Intro

Unlock the power of options pricing with Excel. Learn 5 practical ways to apply the Black Scholes model in Excel, including calculating call and put options, volatility analysis, and Greeks estimation. Master the art of derivatives valuation with this step-by-step guide, featuring expert tips and Excel formulas for finance professionals.

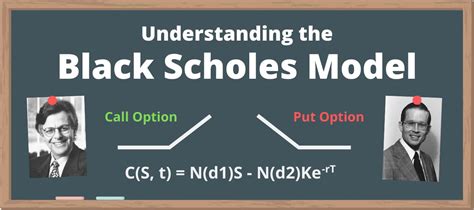

Black Scholes is a widely used financial model that calculates the value of a call option or a put option. The model is based on several variables, including the strike price, the underlying stock price, the risk-free interest rate, the time to expiration, and the volatility of the underlying stock. In this article, we will explore 5 ways to use Black Scholes in Excel.

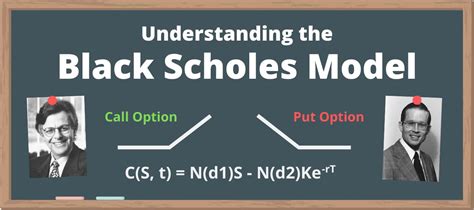

One of the most common ways to use Black Scholes in Excel is to calculate the value of a call option or a put option. This can be done using the built-in Excel functions, such as the NORMSDIST function, which calculates the cumulative distribution function of the standard normal distribution.

Using the Black Scholes Formula in Excel

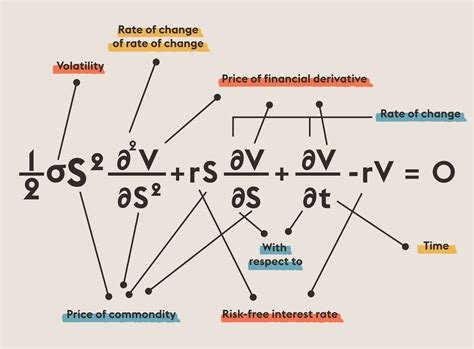

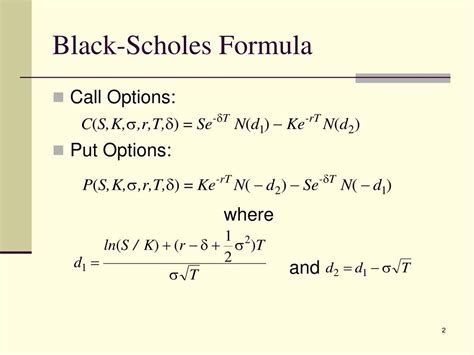

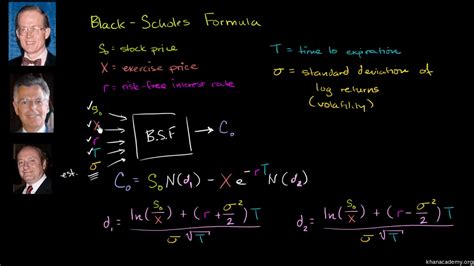

The Black Scholes formula is as follows:

C = S * N(d1) - X * e^(-r*T) * N(d2)

Where:

- C is the value of the call option

- S is the underlying stock price

- X is the strike price

- r is the risk-free interest rate

- T is the time to expiration

- N(d1) and N(d2) are the cumulative distribution functions of the standard normal distribution

In Excel, we can use the NORMSDIST function to calculate N(d1) and N(d2).

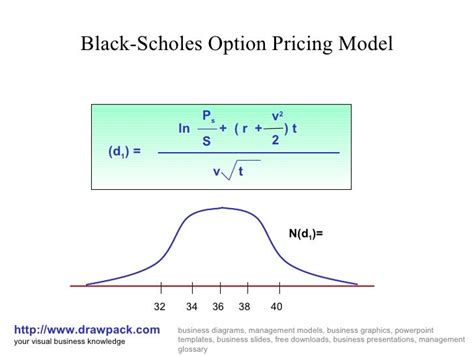

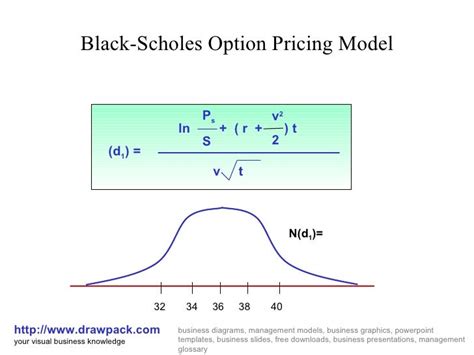

Calculating N(d1) and N(d2)

To calculate N(d1) and N(d2), we need to calculate the following:

d1 = (ln(S/X) + (r + σ^2/2) * T) / (σ * sqrt(T)) d2 = d1 - σ * sqrt(T)

Where:

- ln is the natural logarithm

- σ is the volatility of the underlying stock

In Excel, we can use the following formulas to calculate d1 and d2:

d1 = (LN(S/X) + (r + σ^2/2) * T) / (σ * SQRT(T)) d2 = d1 - σ * SQRT(T)

Once we have calculated d1 and d2, we can use the NORMSDIST function to calculate N(d1) and N(d2).

