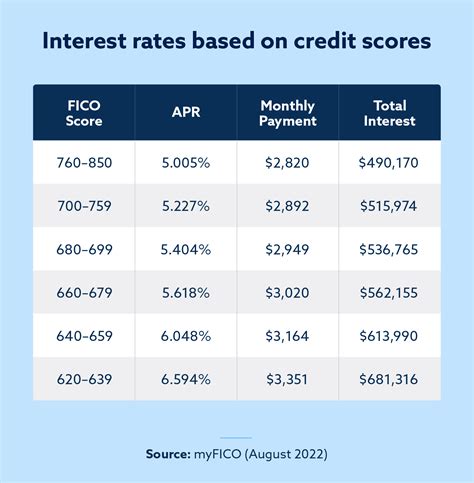

- Competitive rates on loans and savings accounts

- Lower fees compared to traditional banks

- A wide range of financial products and services tailored to meet the unique needs of its members

- A commitment to community development and financial education

- A more personalized level of service from experienced and knowledgeable staff

Financial Products and Services

Mtu Credit Union offers a comprehensive suite of financial products and services designed to meet the diverse needs of its members. These include:

- Savings accounts with competitive interest rates

- Loans for cars, homes, and other personal needs

- Credit cards with low interest rates and no annual fees

- Investment services for those looking to grow their wealth

- Insurance products to protect against unforeseen events

Community Development and Financial Education

Mtu Credit Union is deeply committed to giving back to the community it serves. Through its community development initiatives and financial education programs, Mtu Credit Union aims to empower its members with the knowledge and resources they need to achieve financial stability and success.

Some of the community development initiatives undertaken by Mtu Credit Union include:

- Financial literacy programs for schools and community groups

- Partnerships with local organizations to support economic development

- Scholarships and grants for students and entrepreneurs

- Community events and seminars on topics related to personal finance and economic development

How to Get Started with Mtu Credit Union

Getting started with Mtu Credit Union is easy and straightforward. Here are the steps to follow:

- Check your eligibility: Mtu Credit Union serves a specific community, so you'll need to check if you're eligible to join.

- Gather required documents: You'll need to provide identification and proof of address to complete the membership application.

- Apply for membership: You can apply online or in-person at one of Mtu Credit Union's branches.

- Fund your account: Once your application is approved, you'll need to fund your account with an initial deposit.

Conclusion

Mtu Credit Union is a trusted partner in financial success, offering a wide range of benefits, financial products, and community development initiatives that set it apart from traditional banks. With a commitment to serving the unique needs of its community, Mtu Credit Union is an attractive option for those looking for a more personalized and community-focused banking experience.

We invite you to share your thoughts on the importance of having a credit union like Mtu by your side. How has Mtu Credit Union helped you achieve your financial goals? Share your story in the comments below!

Mtu Credit Union Image Gallery