Intro

Unlock the power of Excels CumIPMT function to calculate cumulative interest payments on a loan or investment. Learn how to use this formula to accurately track interest payments over time, incorporating key concepts such as principal, rate, and period. Master Excels financial functions and streamline your financial analysis with this expert guide.

Calculating cumulative interest payments is a crucial aspect of financial planning, especially when dealing with loans or investments. Excel's CumIPMT function is a powerful tool that helps users accurately determine the cumulative interest paid over a specific period. In this article, we will delve into the world of cumulative interest payments, explore the CumIPMT function, and provide practical examples to demonstrate its application.

Understanding Cumulative Interest Payments

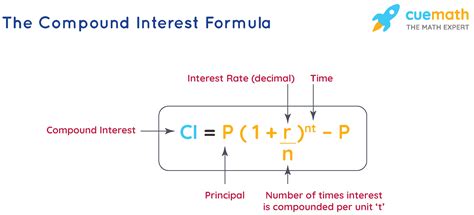

Cumulative interest payments refer to the total interest paid on a loan or investment over a specified period. This calculation is essential for borrowers and investors alike, as it helps them understand the true cost of borrowing or the actual return on investment. Cumulative interest payments take into account the interest rate, principal amount, and time period, providing a comprehensive picture of the interest paid.

Introducing Excel's CumIPMT Function

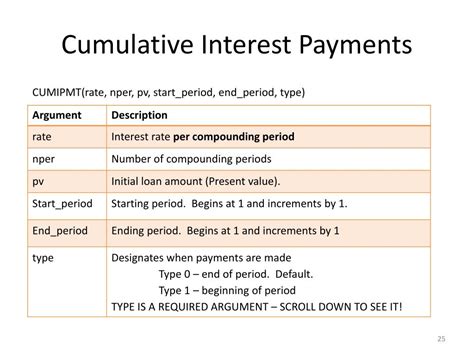

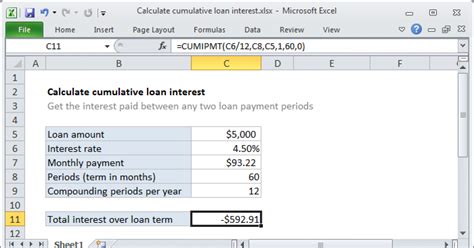

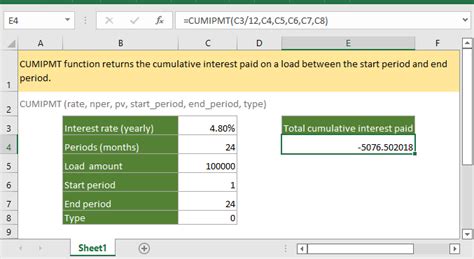

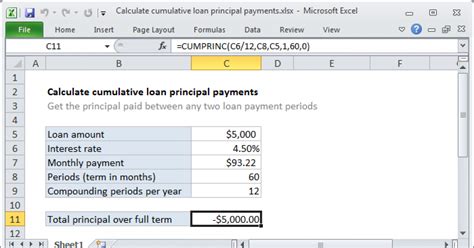

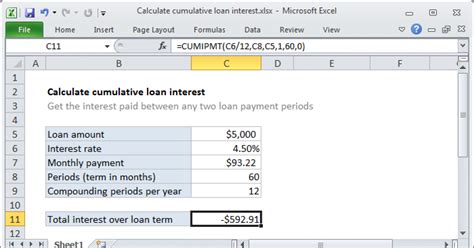

Excel's CumIPMT function is a built-in formula designed to calculate cumulative interest payments. The function is part of Excel's financial functions and can be used to determine the cumulative interest paid on a loan or investment. The syntax for the CumIPMT function is:

CumIPMT(rate, nper, pv, start_period, end_period, type)

Where:

- rate: The interest rate per period

- nper: The total number of payment periods

- pv: The present value (principal amount)

- start_period: The starting period for the calculation

- end_period: The ending period for the calculation

- type: The type of payment (0 for end-of-period, 1 for beginning-of-period)

How to Use the CumIPMT Function

Using the CumIPMT function is straightforward. Follow these steps:

- Open your Excel spreadsheet and select the cell where you want to display the cumulative interest payment.

