Intro

Unlock the secrets to Index False mastery. Discover 5 expert strategies to excel in Index False, including optimization techniques, indexing best practices, and advanced formula management. Boost your Excel skills with insights into table formatting, data validation, and error handling, and take your spreadsheet game to the next level.

Exceling with index false requires a deep understanding of financial markets and the ability to make informed investment decisions. Here are five ways to help you excel with index false:

Firstly, it's essential to understand the concept of index false and how it works. Index false refers to the practice of investing in a portfolio that is designed to track the performance of a specific stock market index, such as the S&P 500. This approach allows investors to benefit from the overall performance of the market, rather than trying to pick individual winners.

Index false can be an attractive option for investors who want to diversify their portfolios and reduce their exposure to individual stock risk. By investing in an index fund, you can gain exposure to a broad range of stocks, which can help to spread risk and increase potential returns.

However, index false is not without its challenges. One of the main drawbacks is that it can be difficult to beat the market average, as the fund is designed to track the index rather than outperform it. Additionally, index false can be affected by market volatility, which can result in significant losses if the market declines.

Despite these challenges, there are several ways to excel with index false. Here are five strategies to consider:

Understanding the Benefits of Index False

Index false offers several benefits to investors, including:

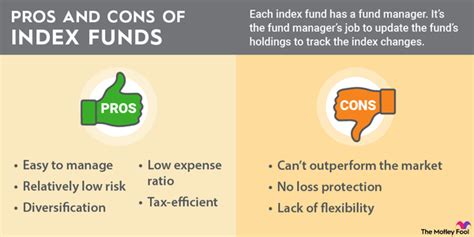

- Diversification: By investing in an index fund, you can gain exposure to a broad range of stocks, which can help to spread risk and increase potential returns.

- Low costs: Index funds typically have lower fees than actively managed funds, which can help to increase returns over the long term.

- Simplicity: Index false is a straightforward investment approach that is easy to understand and implement.

To excel with index false, it's essential to understand these benefits and how they can help you achieve your investment goals.

Choosing the Right Index Fund

With so many index funds available, it can be challenging to choose the right one for your needs. Here are a few tips to consider:

- Track record: Look for a fund with a strong track record of performance over the long term.

- Fees: Consider the fees associated with the fund, as lower fees can help to increase returns over the long term.

- Investment approach: Think about the investment approach that aligns with your goals and risk tolerance.

By choosing the right index fund, you can increase your chances of success with index false.

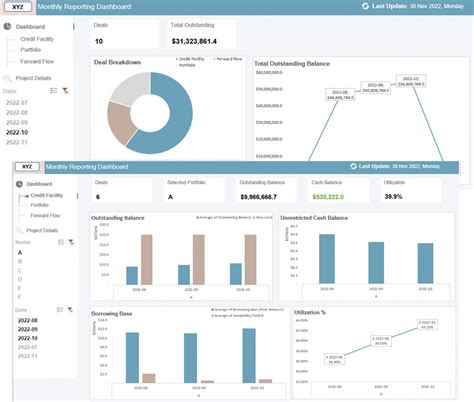

Monitoring and Adjusting Your Portfolio

Once you've invested in an index fund, it's essential to monitor and adjust your portfolio as needed. Here are a few tips to consider:

- Regular reviews: Regularly review your portfolio to ensure it remains aligned with your investment goals and risk tolerance.

- Rebalancing: Consider rebalancing your portfolio periodically to maintain an optimal asset allocation.

- Tax efficiency: Think about the tax implications of your investment decisions and aim to minimize tax liabilities.

By monitoring and adjusting your portfolio, you can help to ensure that your investment strategy remains on track.

Managing Risk with Index False

Index false can be affected by market volatility, which can result in significant losses if the market declines. Here are a few strategies to help manage risk:

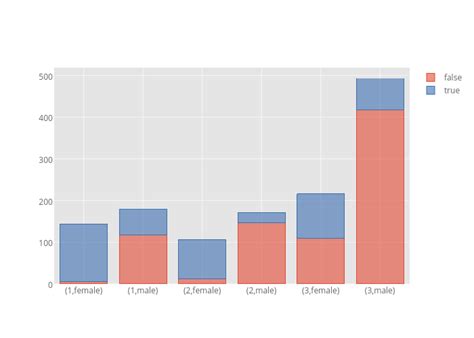

- Diversification: Consider diversifying your portfolio by investing in a range of asset classes, including stocks, bonds, and cash.

