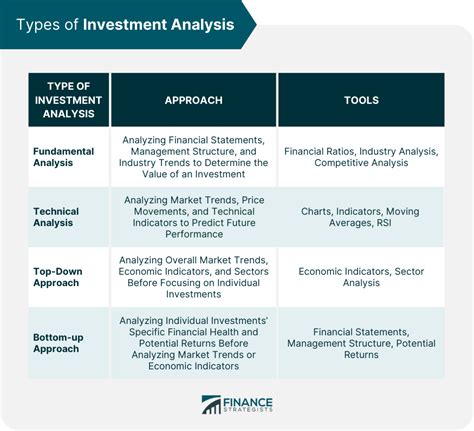

Calculating the payback period is a crucial step in evaluating the feasibility of an investment or a project. It helps investors and managers understand how long it will take to recover their initial investment. Excel provides several ways to calculate the payback period, making it an essential tool in financial analysis. In this article, we will explore five ways to calculate the payback period in Excel.

What is Payback Period?

The payback period is the time it takes for an investment to generate returns equal to its initial cost. It is a simple and intuitive measure of an investment's profitability. A shorter payback period indicates that an investment will generate returns more quickly, making it a more attractive option.

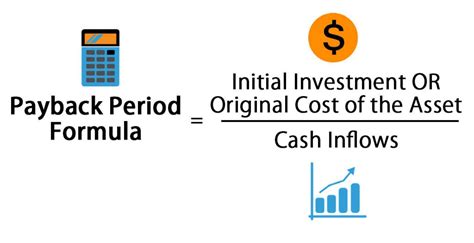

Method 1: Using the Payback Period Formula

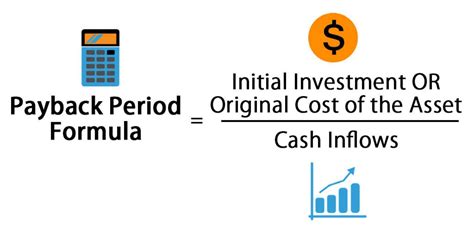

The payback period formula is:

Payback Period = Initial Investment / Annual Cash Flow

This formula assumes that the annual cash flow is constant over the life of the investment.

To calculate the payback period in Excel using this formula, follow these steps:

- Enter the initial investment in cell A1.

- Enter the annual cash flow in cell B1.

- Enter the formula

=A1/B1in cell C1. - Format the result as a number with two decimal places.

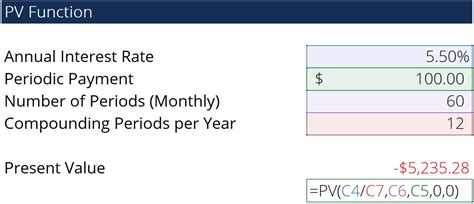

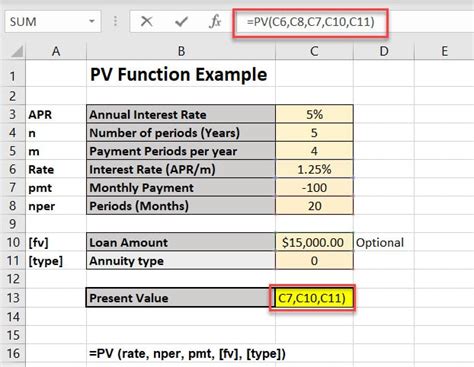

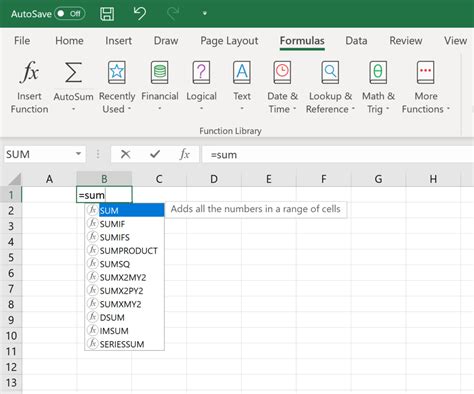

Method 2: Using the PV Function

The PV function in Excel calculates the present value of a series of cash flows. We can use this function to calculate the payback period by setting the present value equal to the initial investment.

To calculate the payback period in Excel using the PV function, follow these steps:

- Enter the initial investment in cell A1.

- Enter the annual cash flow in cell B1.

- Enter the formula

=PV(B1,A1,0)in cell C1. - Format the result as a number with two decimal places.

