Intro

Boost your financial calculations with Excel! Discover 5 easy methods to calculate daily compound interest in Excel, including formulas and functions. Learn how to harness the power of compounding, accurately calculate interest rates, and create automated spreadsheets for precise financial projections and investment tracking.

Daily compound interest can have a profound impact on your savings and investments. Whether you're an individual looking to grow your wealth or a business aiming to maximize returns, understanding how to calculate daily compound interest is essential. In this article, we'll explore five ways to calculate daily compound interest in Excel, a popular spreadsheet software used by millions worldwide.

What is Daily Compound Interest?

Daily compound interest is a type of interest calculation where the interest is applied daily, rather than monthly or annually. This means that the interest earned each day is added to the principal amount, so that the next day's interest is calculated based on the new, higher principal balance.

Why is Daily Compound Interest Important?

Daily compound interest can have a significant impact on your savings and investments. By earning interest on your interest, you can accelerate the growth of your wealth over time. This is particularly important for long-term investments, such as retirement accounts or savings plans.

Method 1: Using the DAILY_rate Function

One way to calculate daily compound interest in Excel is to use the DAILY_rate function. This function calculates the daily interest rate based on a specified annual interest rate and compounding frequency.

To use the DAILY_rate function, follow these steps:

- Enter the annual interest rate in cell A1.

- Enter the compounding frequency (365 for daily compounding) in cell A2.

- Enter the principal amount in cell A3.

- Enter the number of days in cell A4.

- Use the formula: =A3*(1+DAILY_rate(A1,A2))^A4

Example:

| Annual Interest Rate | Compounding Frequency | Principal Amount | Number of Days |

|---|---|---|---|

| 5% | 365 | $1,000 | 365 |

Using the formula above, the daily compound interest would be calculated as:

=DAILY_rate(0.05,365)^365

This would give a result of $1,051.27, which is the future value of the investment after one year of daily compounding.

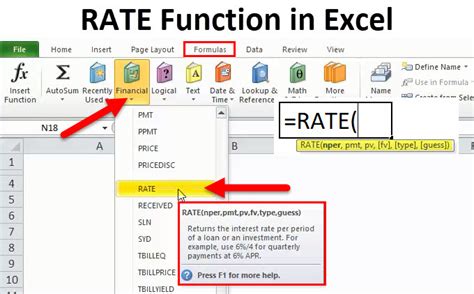

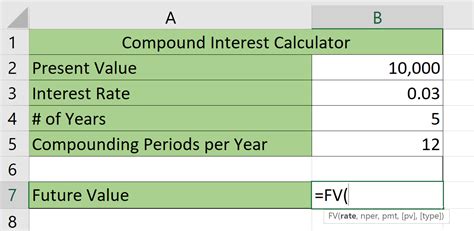

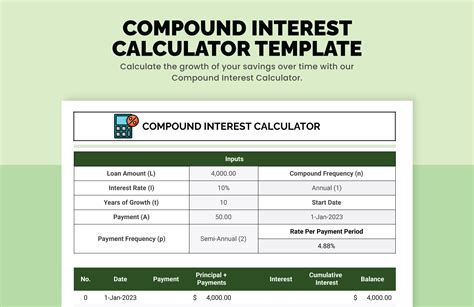

Method 2: Using the FV Function

Another way to calculate daily compound interest in Excel is to use the FV function. This function calculates the future value of an investment based on a specified interest rate, principal amount, and compounding frequency.

To use the FV function, follow these steps:

- Enter the interest rate in cell A1.

- Enter the principal amount in cell A2.

- Enter the number of periods (days) in cell A3.

- Enter the compounding frequency (365 for daily compounding) in cell A4.

- Use the formula: =FV(A1,A3,-A2,,A4)

Example:

| Interest Rate | Principal Amount | Number of Periods | Compounding Frequency |

|---|---|---|---|

| 5% | $1,000 | 365 | 365 |

Using the formula above, the daily compound interest would be calculated as:

=FV(0.05,365,-1000,,365)

This would give a result of $1,051.27, which is the future value of the investment after one year of daily compounding.

