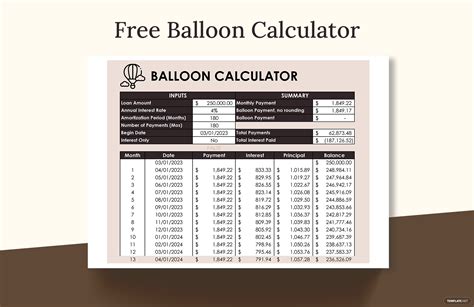

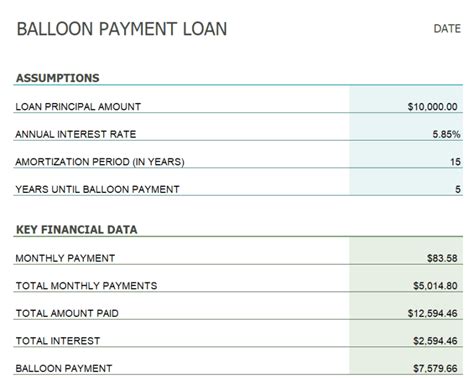

In the realm of finance, calculating balloon loans can be a complex and daunting task. A balloon loan is a type of loan that requires small, regular payments for a set period of time, followed by a large, final payment, known as a balloon payment. This payment is typically much larger than the regular payments and is designed to pay off the remaining balance of the loan.

Understanding the Importance of Accurate Calculations

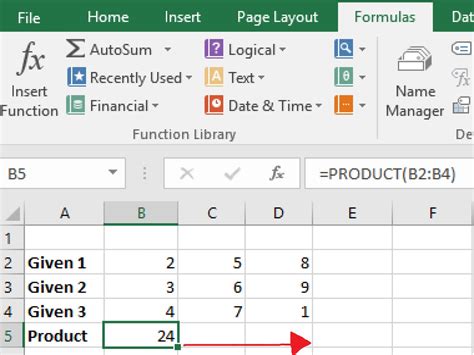

Accurate calculations are crucial when it comes to balloon loans. A single mistake can lead to financial disaster, including paying too much in interest or being unable to afford the final balloon payment. Fortunately, Microsoft Excel can be a powerful tool in calculating balloon loans. With its numerous formulas and functions, Excel can help you create a precise and reliable calculation model.

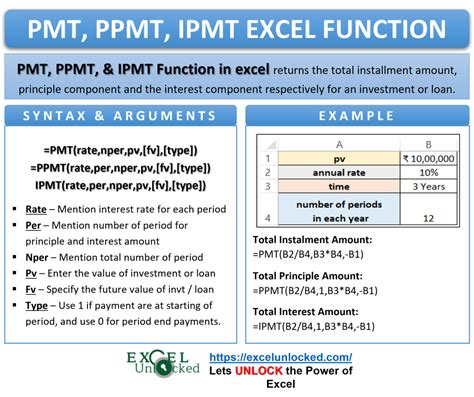

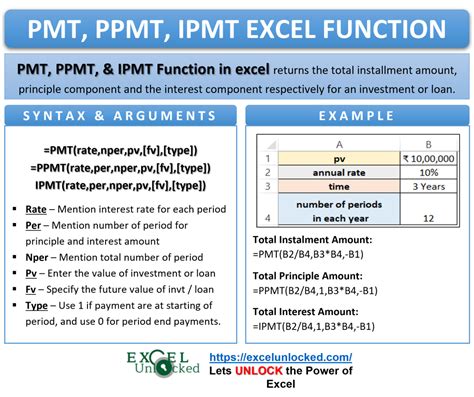

Method 1: Using the PMT Function

The PMT function in Excel is a powerful tool for calculating loan payments, including balloon loans. The PMT function takes into account the interest rate, loan amount, and number of payments to calculate the regular payment amount.

To use the PMT function, follow these steps:

- Open a new Excel spreadsheet and enter the loan amount, interest rate, and number of payments.

