Learn Navy Federal Bank wire transfer basics, including fees, limits, and routing numbers, to securely send and receive funds domestically and internationally with this comprehensive guide.

The world of banking has undergone significant transformations in recent years, with the advent of digital technologies and online platforms. One of the most popular banks in the United States, Navy Federal Bank, has been at the forefront of this revolution, offering a wide range of services to its members. Among these services, wire transfers have become an essential tool for individuals and businesses alike, enabling them to send and receive funds quickly and securely. In this article, we will delve into the world of Navy Federal Bank wire transfers, exploring the benefits, procedures, and best practices associated with this service.

As a leading financial institution, Navy Federal Bank has established itself as a trusted partner for its members, providing them with a comprehensive range of financial products and services. Wire transfers, in particular, have become an indispensable tool for individuals and businesses, allowing them to transfer funds across the globe with ease and convenience. Whether you need to send money to a family member, pay a bill, or conduct international trade, Navy Federal Bank's wire transfer service has got you covered.

The importance of wire transfers cannot be overstated, as they offer a fast, secure, and reliable way to move funds from one account to another. With the rise of globalization and international trade, wire transfers have become an essential tool for businesses, enabling them to conduct transactions with partners and suppliers across the globe. Similarly, individuals can use wire transfers to send money to family members or friends living abroad, providing them with a convenient and secure way to support their loved ones.

Introduction to Navy Federal Bank Wire Transfers

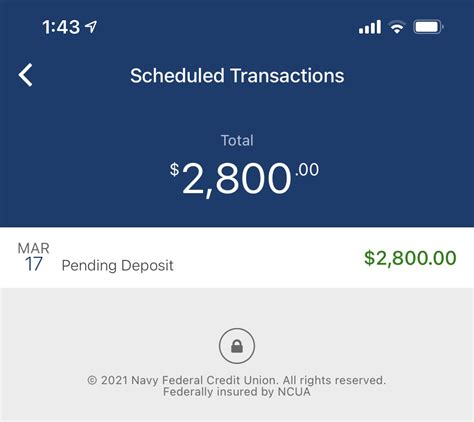

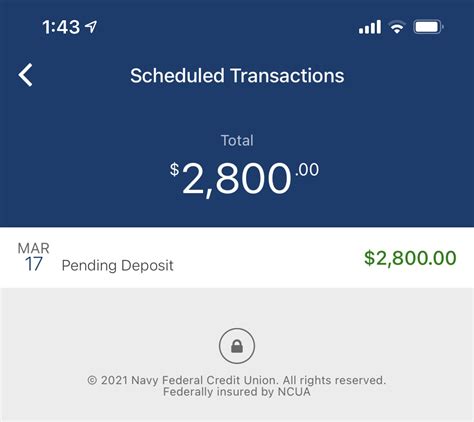

Navy Federal Bank's wire transfer service allows members to send and receive funds electronically, using a network of banks and financial institutions across the globe. This service is available for both domestic and international transactions, enabling members to transfer funds to anywhere in the world. With Navy Federal Bank's wire transfer service, members can enjoy a range of benefits, including fast and secure transactions, competitive exchange rates, and low fees.

Benefits of Navy Federal Bank Wire Transfers

The benefits of using Navy Federal Bank's wire transfer service are numerous, including: * Fast and secure transactions: Wire transfers are processed quickly, often in real-time, ensuring that funds are transferred securely and efficiently. * Competitive exchange rates: Navy Federal Bank offers competitive exchange rates for international transactions, helping members save money on their transfers. * Low fees: The bank's wire transfer fees are competitive, making it an affordable option for members. * Convenience: Wire transfers can be initiated online, by phone, or in-person, providing members with a range of convenient options.How to Use Navy Federal Bank Wire Transfers

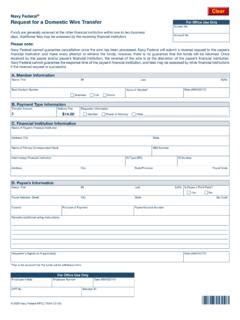

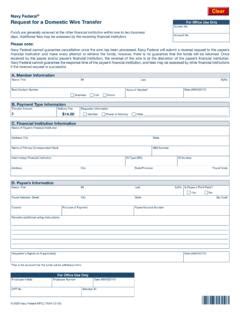

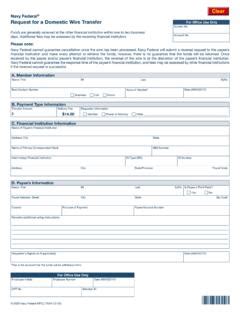

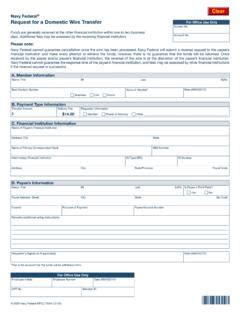

Using Navy Federal Bank's wire transfer service is relatively straightforward, requiring members to follow a few simple steps. To initiate a wire transfer, members can:

- Log in to their online banking account: Members can access their account online, using their username and password.

- Navigate to the wire transfer section: Once logged in, members can navigate to the wire transfer section, where they can initiate a new transfer.

