Intro

Discover how food stamps impact your tax situation. Learn the 5 ways food stamps affect your taxes, including effects on income, deductions, and credits. Get expert insights on SNAP benefits, tax obligations, and financial planning strategies to maximize your refund and minimize tax liability. Understand the intersection of food stamps and taxes.

Receiving food stamps can have a significant impact on an individual's or family's daily life, providing essential nutrition and sustenance. However, it's essential to understand how food stamps can affect your taxes. In this article, we'll explore five ways food stamps can impact your tax situation, helping you navigate the complexities of the tax system.

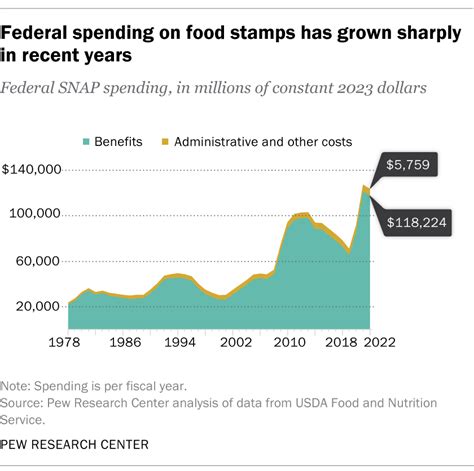

What are Food Stamps?

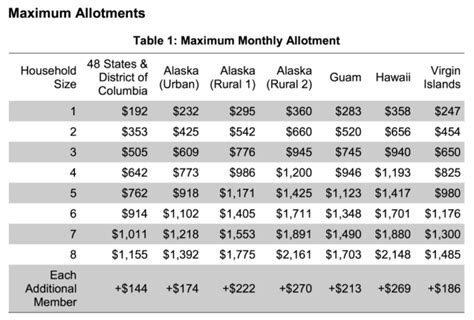

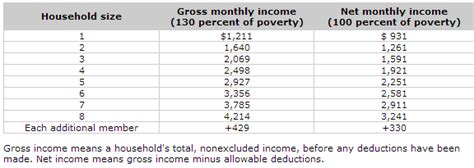

Before we dive into the tax implications, let's briefly explain what food stamps are. Food stamps, now known as the Supplemental Nutrition Assistance Program (SNAP), are a government-funded program that provides financial assistance to low-income individuals and families to purchase food. The program aims to alleviate hunger and malnutrition, ensuring that vulnerable populations have access to nutritious food.

1. Taxability of Food Stamps

The first and most important aspect to understand is that food stamps are not considered taxable income. According to the Internal Revenue Service (IRS), SNAP benefits are not subject to federal income tax. This means that you won't need to report food stamps as income on your tax return, and they won't affect your taxable income.

Why are Food Stamps Not Taxable?

Food stamps are not taxable because they are considered a form of assistance, rather than income. The program is designed to provide essential support to those in need, rather than providing a source of income. As a result, the IRS does not consider SNAP benefits to be taxable.

2. Impact on Tax Credits and Deductions

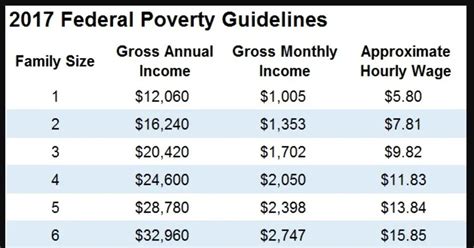

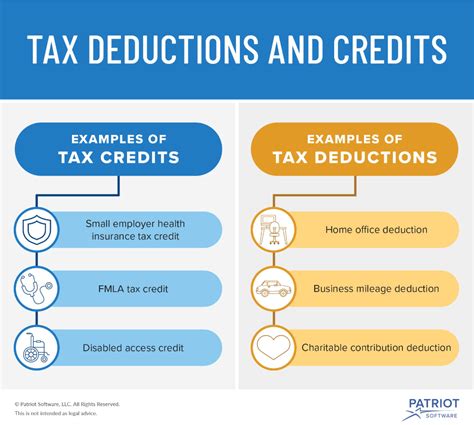

While food stamps are not taxable, they can affect your tax credits and deductions. For example, if you receive SNAP benefits, you may be eligible for the Earned Income Tax Credit (EITC). However, the amount of EITC you receive may be affected by your SNAP benefits. Additionally, food stamps may impact your eligibility for other tax credits, such as the Child Tax Credit.