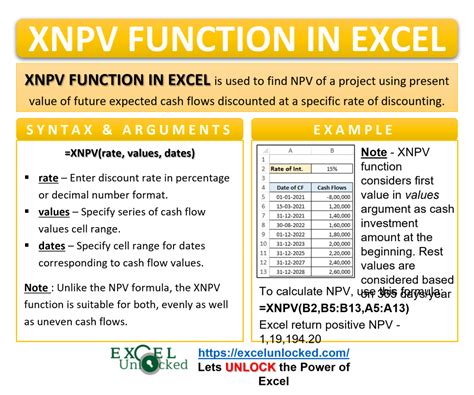

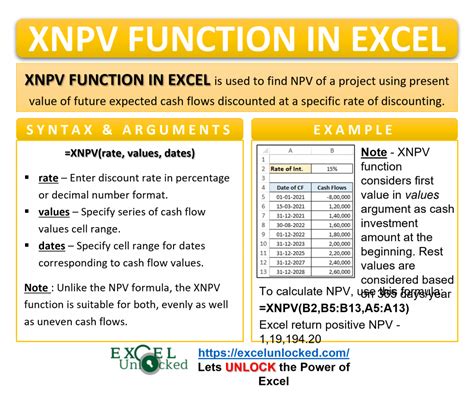

Method 3: Using the XNPV Function

The XNPV function in Excel calculates the present value of a series of cash flows that are not periodic. We can use this function to calculate the payback period by setting the present value equal to the initial investment.

To calculate the payback period in Excel using the XNPV function, follow these steps:

- Enter the initial investment in cell A1.

- Enter the annual cash flow in cell B1.

- Enter the formula

=XNPV(B1,A1,0)in cell C1. - Format the result as a number with two decimal places.

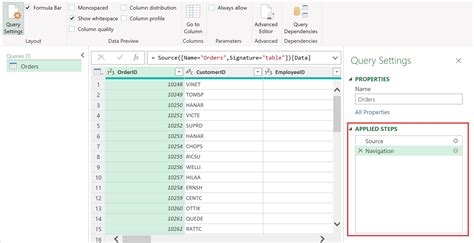

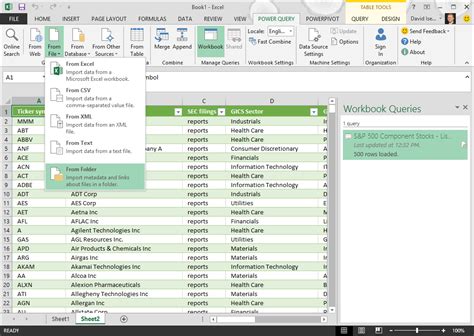

Method 4: Using the Power Query

Power Query is a powerful tool in Excel that allows you to manipulate and analyze data. We can use Power Query to calculate the payback period by creating a custom function.

To calculate the payback period in Excel using Power Query, follow these steps:

- Go to the "Data" tab in the ribbon.

- Click on "New Query" and select "From Other Sources".

- Select "Blank Query".

- Enter the formula

=let initial_investment = A1, annual_cash_flow = B1 in initial_investment / annual_cash_flowin the formula bar. - Load the query into the worksheet.

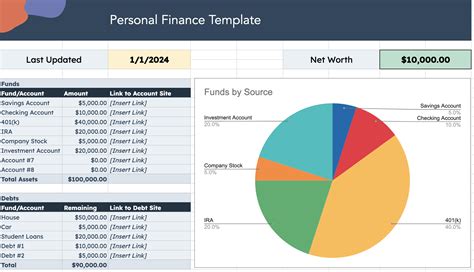

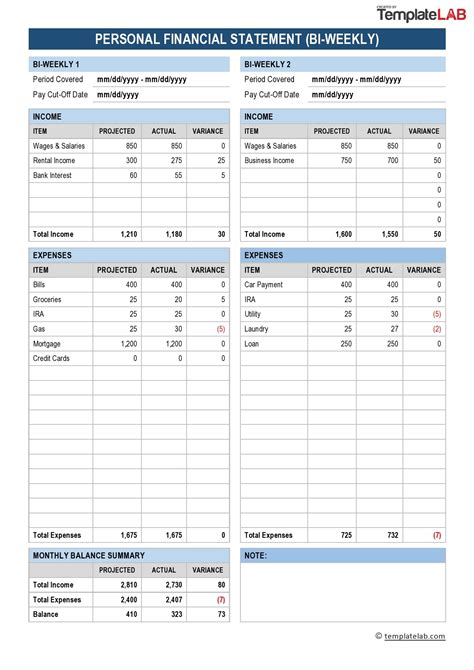

Method 5: Using the Financial Templates

Excel provides several financial templates that can be used to calculate the payback period. One of the most useful templates is the "Amortization Schedule" template.

To calculate the payback period in Excel using the Financial Templates, follow these steps:

- Go to the "File" tab in the ribbon.

- Click on "New" and select "Spreadsheet".

- Search for "Amortization Schedule" in the template gallery.

- Select the template and click on "Create".

- Enter the initial investment and annual cash flow in the designated cells.

Conclusion

Calculating the payback period is an essential step in evaluating the feasibility of an investment or a project. Excel provides several ways to calculate the payback period, including using the payback period formula, PV function, XNPV function, Power Query, and financial templates. By using these methods, you can quickly and easily calculate the payback period and make informed decisions about your investments.

Gallery of Payback Period Calculation in Excel

Payback Period Calculation in Excel Image Gallery

We hope this article has helped you understand how to calculate the payback period in Excel using different methods. If you have any questions or need further assistance, please don't hesitate to ask.