Intro

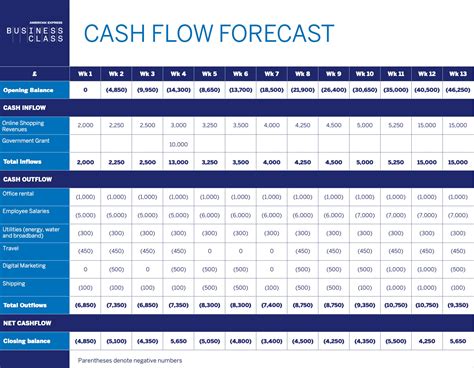

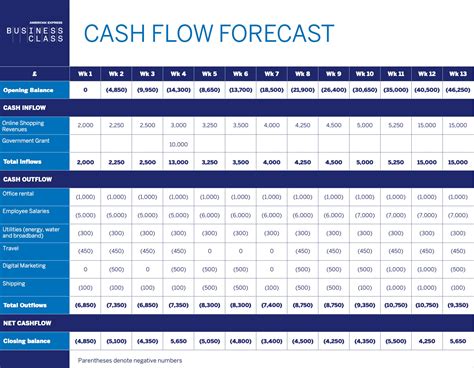

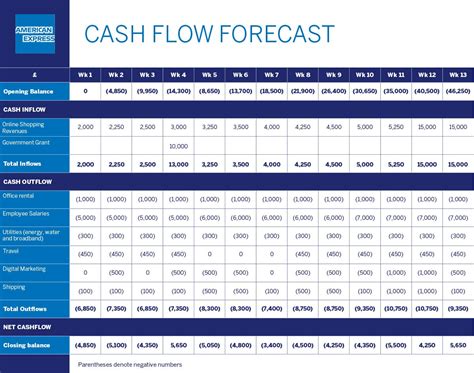

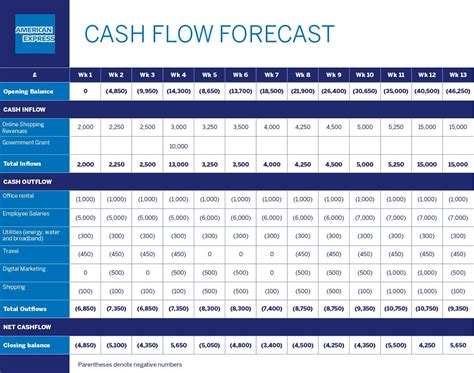

Master your business finances with a 12-month rolling cash flow forecast template. Easily predict income and expenses, identify cash flow gaps, and make informed decisions. Get a template that adapts to your business needs, includes key performance indicators, and helps you stay on top of your cash flow management, financial planning, and budgeting.

Creating a 12-month rolling cash flow forecast can seem daunting, but with the right template and guidance, it can be made easy. A well-structured cash flow forecast is essential for businesses to manage their finances effectively, make informed decisions, and ensure they have sufficient funds to meet their obligations. In this article, we will provide you with a comprehensive guide on creating a 12-month rolling cash flow forecast template and explore its benefits, components, and steps to create one.

Benefits of a 12-Month Rolling Cash Flow Forecast

A 12-month rolling cash flow forecast offers several benefits to businesses, including:

- Improved financial management: By forecasting cash inflows and outflows, businesses can better manage their finances and make informed decisions.

- Reduced financial stress: A cash flow forecast helps businesses identify potential cash shortages and take proactive measures to mitigate them.

- Enhanced decision-making: A 12-month rolling cash flow forecast provides businesses with a clear understanding of their financial position, enabling them to make informed decisions about investments, funding, and resource allocation.

- Increased transparency: A cash flow forecast helps businesses communicate their financial position to stakeholders, including investors, lenders, and suppliers.