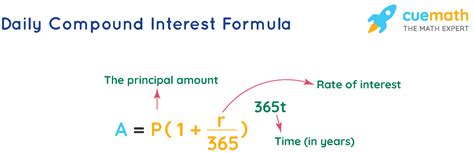

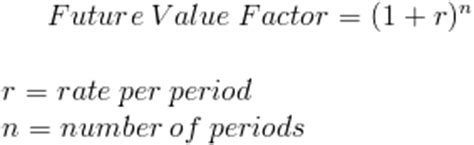

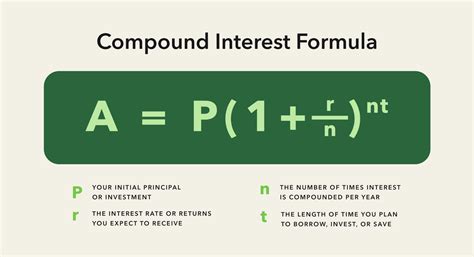

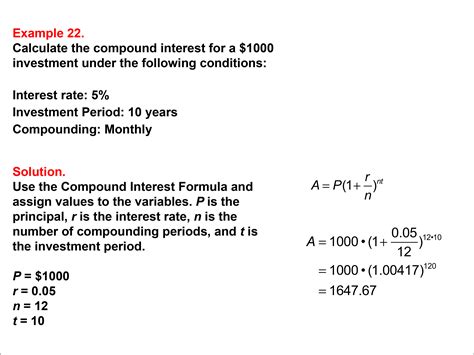

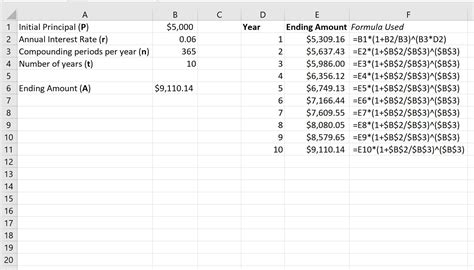

Method 3: Using a Formula

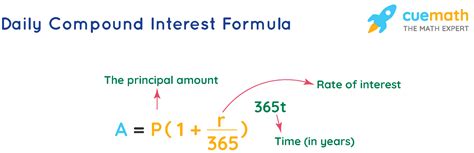

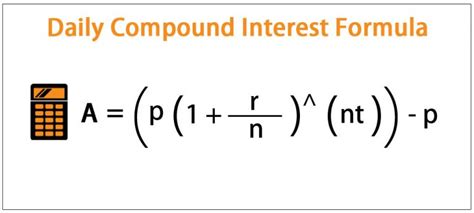

You can also calculate daily compound interest using a simple formula:

A = P(1 + r/n)^(nt)

Where:

- A is the future value of the investment

- P is the principal amount

- r is the annual interest rate

- n is the compounding frequency (365 for daily compounding)

- t is the number of years

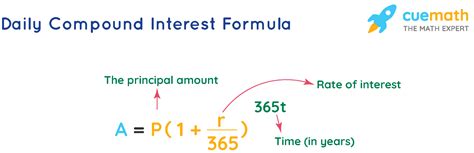

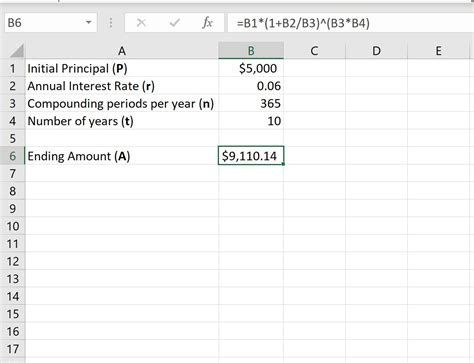

To use this formula, follow these steps:

- Enter the principal amount in cell A1.

- Enter the annual interest rate in cell A2.

- Enter the number of years in cell A3.

- Use the formula: =A1*(1+A2/365)^(365*A3)

Example:

| Principal Amount | Annual Interest Rate | Number of Years |

|---|---|---|

| $1,000 | 5% | 1 |

Using the formula above, the daily compound interest would be calculated as:

=1000*(1+0.05/365)^(365*1)

This would give a result of $1,051.27, which is the future value of the investment after one year of daily compounding.

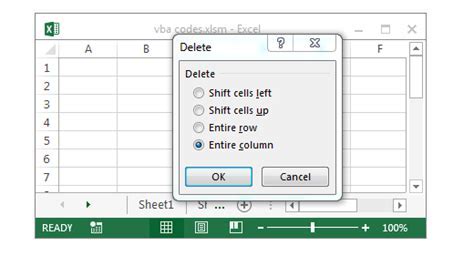

Method 4: Using a Macro

You can also calculate daily compound interest using a macro in Excel. A macro is a set of instructions that can be recorded and played back to perform a specific task.

To create a macro for daily compound interest, follow these steps:

- Open the Visual Basic Editor by pressing Alt+F11.

- Click on "Insert" and then "Module" to insert a new module.

- Paste the following code into the module:

Sub DailyCompoundInterest()

Dim principal As Double

Dim rate As Double

Dim days As Integer

Dim result As Double

principal = InputBox("Enter the principal amount")

rate = InputBox("Enter the annual interest rate")

days = InputBox("Enter the number of days")

result = principal * (1 + rate / 365) ^ days

MsgBox "The daily compound interest is: " & result

End Sub

- Click on "Run" and then "Run Sub/UserForm" to run the macro.

Example:

Enter the principal amount, annual interest rate, and number of days when prompted.

This will calculate the daily compound interest and display the result in a message box.

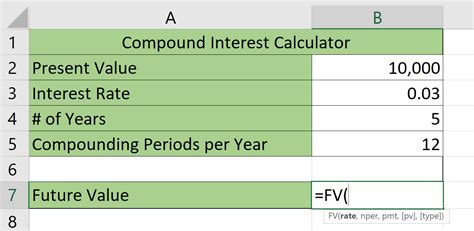

Method 5: Using a Add-in

You can also calculate daily compound interest using an add-in in Excel. An add-in is a software program that can be installed to add new functionality to Excel.

To use an add-in for daily compound interest, follow these steps:

- Search for an add-in that calculates daily compound interest, such as the "Daily Compound Interest Calculator" add-in.

- Download and install the add-in according to the instructions provided.

- Once installed, the add-in will be available in the "Add-ins" tab in Excel.

- Click on the add-in and follow the prompts to enter the principal amount, annual interest rate, and number of days.

Example:

Enter the principal amount, annual interest rate, and number of days when prompted.

This will calculate the daily compound interest and display the result.

Daily Compound Interest Image Gallery

We hope this article has helped you understand the different ways to calculate daily compound interest in Excel. Whether you're using a formula, a macro, or an add-in, calculating daily compound interest can help you make informed decisions about your savings and investments.

We encourage you to share your thoughts and experiences with daily compound interest in the comments below. How do you calculate daily compound interest in Excel? What methods do you find most effective?