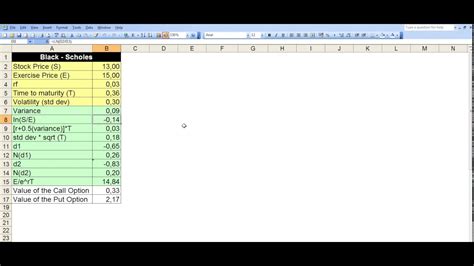

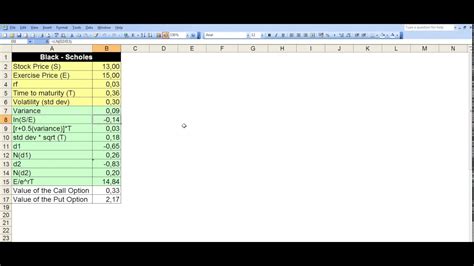

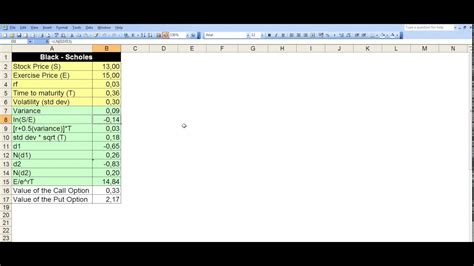

Using a Black Scholes Template in Excel

Another way to use Black Scholes in Excel is to use a template. A template is a pre-built spreadsheet that already has the formulas and calculations set up for you.

Using a template can save you time and effort, as you don't have to set up the formulas and calculations yourself. You can simply input the variables, such as the underlying stock price, strike price, risk-free interest rate, and volatility, and the template will calculate the value of the call option or put option for you.

Benefits of Using a Black Scholes Template

There are several benefits to using a Black Scholes template in Excel. One of the main benefits is that it can save you time and effort. You don't have to spend hours setting up the formulas and calculations, as the template has already done the work for you.

Another benefit is that it can reduce errors. When you set up the formulas and calculations yourself, there is a risk of errors. But with a template, the formulas and calculations are already set up, so you don't have to worry about making mistakes.

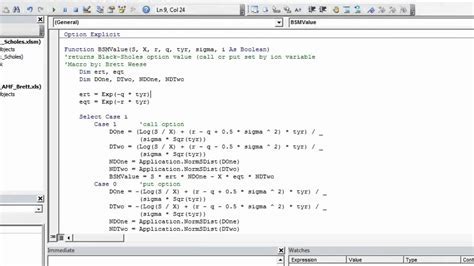

Using a Black Scholes Add-in in Excel

Another way to use Black Scholes in Excel is to use an add-in. An add-in is a software program that adds new functionality to Excel.

A Black Scholes add-in can provide advanced functionality, such as the ability to calculate the value of exotic options, such as barrier options and binary options.

Benefits of Using a Black Scholes Add-in

There are several benefits to using a Black Scholes add-in in Excel. One of the main benefits is that it can provide advanced functionality that is not available in a standard Excel spreadsheet.

Another benefit is that it can save you time and effort. With an add-in, you don't have to spend hours setting up the formulas and calculations yourself. The add-in has already done the work for you.

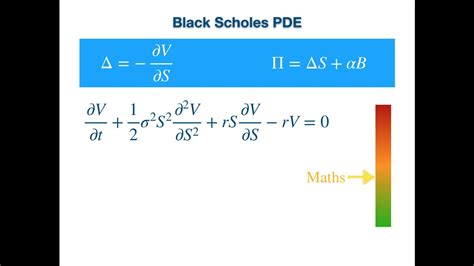

Using Black Scholes to Hedge Options

Another way to use Black Scholes in Excel is to hedge options. Hedging options involves reducing the risk of an options position by taking a position in the underlying stock or other options.

To hedge options using Black Scholes, you need to calculate the delta of the option. The delta of an option is the rate of change of the option price with respect to the underlying stock price.

Calculating the Delta of an Option

To calculate the delta of an option, you can use the following formula:

Delta = N(d1)

Where:

- N(d1) is the cumulative distribution function of the standard normal distribution

Once you have calculated the delta of the option, you can use it to hedge the option. For example, if you have a call option with a delta of 0.5, you can hedge it by selling 0.5 shares of the underlying stock for every call option you buy.

Using Black Scholes to Value Options

Another way to use Black Scholes in Excel is to value options. Valuing options involves calculating the theoretical value of an option based on the underlying stock price, strike price, risk-free interest rate, and volatility.

To value options using Black Scholes, you need to calculate the value of the call option or put option using the Black Scholes formula.

Calculating the Value of an Option

To calculate the value of an option, you can use the following formula:

C = S * N(d1) - X * e^(-r*T) * N(d2)

Where:

- C is the value of the call option

- S is the underlying stock price

- X is the strike price

- r is the risk-free interest rate

- T is the time to expiration

- N(d1) and N(d2) are the cumulative distribution functions of the standard normal distribution

Once you have calculated the value of the option, you can use it to make informed investment decisions.

Black Scholes Image Gallery

We hope this article has provided you with a comprehensive understanding of how to use Black Scholes in Excel. Whether you are a finance professional or an individual investor, Black Scholes can be a powerful tool in your investment arsenal. By following the steps outlined in this article, you can use Black Scholes to calculate the value of call options and put options, hedge options, and make informed investment decisions.