Discover 5 ways to refinance your vehicle with Navy Federal, exploring options like lower interest rates, flexible terms, and debt consolidation, to save money and improve your financial situation with auto loan refinancing.

Refinancing a vehicle can be a great way to save money on your monthly payments, reduce your interest rate, or even switch to a more manageable loan term. For members of the Navy Federal Credit Union, refinancing a vehicle can be a straightforward process that offers numerous benefits. In this article, we will explore the ways that Navy Federal can help you refinance your vehicle, the benefits of doing so, and what you need to know before making a decision.

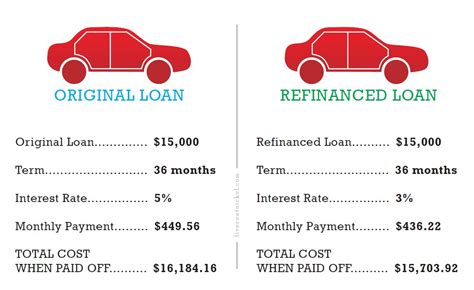

Refinancing a vehicle with Navy Federal can be a smart financial move, especially if you have improved your credit score since taking out the original loan or if interest rates have dropped. By refinancing, you may be able to lower your monthly payments, reduce the total amount of interest you pay over the life of the loan, or even remove a co-signer from the loan. Navy Federal offers competitive interest rates and flexible loan terms, making it easier for you to find a refinancing option that meets your needs.

One of the key benefits of refinancing a vehicle with Navy Federal is the potential to save money on your monthly payments. By lowering your interest rate or extending your loan term, you can reduce the amount you pay each month, freeing up more money in your budget for other expenses. Additionally, Navy Federal offers a range of loan terms, from 36 to 96 months, giving you the flexibility to choose a term that works best for your financial situation. Whether you are looking to save money, reduce your debt, or simply make your monthly payments more manageable, refinancing a vehicle with Navy Federal can be a great option.

Understanding Refinancing Options

Before refinancing a vehicle with Navy Federal, it's essential to understand your options. You can refinance a car, truck, van, or SUV, as long as it is less than 10 years old and has fewer than 80,000 miles. You can also refinance a loan from another lender, making it easy to switch to Navy Federal and take advantage of their competitive rates and flexible terms. Additionally, Navy Federal offers a range of refinancing options, including fixed-rate loans and variable-rate loans, giving you the flexibility to choose a loan that meets your needs.

Benefits of Refinancing with Navy Federal

Refinancing a vehicle with Navy Federal offers numerous benefits, including competitive interest rates, flexible loan terms, and the potential to save money on your monthly payments. By refinancing, you may also be able to remove a co-signer from the loan, making it easier to manage your debt. Additionally, Navy Federal offers a range of tools and resources to help you make informed decisions about your finances, including online calculators and financial advisors.

How to Refinance a Vehicle with Navy Federal

Refinancing a vehicle with Navy Federal is a straightforward process that can be completed online, by phone, or in person at a branch. To get started, you will need to gather some information, including the make and model of your vehicle, the current loan balance, and your income and credit score. You can then apply for refinancing online or by phone, and a representative from Navy Federal will guide you through the process.

Steps to Refinance a Vehicle

To refinance a vehicle with Navy Federal, follow these steps:

- Check your credit score and history to ensure you are eligible for refinancing

- Gather information about your vehicle, including the make and model, current loan balance, and mileage

- Apply for refinancing online or by phone, providing the required information

- Review and sign the loan documents, which will outline the terms of your new loan

- Make your monthly payments on time to avoid late fees and negative credit reporting

5 Ways Refinance Vehicle Navy Federal

Here are five ways that Navy Federal can help you refinance your vehicle:

- Lower Monthly Payments: By refinancing your vehicle with Navy Federal, you may be able to lower your monthly payments, freeing up more money in your budget for other expenses.

- Competitive Interest Rates: Navy Federal offers competitive interest rates on refinanced loans, which can help you save money over the life of the loan.

- Flexible Loan Terms: Navy Federal offers a range of loan terms, from 36 to 96 months, giving you the flexibility to choose a term that works best for your financial situation.

- Remove a Co-Signer: If you have a co-signer on your current loan, refinancing with Navy Federal may allow you to remove them from the loan, making it easier to manage your debt.

- Save Money on Interest: By refinancing your vehicle with Navy Federal, you may be able to reduce the total amount of interest you pay over the life of the loan, saving you money in the long run.

Common Refinancing Mistakes to Avoid

When refinancing a vehicle with Navy Federal, there are several common mistakes to avoid, including:

- Not checking your credit score and history before applying for refinancing

- Not comparing rates and terms from multiple lenders

- Not reading the fine print on your loan documents

- Not making your monthly payments on time

- Not considering the total cost of the loan, including interest and fees

Refinancing with Navy Federal: Is It Right for You?

Refinancing a vehicle with Navy Federal can be a great way to save money, reduce your debt, and make your monthly payments more manageable. However, it's essential to carefully consider your options and make an informed decision. By understanding the benefits and risks of refinancing, comparing rates and terms from multiple lenders, and avoiding common mistakes, you can make the best decision for your financial situation.

Alternatives to Refinancing

If refinancing a vehicle with Navy Federal is not the right option for you, there are several alternatives to consider, including:

- Selling your vehicle and using the proceeds to pay off your loan

- Trading in your vehicle for a new one

- Making extra payments on your current loan to pay it off faster

- Considering a personal loan or other type of financing

Gallery of Refinancing Options

Refinancing Image Gallery

In conclusion, refinancing a vehicle with Navy Federal can be a great way to save money, reduce your debt, and make your monthly payments more manageable. By understanding the benefits and risks of refinancing, comparing rates and terms from multiple lenders, and avoiding common mistakes, you can make the best decision for your financial situation. We invite you to share your thoughts and experiences with refinancing a vehicle in the comments below. If you found this article helpful, please share it with others who may be considering refinancing their vehicle. Additionally, if you have any questions or need further guidance, don't hesitate to reach out to a financial advisor or contact Navy Federal directly.