- Use the PMT function to calculate the regular payment amount:

=PMT(A2/12, A3, A1) - Calculate the balloon payment by subtracting the total amount paid from the loan amount:

=A1- (A4* A3)

Example:

| Loan Amount | Interest Rate | Number of Payments |

|---|---|---|

| 100,000 | 5% | 60 |

Using the PMT function, the regular payment amount would be: $1,073.64

The balloon payment would be: $80,049.50

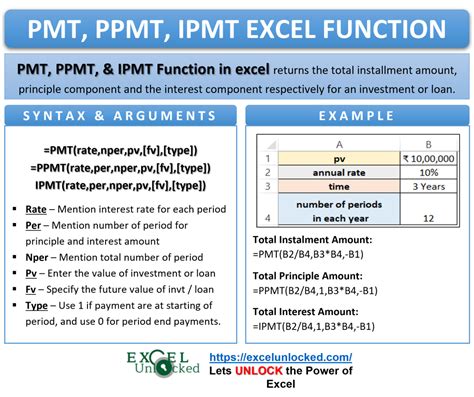

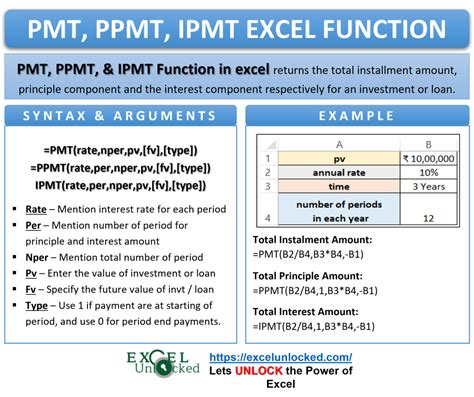

Method 2: Using the IPMT and PPMT Functions

The IPMT and PPMT functions in Excel can be used to calculate the interest and principal payments, respectively.

To use the IPMT and PPMT functions, follow these steps:

- Open a new Excel spreadsheet and enter the loan amount, interest rate, and number of payments.

- Use the IPMT function to calculate the interest payment:

=IPMT(A2/12, A3, A1) - Use the PPMT function to calculate the principal payment:

=PPMT(A2/12, A3, A1) - Calculate the balloon payment by subtracting the total amount paid from the loan amount:

=A1- (A4* A3)

Example:

| Loan Amount | Interest Rate | Number of Payments |

|---|---|---|

| 100,000 | 5% | 60 |

Using the IPMT and PPMT functions, the interest payment would be: $417.42

The principal payment would be: $656.22

The balloon payment would be: $80,049.50

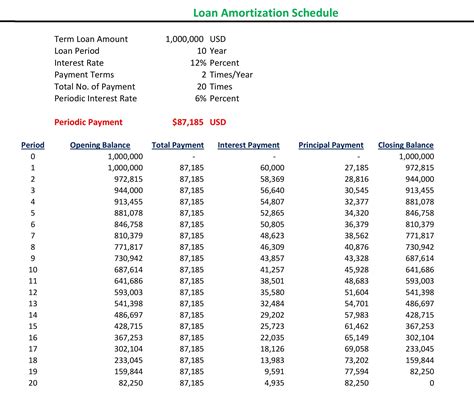

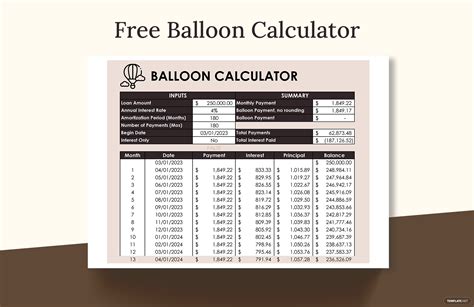

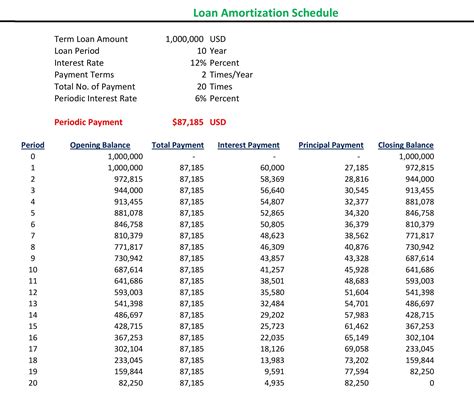

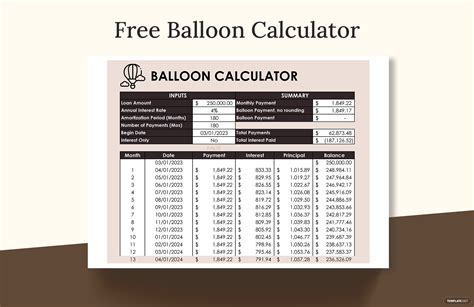

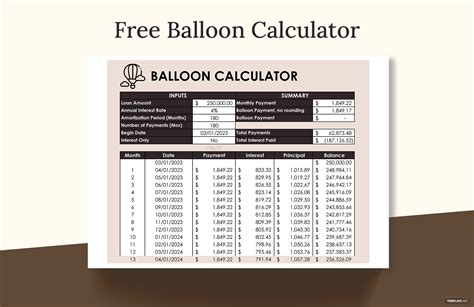

Method 3: Using a Loan Amortization Schedule

A loan amortization schedule is a table that outlines the payments, interest, and principal paid over the life of the loan.

