Intro

Streamline your international trade with a Pro Forma Invoice Template Excel. This template simplifies customs clearance, reduces errors, and accelerates payment processing. Easily create, edit, and manage Pro Forma invoices for import/export transactions, ensuring compliance with global trade regulations and boosting business efficiency.

Understanding the Importance of Pro Forma Invoices in International Trade

In the world of international trade, a pro forma invoice is a crucial document that serves as a preliminary bill of sale, outlining the terms and conditions of a transaction between a buyer and seller. It provides a detailed description of the goods or services being sold, including quantities, prices, and payment terms. A pro forma invoice template Excel can help streamline this process, making it easier to create and manage these documents.

The use of pro forma invoices has become increasingly popular in recent years, particularly among small and medium-sized enterprises (SMEs) that engage in international trade. This is because pro forma invoices offer several benefits, including:

- They provide a clear and concise summary of the transaction, reducing the risk of misunderstandings or miscommunications.

- They help to establish the terms and conditions of the sale, including payment terms and delivery dates.

- They can be used to obtain import licenses, permits, and other necessary documents.

- They can help to facilitate the smooth clearance of goods through customs.

What is a Pro Forma Invoice?

A pro forma invoice is a document that outlines the terms and conditions of a sale, including the description of goods or services, quantities, prices, and payment terms. It is typically used in international trade to provide a preliminary bill of sale, and is often required by customs authorities to facilitate the clearance of goods.

Pro forma invoices are usually issued by the seller, and are sent to the buyer prior to the shipment of goods. They can be used for a variety of purposes, including:

- To obtain import licenses and permits

- To facilitate the clearance of goods through customs

- To establish the terms and conditions of the sale

- To provide a detailed description of the goods or services being sold

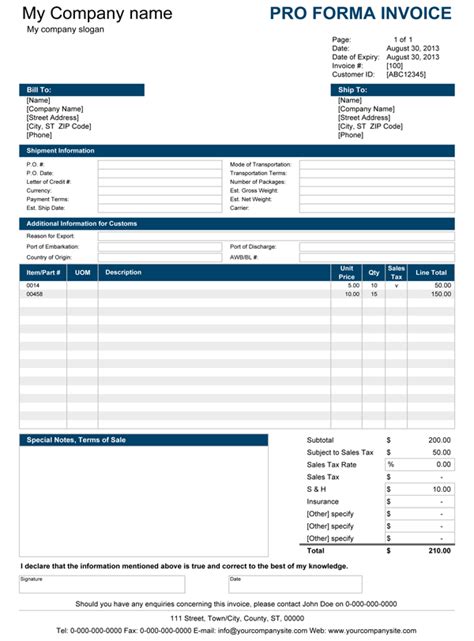

Creating a Pro Forma Invoice Template Excel

Creating a pro forma invoice template Excel can help streamline the process of creating and managing these documents. Here are some steps to follow:

- Determine the layout and design of the template

- Include the necessary fields and columns, such as:

