Intro

Discover how Vanguard dominates the UK investment market with 5 key strategies. From low-cost index funds to ETFs, explore the innovative approaches that set Vanguard apart. Learn about the benefits of passive investing, tax-efficient investing, and more. Get expert insights into Vanguards winning formula and start investing like a pro.

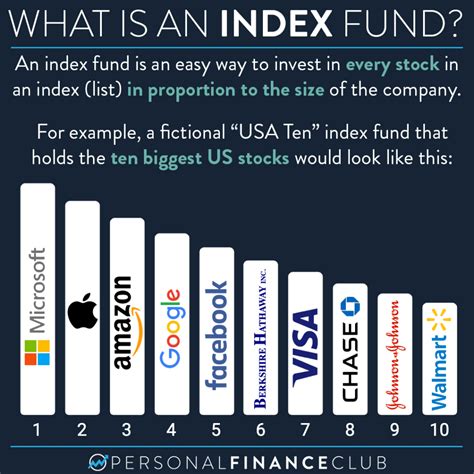

Investing in the UK can be a daunting task, especially for beginners. With so many investment platforms and options available, it's hard to know where to start. However, one name that stands out in the UK investment landscape is Vanguard. Known for its low-cost index funds and ETFs, Vanguard has become a popular choice among UK investors. In this article, we'll explore five ways Vanguard wins in the UK.

Low-Cost Investing

One of the primary reasons Vanguard stands out in the UK is its commitment to low-cost investing. Vanguard's index funds and ETFs are designed to track the market as a whole, rather than trying to beat it. This approach eliminates the need for expensive fund managers and analysts, resulting in lower fees for investors. In fact, Vanguard's average fund fee is just 0.14%, compared to the UK industry average of 0.73%. This means that investors can keep more of their returns, rather than lining the pockets of fund managers.

How Low-Cost Investing Benefits UK Investors

- Lower fees result in higher returns over the long-term

- Reduced risk of underperforming the market

- Increased transparency and simplicity

Wide Range of Investment Options

Vanguard offers a wide range of investment options to suit different investment goals and risk profiles. From low-risk bond funds to higher-risk equity funds, Vanguard has something for everyone. Its ETF range is particularly popular among UK investors, with over 20 different ETFs to choose from. This includes ETFs tracking major UK indices, such as the FTSE 100, as well as international indices like the S&P 500.

Key Benefits of Vanguard's Investment Options

- Diversified portfolios to reduce risk

- Choice of passive or active management

- Ability to invest in a range of asset classes

Transparent and Simple Fees

Vanguard is known for its transparent and simple fee structure. Unlike some other investment platforms, Vanguard doesn't charge hidden fees or complex management fees. Its fees are clearly disclosed upfront, so investors know exactly what they're paying. This transparency is particularly important in the UK, where investors are increasingly seeking low-cost and straightforward investment options.

Key Benefits of Vanguard's Fee Structure

- Clear and transparent fees

- No hidden charges or surprises

- Ability to budget and plan with confidence

Established Track Record

Vanguard has an established track record of delivering strong investment returns over the long-term. Its index funds and ETFs have consistently outperformed actively managed funds, with many of its funds ranking among the top performers in their respective categories. This track record is particularly important in the UK, where investors are seeking reliable and consistent returns.

Key Benefits of Vanguard's Track Record

- Proven investment approach

- Consistent returns over the long-term

- Reduced risk of investment losses

Innovative Investment Solutions

Vanguard is constantly innovating and improving its investment solutions to meet the evolving needs of UK investors. From its popular Vanguard Investor platform to its range of sustainable investment funds, Vanguard is at the forefront of investment innovation. Its commitment to innovation is particularly important in the UK, where investors are seeking new and better ways to invest their money.

Key Benefits of Vanguard's Innovative Solutions

- Access to cutting-edge investment products

- Ability to invest in a range of themes and sectors

- Constantly improving investment experience

Vanguard Investment Solutions Gallery

In conclusion, Vanguard wins in the UK by offering low-cost investing, a wide range of investment options, transparent and simple fees, an established track record, and innovative investment solutions. Whether you're a seasoned investor or just starting out, Vanguard has something to offer. With its commitment to low-cost investing and innovation, Vanguard is an excellent choice for UK investors seeking reliable and consistent returns.

We hope you found this article informative and helpful. Do you have any experience with Vanguard or other investment platforms? Share your thoughts and comments below!