- Type "=CumIPMT(" and select the rate, nper, pv, start_period, end_period, and type arguments.

- Enter the values for each argument, separated by commas.

- Close the parentheses and press Enter.

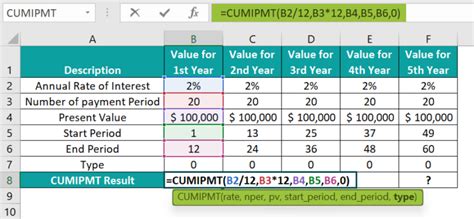

Example 1: Calculating Cumulative Interest Payments on a Loan

Suppose you have a loan with the following details:

- Interest rate: 6% per annum

- Loan amount (principal): $10,000

- Loan term: 5 years

- Monthly payments: $188.71

To calculate the cumulative interest paid over the 5-year period, follow these steps:

- Enter the rate: 6%/year = 0.06 ( converted to monthly rate: 0.06/12 = 0.005)

- Enter the nper: 5 years * 12 months/year = 60 months

- Enter the pv: $10,000

- Enter the start_period: 1 (first month)

- Enter the end_period: 60 (last month)

- Enter the type: 0 (end-of-period payments)

The formula becomes: =CumIPMT(0.005, 60, 10000, 1, 60, 0)

Press Enter, and the result will be: $3,441.91

This means that over the 5-year period, you will pay a total of $3,441.91 in interest.

Example 2: Calculating Cumulative Interest Payments on an Investment

Suppose you have an investment with the following details:

- Interest rate: 4% per annum

- Principal amount: $5,000

- Investment term: 3 years

- Quarterly payments: $150

To calculate the cumulative interest earned over the 3-year period, follow these steps:

- Enter the rate: 4%/year = 0.04 (converted to quarterly rate: 0.04/4 = 0.01)

- Enter the nper: 3 years * 4 quarters/year = 12 quarters

- Enter the pv: $5,000

- Enter the start_period: 1 (first quarter)

- Enter the end_period: 12 (last quarter)

- Enter the type: 1 (beginning-of-period payments)

The formula becomes: =CumIPMT(0.01, 12, 5000, 1, 12, 1)

Press Enter, and the result will be: $645.19

This means that over the 3-year period, you will earn a total of $645.19 in interest.

Tips and Variations

- To calculate the cumulative interest paid or earned between two specific periods, adjust the start_period and end_period arguments accordingly.

- To calculate the cumulative interest paid or earned on a series of investments or loans, use the CumIPMT function for each individual investment or loan, and then sum the results.

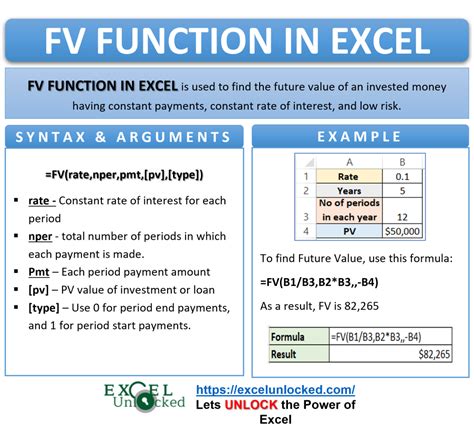

- To account for compounding interest, use the FV function (Future Value) in combination with the CumIPMT function.

Gallery of Cumulative Interest Payments and Excel's CumIPMT Function

Cumulative Interest Payments Image Gallery

By mastering the CumIPMT function, you can accurately calculate cumulative interest payments and make informed decisions about your financial endeavors. Remember to experiment with different scenarios and explore the various applications of this powerful Excel function.

We hope you found this article informative and helpful. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with your friends and colleagues who might benefit from learning about cumulative interest payments and Excel's CumIPMT function.