- Enter the recipient's details: Members will need to enter the recipient's name, address, and bank account details, including the routing number and account number.

- Specify the transfer amount: Members will need to specify the amount they wish to transfer, as well as the currency (if applicable).

- Review and confirm the transfer: Before confirming the transfer, members should review the details carefully, ensuring that all information is accurate.

Types of Wire Transfers

Navy Federal Bank offers two types of wire transfers: * Domestic wire transfers: These transfers are used to send funds within the United States, typically taking one business day to process. * International wire transfers: These transfers are used to send funds outside the United States, typically taking two to five business days to process.Navy Federal Bank Wire Transfer Fees

Like most banks, Navy Federal Bank charges fees for wire transfers, which vary depending on the type of transfer and the destination. The fees for domestic wire transfers are typically lower than those for international wire transfers, reflecting the lower costs associated with processing these transactions. Members can expect to pay:

- $10-$20 for domestic wire transfers

- $20-$50 for international wire transfers

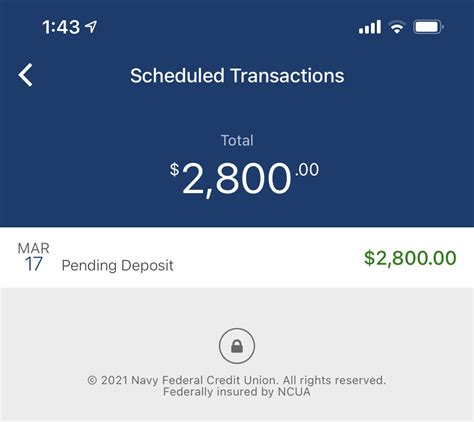

Wire Transfer Limits

Navy Federal Bank imposes limits on the amount that can be transferred using its wire transfer service. These limits vary depending on the type of account and the member's relationship with the bank. Members can expect to be subject to the following limits: * $10,000 per day for domestic wire transfers * $50,000 per day for international wire transfersSecurity and Safety

Security and safety are top priorities for Navy Federal Bank, which has implemented a range of measures to protect its members' transactions. These measures include:

- Encryption: The bank uses advanced encryption technologies to protect member data and prevent unauthorized access.

- Authentication: Members are required to authenticate themselves before initiating a wire transfer, using a combination of passwords and security questions.

- Monitoring: The bank's systems are continuously monitored for suspicious activity, enabling swift action to be taken in the event of a security breach.

Best Practices for Wire Transfers

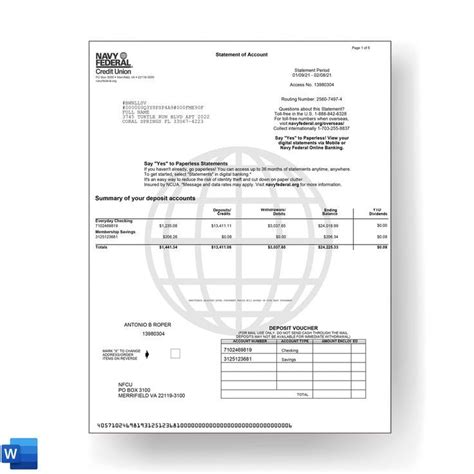

To ensure the security and success of wire transfers, members should follow best practices, including: * Verifying recipient information: Members should verify the recipient's details carefully, ensuring that all information is accurate. * Using secure connections: Members should use secure connections when initiating wire transfers, avoiding public computers and unsecured networks. * Monitoring account activity: Members should monitor their account activity regularly, reporting any suspicious transactions to the bank immediately.Gallery of Navy Federal Bank Wire Transfer Images

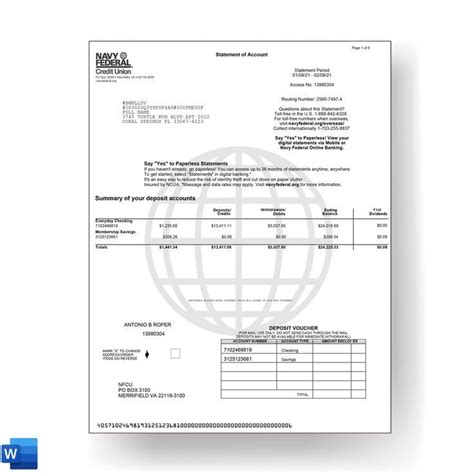

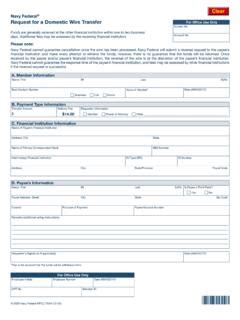

Navy Federal Bank Wire Transfer Image Gallery

In conclusion, Navy Federal Bank's wire transfer service offers a range of benefits, including fast and secure transactions, competitive exchange rates, and low fees. By following best practices and understanding the procedures and requirements associated with wire transfers, members can ensure the success and security of their transactions. Whether you need to send money to a family member, pay a bill, or conduct international trade, Navy Federal Bank's wire transfer service has got you covered. We invite you to share your experiences with Navy Federal Bank's wire transfer service, ask questions, or provide feedback on this article. Your input is invaluable in helping us create informative and engaging content that meets your needs.