- Hedging: Think about using hedging strategies, such as options or futures, to reduce exposure to market risk.

- Risk assessment: Regularly assess your risk tolerance and adjust your investment strategy as needed.

By managing risk effectively, you can help to protect your investments and achieve your long-term goals.

Staying Disciplined with Index False

Finally, it's essential to stay disciplined with index false. Here are a few tips to consider:

- Long-term focus: Maintain a long-term focus and avoid making emotional decisions based on short-term market fluctuations.

- Regular investing: Consider investing regularly, rather than trying to time the market.

- Patience: Be patient and avoid making impulsive decisions based on market volatility.

By staying disciplined, you can help to ensure that your investment strategy remains on track and that you achieve your long-term goals.

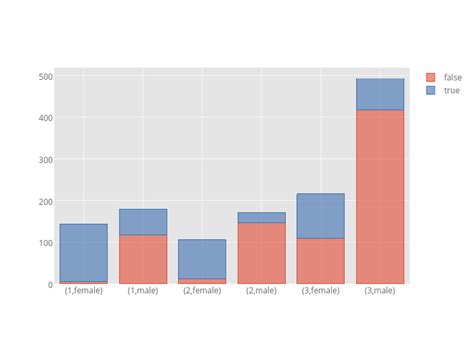

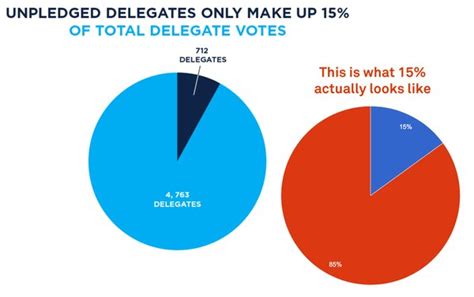

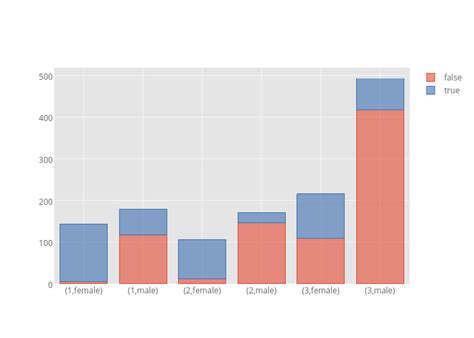

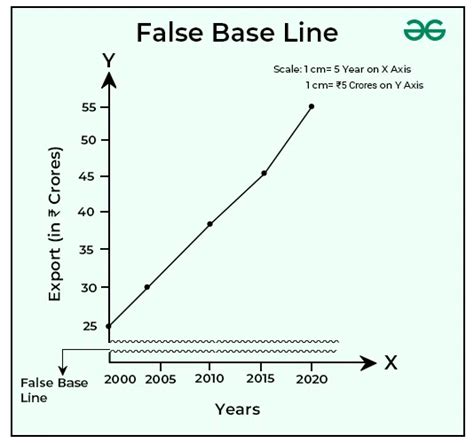

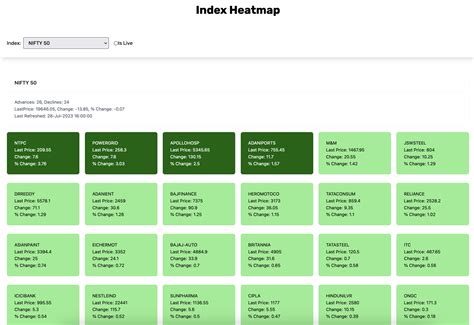

Gallery of Index False Images

Index False Image Gallery

By following these five strategies, you can help to excel with index false and achieve your long-term investment goals. Remember to stay disciplined, manage risk effectively, and regularly monitor and adjust your portfolio to ensure that your investment strategy remains on track.