- Buyer and seller information

- Description of goods or services

- Quantities and prices

- Payment terms

- Delivery dates

- Use formulas and functions to automate calculations and formatting

- Test the template to ensure it is working correctly

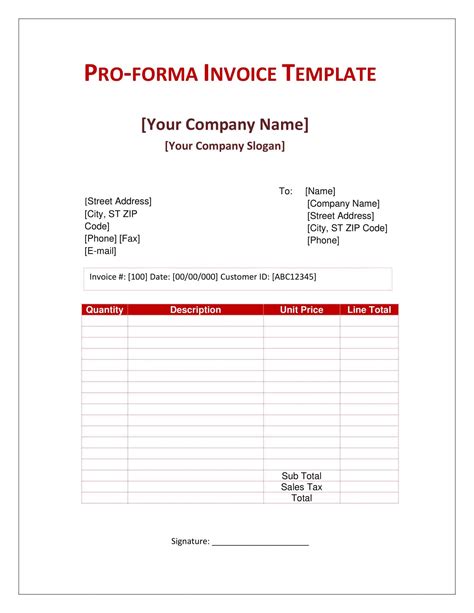

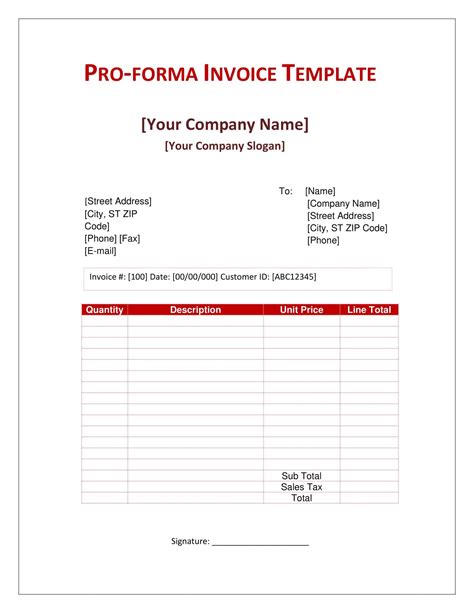

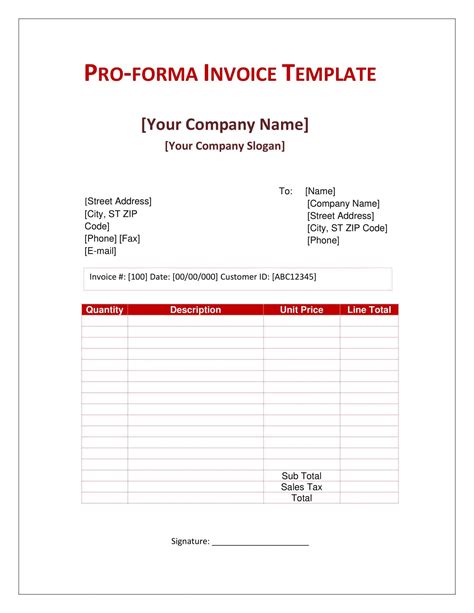

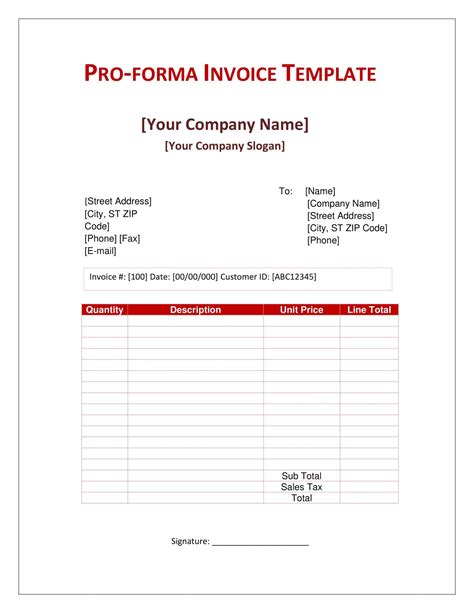

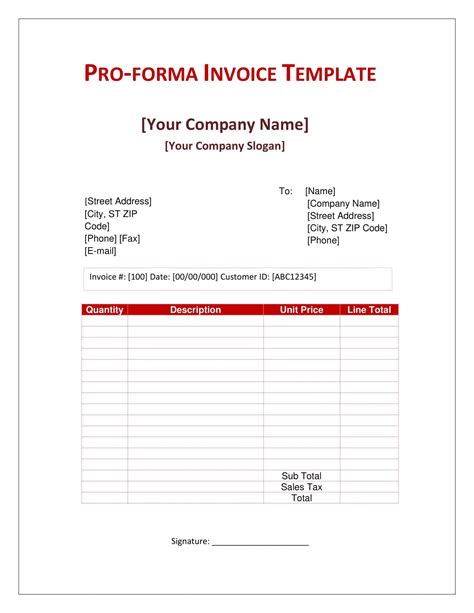

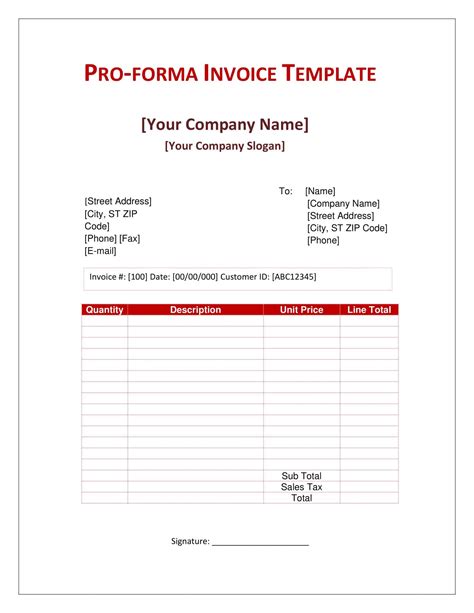

Here is an example of what a pro forma invoice template Excel might look like:

| Field | Description |

|---|---|

| Buyer Name | The name of the buyer |

| Buyer Address | The address of the buyer |

| Seller Name | The name of the seller |

| Seller Address | The address of the seller |

| Description of Goods | A detailed description of the goods or services being sold |

| Quantity | The quantity of goods or services being sold |

| Unit Price | The unit price of the goods or services |

| Total Price | The total price of the goods or services |

| Payment Terms | The payment terms, including the method of payment and any discounts or penalties |

Benefits of Using a Pro Forma Invoice Template Excel

Using a pro forma invoice template Excel can offer several benefits, including:

- Increased efficiency and productivity

- Improved accuracy and reduced errors

- Enhanced professionalism and credibility

- Streamlined workflow and reduced paperwork

- Ability to automate calculations and formatting

By using a pro forma invoice template Excel, businesses can save time and reduce the risk of errors, while also presenting a professional and credible image to their customers and partners.

Common Mistakes to Avoid When Creating a Pro Forma Invoice Template Excel

When creating a pro forma invoice template Excel, there are several common mistakes to avoid, including:

- Inaccurate or incomplete information

- Incorrect formatting or layout

- Failure to include necessary fields or columns

- Insufficient testing and validation

- Lack of automation and calculation formulas

By avoiding these common mistakes, businesses can create a pro forma invoice template Excel that is accurate, efficient, and effective.

Best Practices for Using a Pro Forma Invoice Template Excel

Here are some best practices for using a pro forma invoice template Excel:

- Use clear and concise language

- Include all necessary fields and columns

- Use automation and calculation formulas to streamline the process

- Test and validate the template regularly

- Use a consistent layout and design

- Consider using a template with built-in formulas and functions

By following these best practices, businesses can get the most out of their pro forma invoice template Excel, and improve their overall efficiency and productivity.

Conclusion

A pro forma invoice template Excel can be a valuable tool for businesses that engage in international trade. By creating a template that is accurate, efficient, and effective, businesses can streamline their workflow, reduce errors, and improve their overall credibility and professionalism.

We hope this article has provided you with a comprehensive understanding of the importance of pro forma invoices in international trade, and how to create a pro forma invoice template Excel that meets your needs.

Pro Forma Invoice Template Excel Gallery