Intro

Excel is a powerful tool for data analysis, and one of its most useful features is the ability to calculate lagged values using the Lag formula. Lagged values are essential in time series analysis, finance, and many other fields, where understanding the relationship between current and past values is crucial.

In this article, we will explore five ways to use the Lag formula in Excel, including basic and advanced techniques. We will also provide practical examples and tips to help you master this powerful formula.

What is the Lag Formula in Excel?

The Lag formula in Excel is used to calculate the value of a cell a specified number of periods before the current period. The formula is often used in combination with other formulas, such as the Moving Average formula, to analyze time series data.

The basic syntax of the Lag formula is:

Lag(value, periods)

Where value is the cell reference or range that you want to calculate the lag for, and periods is the number of periods that you want to lag the value by.

1. Basic Lag Calculation

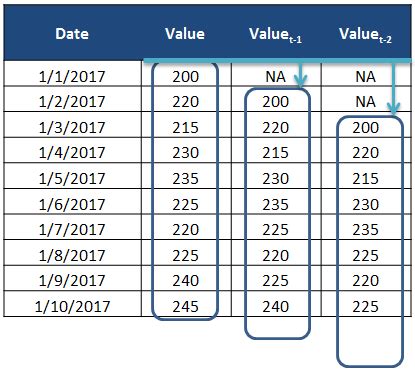

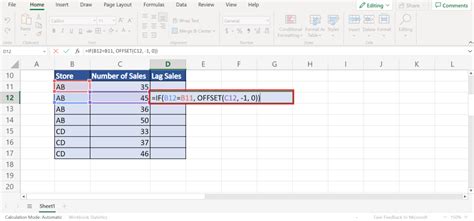

Let's start with a simple example of using the Lag formula to calculate the value of a cell one period ago.

Suppose we have a dataset with sales figures for each month of the year, and we want to calculate the sales figure for the previous month.

| Month | Sales |

|---|---|

| Jan | 100 |

| Feb | 120 |

| Mar | 150 |

| ... | ... |

We can use the Lag formula to calculate the sales figure for the previous month as follows:

=Lag(B2, 1)

Where B2 is the cell reference for the current sales figure.

This formula will return the sales figure for January, which is 100.

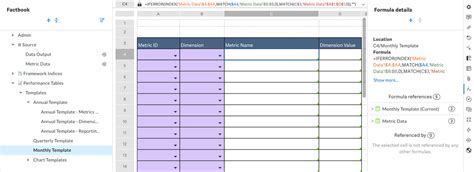

Image: Basic Lag Calculation

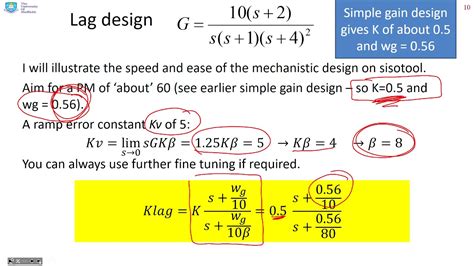

2. Using Lag with Moving Average

The Lag formula is often used in combination with the Moving Average formula to smooth out fluctuations in time series data.

Suppose we have a dataset with stock prices for each day of the month, and we want to calculate the 3-day moving average of the stock price.

| Day | Stock Price |

|---|---|

| 1 | 100 |

| 2 | 120 |

| 3 | 150 |

| ... | ... |

We can use the Lag formula to calculate the stock price for the previous day as follows:

=Lag(B2, 1)

Where B2 is the cell reference for the current stock price.

We can then use the Moving Average formula to calculate the 3-day moving average of the stock price as follows:

=AVERAGE(B2:Lag(B2, 3))

This formula will return the 3-day moving average of the stock price.

Image: Using Lag with Moving Average

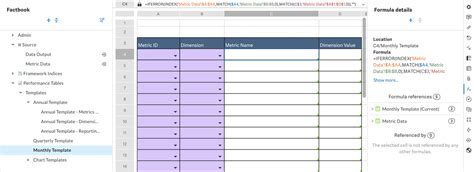

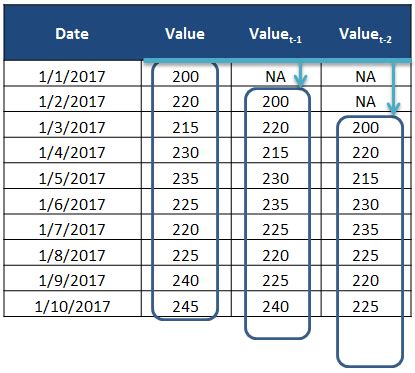

3. Using Lag with Index/Match

The Lag formula can also be used with the Index/Match function to look up values in a table.

Suppose we have a dataset with sales figures for each region, and we want to calculate the sales figure for the previous quarter.

| Region | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| North | 100 | 120 | 150 | 180 |

| South | 80 | 100 | 120 | 150 |

| ... | ... | ... | ... | ... |

We can use the Lag formula to calculate the sales figure for the previous quarter as follows:

=INDEX(C:C, MATCH("Q2", A:A, 0), Lag(B2, 1))

Where C:C is the range of sales figures, A:A is the range of region names, B2 is the cell reference for the current sales figure, and Q2 is the quarter that we want to look up.

This formula will return the sales figure for the previous quarter.

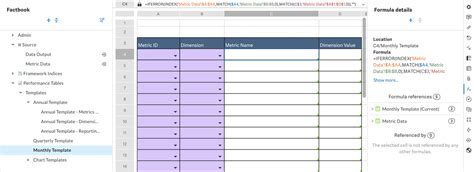

Image: Using Lag with Index/Match

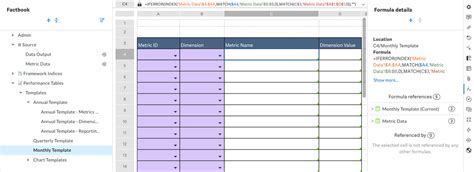

4. Using Lag with PivotTables

The Lag formula can also be used with PivotTables to analyze large datasets.

Suppose we have a dataset with sales figures for each region and quarter, and we want to calculate the sales figure for the previous quarter.

| Region | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| North | 100 | 120 | 150 | 180 |

| South | 80 | 100 | 120 | 150 |

| ... | ... | ... | ... | ... |

We can create a PivotTable to summarize the sales figures by region and quarter.

We can then use the Lag formula to calculate the sales figure for the previous quarter as follows:

=Lag(B2, 1)

Where B2 is the cell reference for the current sales figure.

We can then use the PivotTable to analyze the sales figures by region and quarter.

Image: Using Lag with PivotTables

5. Advanced Lag Calculation

Finally, let's look at an advanced example of using the Lag formula to calculate the value of a cell multiple periods ago.

Suppose we have a dataset with stock prices for each day of the month, and we want to calculate the stock price 5 days ago.

| Day | Stock Price |

|---|---|

| 1 | 100 |

| 2 | 120 |

| 3 | 150 |

| ... | ... |

We can use the Lag formula to calculate the stock price 5 days ago as follows:

=Lag(B2, 5)

Where B2 is the cell reference for the current stock price.

This formula will return the stock price 5 days ago.

Image: Advanced Lag Calculation

Gallery of Lag Formula Examples

Lag Formula Examples

Conclusion

The Lag formula is a powerful tool in Excel that can be used to calculate lagged values in time series data. We have explored five ways to use the Lag formula, including basic and advanced techniques. We have also provided practical examples and tips to help you master this formula.

Whether you are a beginner or an advanced user, we hope that this article has provided you with the knowledge and skills to use the Lag formula effectively in your data analysis.

What do you think? Share your thoughts in the comments below!