Intro

Identify the warning signs of a downturn before its too late. Discover the 7 signs of a dangerous decline ahead, including market volatility, economic indicators, and behavioral changes. Learn to recognize the red flags, from declining sales to increased debt, and take proactive steps to safeguard your business and investments in a shifting market landscape.

The global economy has experienced a significant amount of turmoil in recent years, and many experts are warning of a potential decline ahead. While it's impossible to predict the future with certainty, there are several signs that suggest a downturn may be on the horizon. In this article, we'll explore seven signs of a potentially dangerous decline ahead.

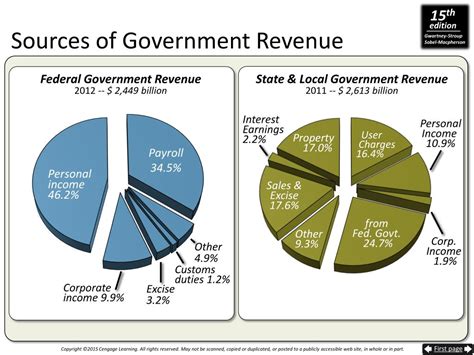

Rising Debt Levels

One of the most significant signs of a potential decline ahead is the rising level of debt in many countries around the world. Government debt, in particular, has reached unprecedented levels, and it's unclear how it will be repaid. When governments take on too much debt, it can lead to a decrease in investor confidence, higher interest rates, and a reduced ability to respond to future economic downturns.

How Does High Government Debt Affect the Economy?

High government debt can have a number of negative effects on the economy, including:

- Increased interest rates: When governments take on too much debt, investors may demand higher interest rates to compensate for the increased risk. This can make borrowing more expensive for consumers and businesses.

- Reduced economic growth: High levels of government debt can reduce economic growth by crowding out private sector investment and increasing the burden of debt repayment on future generations.

- Decreased investor confidence: When governments are heavily indebted, it can erode investor confidence and lead to a decrease in investment and economic activity.

Falling Productivity Rates

Another sign of a potentially dangerous decline ahead is falling productivity rates. Productivity growth is essential for economic growth, and when it slows down, it can have serious consequences for the economy. In recent years, productivity growth has slowed significantly in many countries, and it's unclear what's causing the decline.

What's Causing the Decline in Productivity Growth?

There are a number of potential explanations for the decline in productivity growth, including:

- Lack of investment in technology: Many countries have seen a decline in investment in technology and other capital goods, which is essential for productivity growth.

- Changing workforce demographics: Changes in workforce demographics, such as an aging population, can lead to a decline in productivity growth.

- Increased regulatory burden: An increased regulatory burden can make it more difficult for businesses to innovate and improve productivity.

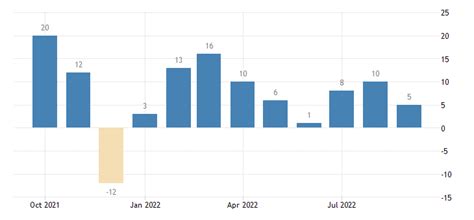

Decreased Business Investment

Decreased business investment is another sign of a potentially dangerous decline ahead. When businesses aren't investing in new projects and technologies, it can have serious consequences for economic growth. In recent years, business investment has declined significantly in many countries, and it's unclear what's causing the decline.

What's Causing the Decline in Business Investment?

There are a number of potential explanations for the decline in business investment, including:

- Increased uncertainty: Increased uncertainty, such as the ongoing trade tensions between the US and China, can make businesses more cautious and less likely to invest.

- Higher interest rates: Higher interest rates can make borrowing more expensive for businesses and reduce their incentive to invest.

- Changing workforce demographics: Changes in workforce demographics, such as an aging population, can lead to a decline in business investment.

Reduced Consumer Confidence

Reduced consumer confidence is another sign of a potentially dangerous decline ahead. When consumers are less confident, they're less likely to spend money, which can have serious consequences for economic growth. In recent years, consumer confidence has declined significantly in many countries, and it's unclear what's causing the decline.

What's Causing the Decline in Consumer Confidence?

There are a number of potential explanations for the decline in consumer confidence, including:

- Increased uncertainty: Increased uncertainty, such as the ongoing trade tensions between the US and China, can make consumers more cautious and less confident.

- Higher interest rates: Higher interest rates can make borrowing more expensive for consumers and reduce their incentive to spend.

- Changing workforce demographics: Changes in workforce demographics, such as an aging population, can lead to a decline in consumer confidence.

Increased Inequality

Increased inequality is another sign of a potentially dangerous decline ahead. When income inequality increases, it can have serious consequences for economic growth and social stability. In recent years, income inequality has increased significantly in many countries, and it's unclear what's causing the increase.

What's Causing the Increase in Income Inequality?

There are a number of potential explanations for the increase in income inequality, including:

- Changing workforce demographics: Changes in workforce demographics, such as an aging population, can lead to an increase in income inequality.

- Increased globalization: Increased globalization can lead to a decline in wages and working conditions for certain groups of workers.

- Tax policies: Tax policies, such as tax cuts for the wealthy, can increase income inequality.

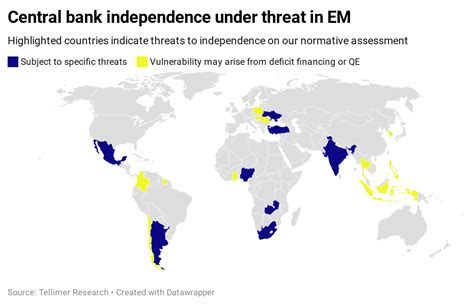

Decreased Central Bank Independence

Decreased central bank independence is another sign of a potentially dangerous decline ahead. Central banks play a crucial role in maintaining economic stability, and when they're not independent, it can have serious consequences for the economy. In recent years, central bank independence has declined significantly in many countries, and it's unclear what's causing the decline.

What's Causing the Decline in Central Bank Independence?

There are a number of potential explanations for the decline in central bank independence, including:

- Increased political pressure: Increased political pressure can reduce central bank independence and make it more difficult for them to make decisions.

- Changing workforce demographics: Changes in workforce demographics, such as an aging population, can lead to a decline in central bank independence.

- Increased globalization: Increased globalization can lead to a decline in central bank independence.

Gallery of Economic Decline

Economic Decline Image Gallery

If you're concerned about the potential decline ahead, there are a number of steps you can take to prepare. These include:

- Diversifying your investments: Diversifying your investments can help reduce your risk and increase your potential returns.

- Building an emergency fund: Building an emergency fund can help you weather any economic storms that may come your way.

- Reducing debt: Reducing debt can help you save money and increase your financial stability.

- Increasing your income: Increasing your income can help you save more money and achieve your financial goals.

By taking these steps, you can help prepare for a potentially uncertain future and achieve your financial goals.