Components of a 12-Month Rolling Cash Flow Forecast

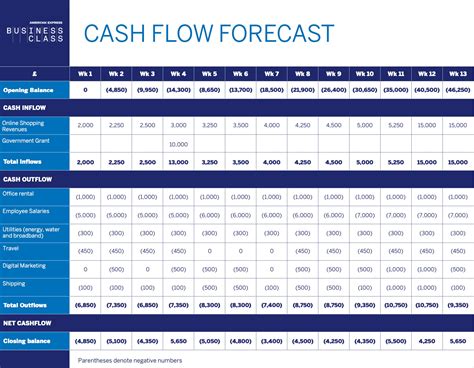

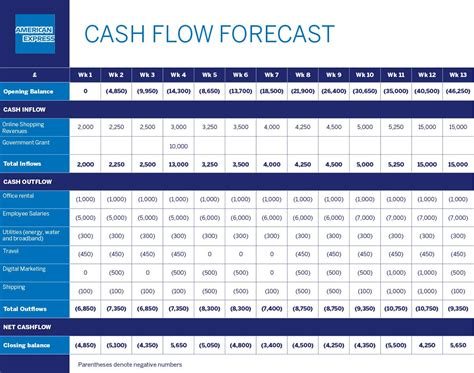

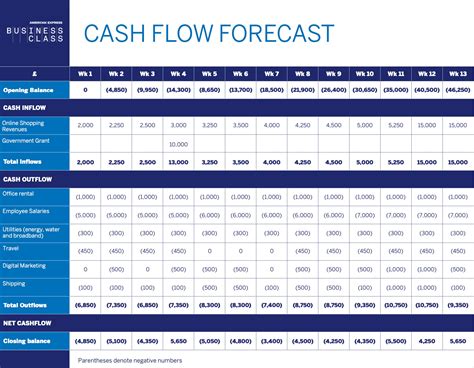

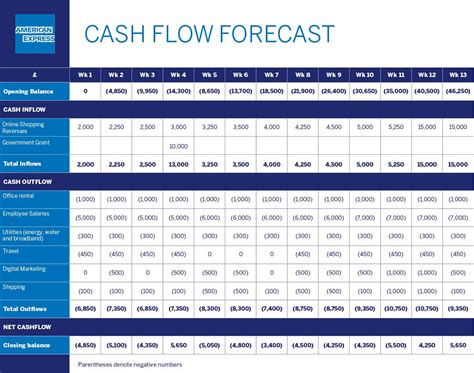

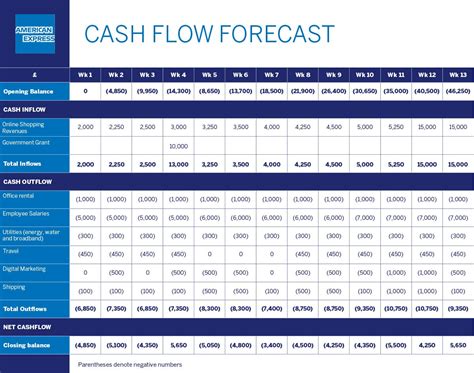

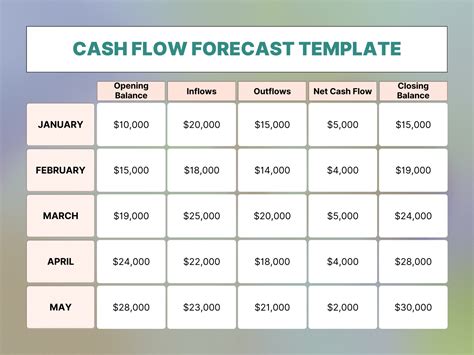

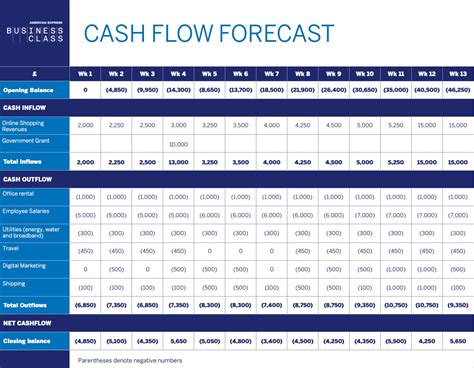

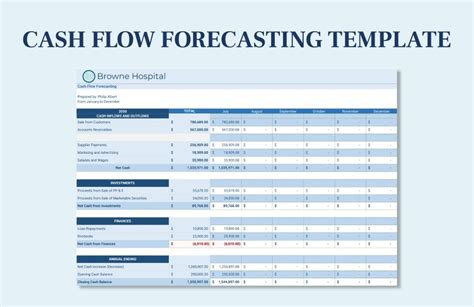

A 12-month rolling cash flow forecast typically includes the following components:

- Historical financial data: This includes past income statements, balance sheets, and cash flow statements.

