Unlock smart USAA loan tips, including credit score requirements, loan options, and repayment strategies, to make informed financial decisions and secure favorable interest rates with USAA banking and insurance services.

USAA loans are a popular option for military personnel, veterans, and their families, offering competitive rates and flexible terms. However, navigating the loan process can be complex, and it's essential to understand the ins and outs of USAA loans to make informed decisions. In this article, we'll delve into the world of USAA loans, exploring the benefits, types, and tips for getting the most out of your loan.

USAA loans are designed to provide financial assistance to military members and their families, offering a range of loan options, including personal loans, auto loans, and home loans. With competitive interest rates and flexible repayment terms, USAA loans can be an attractive option for those who qualify. However, it's crucial to carefully consider your financial situation and loan options before making a decision. By doing your research and understanding the loan process, you can make the most of your USAA loan and achieve your financial goals.

The importance of understanding USAA loans cannot be overstated. With the right knowledge and planning, you can navigate the loan process with confidence, avoiding common pitfalls and securing the best possible rates and terms. Whether you're looking to purchase a new car, finance a home, or cover unexpected expenses, USAA loans can provide the financial flexibility you need. In the following sections, we'll explore the benefits and types of USAA loans, as well as provide valuable tips for getting the most out of your loan.

Understanding USAA Loans

Types of USAA Loans

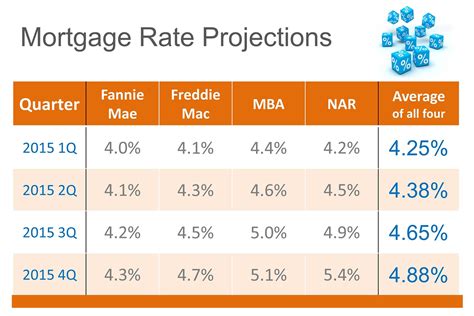

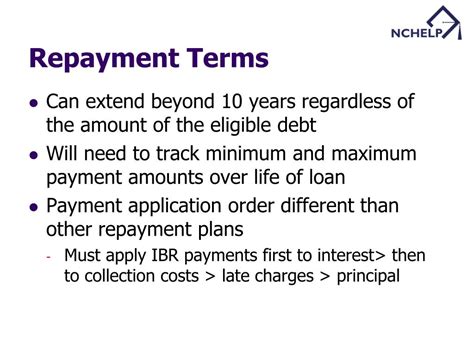

USAA offers a range of loan options, each designed to meet the unique needs of military members and their families. These include: * Personal loans: USAA personal loans offer flexible repayment terms and competitive interest rates, making them an ideal option for covering unexpected expenses or financing large purchases. * Auto loans: USAA auto loans provide competitive interest rates and flexible repayment terms, making it easy to finance a new or used vehicle. * Home loans: USAA home loans offer competitive interest rates and flexible repayment terms, making it possible to purchase or refinance a home. * VA loans: USAA VA loans offer competitive interest rates and flexible repayment terms, making it possible to purchase or refinance a home using your VA loan benefits.USAA Loan Tips

Applying for a USAA Loan

Applying for a USAA loan is a straightforward process that can be completed online or over the phone. To apply for a USAA loan, you'll need to provide personal and financial information, including your credit score, income, and employment history. You'll also need to specify the type of loan you're applying for and the amount you need to borrow. Once you've submitted your application, USAA will review your creditworthiness and provide a loan decision, often within minutes.USAA Loan Benefits

USAA Loan Drawbacks

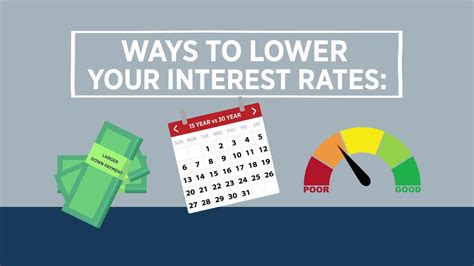

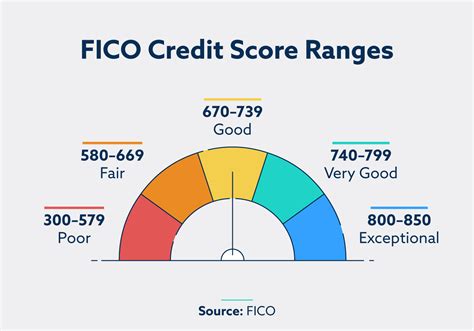

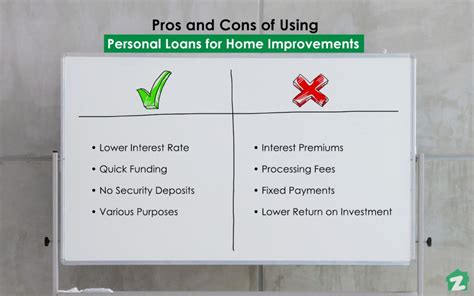

While USAA loans offer a range of benefits, there are also some drawbacks to consider. These include: * Membership requirements: To qualify for a USAA loan, you must be a USAA member, which is open to active and retired military personnel, as well as their spouses and children. * Credit score requirements: USAA loans require a good credit score, which can make it difficult for those with poor credit to qualify. * Interest rates: While USAA loans offer competitive interest rates, they may not always be the lowest rates available.USAA Loan Alternatives

USAA Loan FAQs

USAA loans are a popular option for military personnel, veterans, and their families, but there are often questions and concerns about the loan process. Here are some frequently asked questions about USAA loans: * What are the eligibility requirements for a USAA loan? * How do I apply for a USAA loan? * What are the interest rates and repayment terms for USAA loans? * Can I use a USAA loan to purchase a home? * Can I use a USAA loan to finance a new car?USAA Loan Image Gallery

In conclusion, USAA loans are a popular option for military personnel, veterans, and their families, offering competitive rates and flexible terms. By understanding the benefits and types of USAA loans, as well as following the tips outlined in this article, you can make the most of your loan and achieve your financial goals. Whether you're looking to purchase a new car, finance a home, or cover unexpected expenses, USAA loans can provide the financial flexibility you need. We invite you to share your thoughts and experiences with USAA loans in the comments below, and to share this article with others who may be interested in learning more about USAA loans.