Intro

Boost online banking security with 5 FSNB tips, including secure login, transaction alerts, and mobile banking best practices to protect accounts.

The world of online banking has revolutionized the way we manage our finances, providing unparalleled convenience and accessibility. Among the numerous banking institutions offering online services, 5 Star Bank (FSNB) stands out for its comprehensive and user-friendly platform. For those looking to maximize their online banking experience with FSNB, understanding the tips and tricks of the system can significantly enhance their financial management capabilities. Whether you're a seasoned online banking user or just starting out, leveraging the full potential of FSNB's online banking can make a substantial difference in how you track, manage, and grow your finances.

The importance of mastering online banking cannot be overstated, especially in today's fast-paced, digitally driven world. With the ability to access your accounts, transfer funds, pay bills, and monitor transactions from anywhere at any time, online banking offers a level of flexibility that traditional banking simply cannot match. Moreover, the security features integrated into these platforms protect your financial information, ensuring that your data remains safe and secure. For FSNB customers, the online banking system is designed to be intuitive and powerful, providing a wide range of tools and features to help manage your financial life efficiently.

In essence, effective use of FSNB's online banking can transform your financial management, making it easier to keep track of your spending, save money, and achieve your long-term financial goals. By exploring the various features and functionalities of the platform, users can unlock a more streamlined and organized approach to banking. This not only saves time but also reduces the stress associated with financial planning, allowing for a more balanced and secure financial future. As we delve into the specifics of how to get the most out of FSNB's online banking, it's clear that understanding these tips is crucial for anyone looking to elevate their banking experience.

Introduction to FSNB Online Banking

Key Features of FSNB Online Banking

Some of the standout features of FSNB's online banking include: - **Account Management:** View detailed account information, including balances, transaction history, and statements. - **Fund Transfers:** Easily transfer funds between your FSNB accounts or to external accounts. - **Bill Pay:** Conveniently pay bills online, setting up one-time or recurring payments. - **Account Alerts:** Customize alerts to notify you of low balances, large transactions, or other significant account activities. - **Mobile Banking:** Access your accounts on-the-go with FSNB's mobile banking app, allowing for mobile check deposit, account transfers, and more.Security Measures in FSNB Online Banking

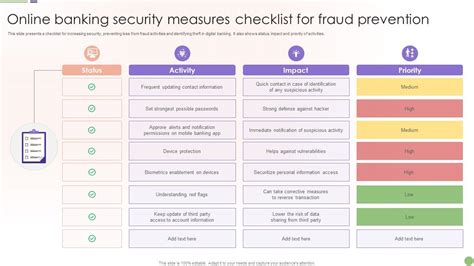

Best Practices for Secure Online Banking

To further enhance the security of your online banking experience, consider the following best practices: - **Use Strong Passwords:** Choose passwords that are unique and difficult to guess, avoiding common words or sequences. - **Keep Software Up-to-Date:** Ensure your browser, operating system, and antivirus software are updated with the latest security patches. - **Be Cautious with Links and Emails:** Never click on links or download attachments from unsolicited emails, as they may be phishing attempts. - **Monitor Account Activity:** Regularly review your account transactions and report any suspicious activity to FSNB immediately.Maximizing the Benefits of FSNB Online Banking

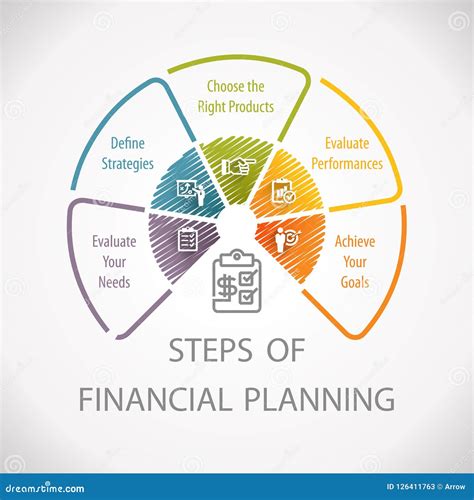

Financial Planning Tools and Resources

FSNB's online banking also provides access to valuable financial planning tools and resources, designed to help you achieve your financial goals. These may include: - **Budgeting Calculators:** Tools to help you create and manage a budget, track your spending, and set savings goals. - **Investment Information:** Resources and guidance on investment options, including retirement savings plans and other investment products. - **Financial Education:** Access to articles, webinars, and workshops focused on personal finance, investing, and money management.Common Online Banking Mistakes to Avoid

Resolving Online Banking Issues

In the event you encounter any issues with your online banking, such as login problems or transaction errors, FSNB provides multiple channels for support. This includes: - **Customer Service Hotline:** A dedicated phone number to reach customer service representatives who can assist with your concerns. - **Email Support:** The option to email your questions or issues, receiving a prompt response from the support team. - **FAQ Section:** A comprehensive FAQ section on the FSNB website, addressing common questions and providing solutions to frequent issues.Future Developments in Online Banking

Preparing for the Future of Banking

To prepare for these advancements and make the most of future online banking developments, it's essential to stay informed about the latest trends and technologies. This includes: - **Staying Updated on FSNB Announcements:** Regularly checking the FSNB website or mobile app for updates on new features and services. - **Participating in Beta Testing:** When available, participating in beta testing for new online banking features to provide feedback and get an early look at upcoming developments. - **Continuing Financial Education:** Engaging in ongoing financial education to understand how to best leverage new technologies and features for your financial benefit.FSNB Online Banking Image Gallery

As we look to the future of online banking with FSNB, it's exciting to consider the potential advancements and innovations that will continue to enhance our banking experiences. By staying informed, leveraging the current features of FSNB's online banking, and adopting best practices for security and financial management, users can position themselves for success in the evolving financial landscape. Whether you're a current FSNB customer or considering joining, understanding the power and potential of online banking can be a pivotal step in achieving your financial goals. We invite you to share your thoughts on the future of online banking, your experiences with FSNB, or any questions you may have about maximizing your online banking benefits. Your feedback and engagement are invaluable in helping us provide the most relevant and useful information to support your financial journey.