- Forecast assumptions: This includes assumptions about future sales, revenue, expenses, and cash flows.

- Income statement forecast: This includes projected income statements for the next 12 months.

- Balance sheet forecast: This includes projected balance sheets for the next 12 months.

- Cash flow statement forecast: This includes projected cash flow statements for the next 12 months.

Steps to Create a 12-Month Rolling Cash Flow Forecast Template

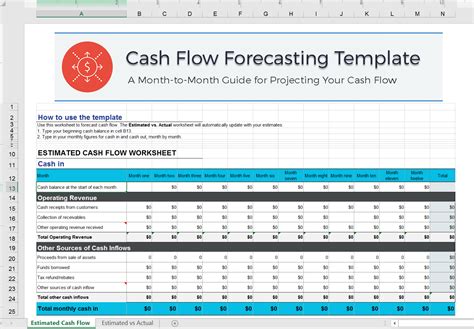

Creating a 12-month rolling cash flow forecast template involves the following steps:

- Gather historical financial data: Collect past income statements, balance sheets, and cash flow statements.

- Make forecast assumptions: Make assumptions about future sales, revenue, expenses, and cash flows.

- Create an income statement forecast: Project income statements for the next 12 months.

- Create a balance sheet forecast: Project balance sheets for the next 12 months.

- Create a cash flow statement forecast: Project cash flow statements for the next 12 months.

- Roll forward the forecast: Update the forecast regularly to reflect actual results and changes in assumptions.

Best Practices for Creating a 12-Month Rolling Cash Flow Forecast Template

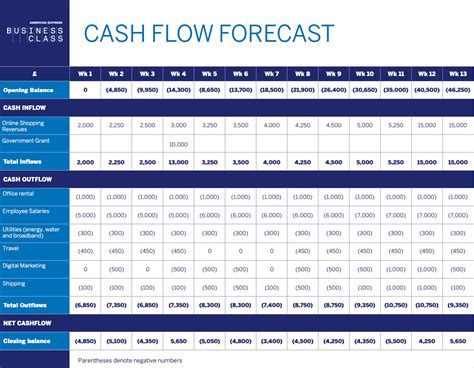

To create an effective 12-month rolling cash flow forecast template, follow these best practices:

- Use a rolling forecast: Update the forecast regularly to reflect actual results and changes in assumptions.

- Use a template: Use a template to ensure consistency and accuracy.

- Use historical data: Use historical data to inform forecast assumptions.

- Use sensitivity analysis: Test different scenarios to understand the impact of changes on cash flows.

Common Mistakes to Avoid When Creating a 12-Month Rolling Cash Flow Forecast Template

When creating a 12-month rolling cash flow forecast template, avoid the following common mistakes:

- Overly optimistic assumptions: Make realistic assumptions about future sales, revenue, and expenses.

- Insufficient detail: Ensure the forecast includes sufficient detail to inform decision-making.

- Lack of regular updates: Update the forecast regularly to reflect actual results and changes in assumptions.

- Failure to consider risks: Consider potential risks and scenarios that could impact cash flows.

Conclusion

Creating a 12-month rolling cash flow forecast template is an essential tool for businesses to manage their finances effectively. By following the steps and best practices outlined in this article, businesses can create an effective cash flow forecast that informs decision-making and ensures they have sufficient funds to meet their obligations. Remember to avoid common mistakes and regularly update the forecast to reflect actual results and changes in assumptions.

Cash Flow Forecast Template Image Gallery

We hope this article has provided you with a comprehensive guide on creating a 12-month rolling cash flow forecast template. If you have any questions or need further assistance, please don't hesitate to ask.