Discover Navy Federal Credit Unions business account options, featuring commercial loans, business credit cards, and merchant services, tailored for entrepreneurs and small business owners, with benefits like cash management and online banking.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the United States, serving over 10 million members. While it's well-known for its personal banking services, Navy Federal also offers a range of business account options designed to meet the unique needs of entrepreneurs and small business owners. In this article, we'll delve into the importance of choosing the right business account, the benefits of banking with Navy Federal, and the various business account options available.

As a business owner, managing your finances effectively is crucial to the success and growth of your company. A business account is essential for separating personal and business expenses, tracking income and expenses, and making tax time easier. Moreover, a business account can help you establish credibility and build a strong financial foundation for your business. With so many financial institutions offering business accounts, it's essential to choose one that meets your specific needs and provides the right features and benefits.

Navy Federal Credit Union is an attractive option for business owners due to its competitive rates, low fees, and exceptional customer service. As a credit union, Navy Federal is member-owned, which means that its primary focus is on serving its members rather than maximizing profits. This approach enables Navy Federal to offer more favorable terms and conditions on its business accounts, making it an excellent choice for entrepreneurs and small business owners.

Benefits of Navy Federal Business Accounts

Features of Navy Federal Business Accounts

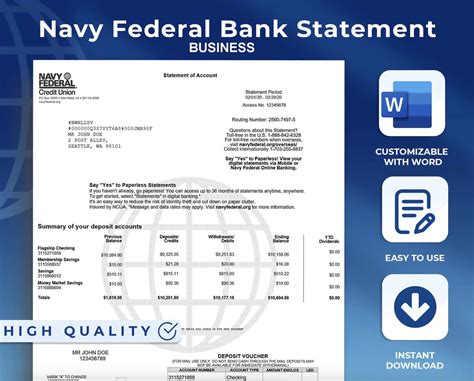

Some of the key features of Navy Federal business accounts include: * Competitive interest rates on savings and checking accounts * Low or no monthly maintenance fees * Flexible account options, including checking, savings, and money market accounts * Online banking and mobile banking services * Account management tools, including budgeting and cash flow management * Access to financial advisors and business experts * Membership discounts on business loans and credit cardsNavy Federal Business Account Options

Business Checking Account

The Business Checking Account is a popular option among Navy Federal business members. This account offers: * Low or no monthly maintenance fees * Competitive interest rates * Unlimited transactions * Free online banking and mobile banking services * Free account management tools * Access to financial advisors and business expertsBusiness Savings Account

Business Money Market Account

The Business Money Market Account is a higher-yielding savings account that provides limited check-writing and debit card privileges. This account offers: * Higher interest rates than a traditional savings account * Limited check-writing and debit card privileges * Low or no monthly maintenance fees * Easy access to funds * Free online banking and mobile banking services * Free account management tools * Access to financial advisors and business expertsBusiness Certificate Account

How to Open a Navy Federal Business Account

To open a Navy Federal business account, you'll need to meet the eligibility requirements and provide the necessary documentation. Here are the steps to follow: 1. Check your eligibility: Navy Federal membership is open to active duty and retired military personnel, veterans, and their families. 2. Gather required documents: You'll need to provide your business license, articles of incorporation, and tax identification number. 3. Choose your account: Select the business account that best meets your needs. 4. Apply online or in-person: You can apply for a Navy Federal business account online or in-person at a branch location. 5. Fund your account: Once your account is approved, you'll need to fund it with an initial deposit.Gallery of Navy Federal Business Account Options

Navy Federal Business Account Options Image Gallery

In conclusion, Navy Federal Credit Union offers a range of business account options designed to meet the diverse needs of entrepreneurs and small business owners. With competitive interest rates, low or no monthly maintenance fees, and flexible account options, Navy Federal is an excellent choice for business owners who want to manage their finances effectively and achieve their financial goals. Whether you're just starting out or looking to expand your business, Navy Federal has the right business account option for you. We invite you to share your thoughts and experiences with Navy Federal business accounts in the comments below. If you found this article helpful, please share it with your friends and colleagues who may be interested in learning more about Navy Federal business account options.