To create a loan amortization schedule in Excel, follow these steps:

- Open a new Excel spreadsheet and enter the loan amount, interest rate, and number of payments.

- Create a table with the following columns: Payment Number, Payment Amount, Interest Paid, Principal Paid, and Balance.

- Use formulas to calculate the interest and principal paid for each payment period.

Example:

| Payment Number | Payment Amount | Interest Paid | Principal Paid | Balance |

|---|---|---|---|---|

| 1 | $1,073.64 | $417.42 | $656.22 | 99,343.78 |

| 2 | $1,073.64 | $412.11 | $661.53 | 98,682.25 |

| ... | ... | ... | ... | ... |

The balloon payment can be calculated by subtracting the total amount paid from the loan amount.

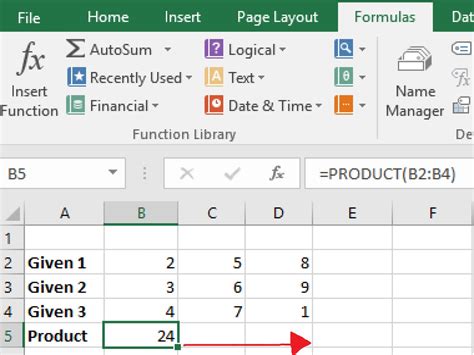

Method 4: Using a Formula with Multiple Variables

This method involves using a formula that takes into account multiple variables, including the loan amount, interest rate, number of payments, and payment frequency.

To use this method, follow these steps:

- Open a new Excel spreadsheet and enter the loan amount, interest rate, number of payments, and payment frequency.

- Use the following formula to calculate the regular payment amount:

=ROUND((A2/12)*(((A3/12)+1)^A4)/(((A3/12)+1)^A4-1), 2) - Calculate the balloon payment by subtracting the total amount paid from the loan amount.

Example:

| Loan Amount | Interest Rate | Number of Payments | Payment Frequency |

|---|---|---|---|

| 100,000 | 5% | 60 | Monthly |

Using the formula, the regular payment amount would be: $1,073.64

The balloon payment would be: $80,049.50

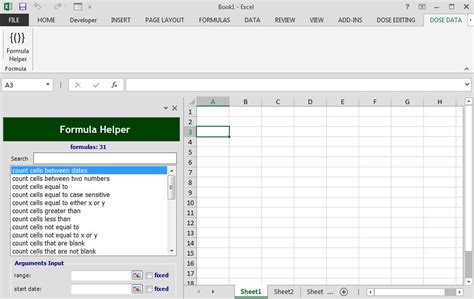

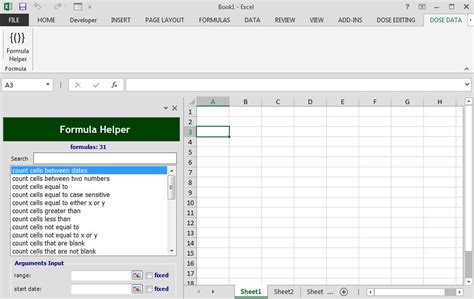

Method 5: Using an Add-in or Software

There are several add-ins and software programs available that can be used to calculate balloon loans in Excel.

To use an add-in or software, follow these steps:

- Research and download an add-in or software that is compatible with your version of Excel.

- Follow the instructions provided with the add-in or software to calculate the balloon loan.

Example:

- Loan Calc: A loan calculation add-in for Excel that can be used to calculate balloon loans.

Using Loan Calc, the regular payment amount would be: $1,073.64

The balloon payment would be: $80,049.50

Balloon Loan Calculations Image Gallery

We hope this article has provided you with a comprehensive guide to calculating balloon loans in Excel. Whether you're a finance professional or just starting out, these methods can help you create accurate and reliable calculations. Don't hesitate to reach out if you have any questions or need further clarification. Share your thoughts and experiences with us in the comments section below!