How Food Stamps Affect Tax Credits

Food stamps can affect tax credits in several ways. For example, if you receive SNAP benefits, you may need to report them on your tax return, even if they're not taxable. This can impact your eligibility for certain tax credits, such as the EITC. Additionally, food stamps may be considered when calculating your Modified Adjusted Gross Income (MAGI), which can affect your eligibility for other tax credits.

3. Effect on Tax-Related Identity Theft

Receiving food stamps can also impact your risk of tax-related identity theft. If your SNAP benefits are stolen or compromised, it can lead to tax-related identity theft. This can result in delayed or denied tax refunds, as well as other tax-related issues.

Protecting Yourself from Tax-Related Identity Theft

To protect yourself from tax-related identity theft, it's essential to keep your SNAP benefits information secure. This includes keeping your Electronic Benefits Transfer (EBT) card and PIN secure, as well as monitoring your account activity regularly. Additionally, be cautious when sharing personal information, and report any suspicious activity to the relevant authorities.

4. Impact on Tax Filing Status

Receiving food stamps can also impact your tax filing status. For example, if you receive SNAP benefits, you may be eligible to file your taxes as a "Qualifying Widow(er) with Dependent Child" or "Head of Household." This can impact your tax liability and eligibility for certain tax credits.

How Food Stamps Affect Tax Filing Status

Food stamps can affect your tax filing status in several ways. For example, if you receive SNAP benefits, you may be eligible for a more favorable tax filing status, such as "Head of Household." This can result in a lower tax liability and increased eligibility for certain tax credits.

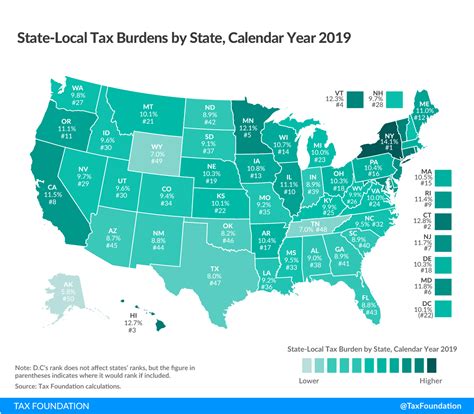

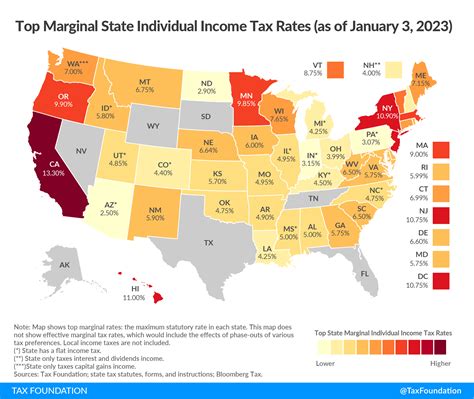

5. State and Local Tax Implications

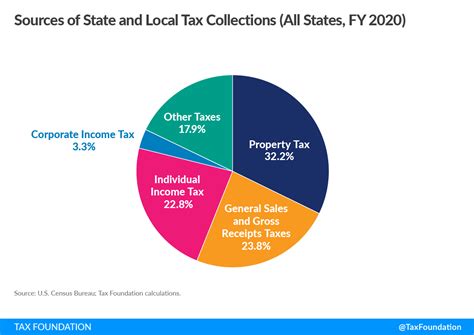

Finally, receiving food stamps can have state and local tax implications. While SNAP benefits are not subject to federal income tax, they may be subject to state and local taxes. This can impact your overall tax liability and eligibility for certain tax credits.

State and Local Tax Implications of Food Stamps

Food stamps can have state and local tax implications in several ways. For example, some states may consider SNAP benefits as taxable income, while others may not. Additionally, local governments may impose taxes on food stamps, which can impact your overall tax liability.

Food Stamps and Taxes Gallery

In conclusion, receiving food stamps can have a significant impact on your tax situation. From taxability and tax credits to tax filing status and state and local tax implications, it's essential to understand how food stamps can affect your taxes. By being informed and taking proactive steps, you can ensure that you're getting the most out of your SNAP benefits while minimizing your tax liability.

We hope this article has provided you with a comprehensive understanding of how food stamps can affect your taxes. If you have any questions or concerns, please don't hesitate to comment below. Additionally, if you found this article informative, please share it with others who may benefit from this information.