Intro

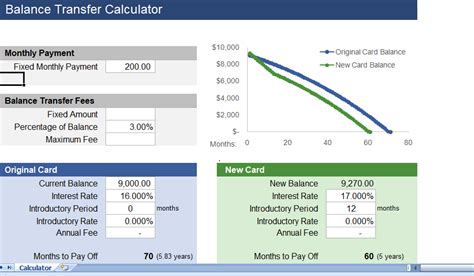

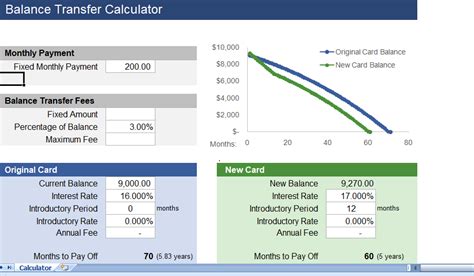

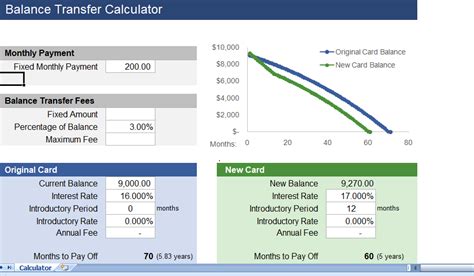

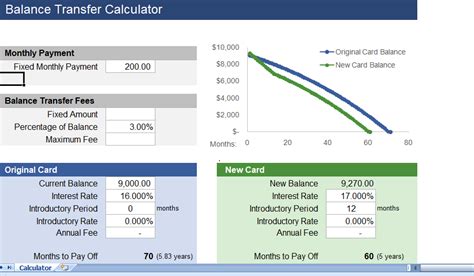

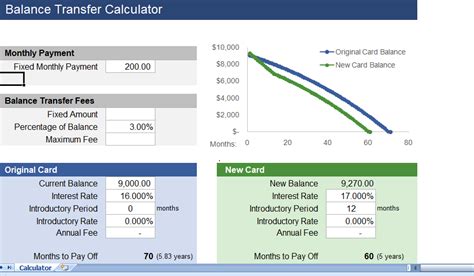

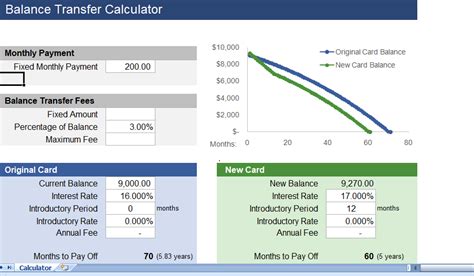

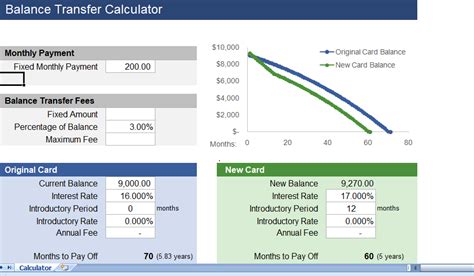

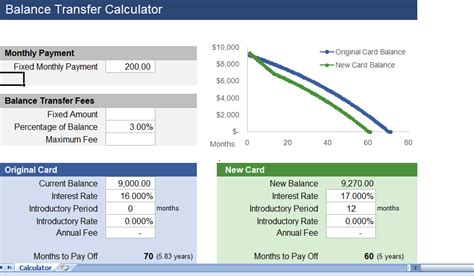

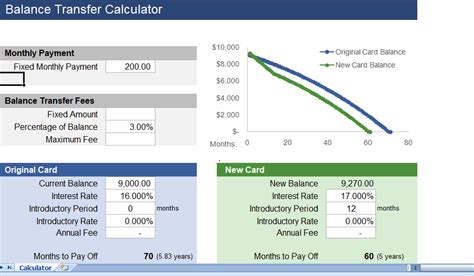

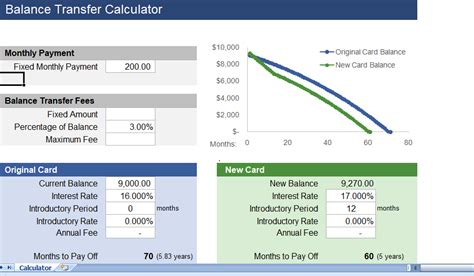

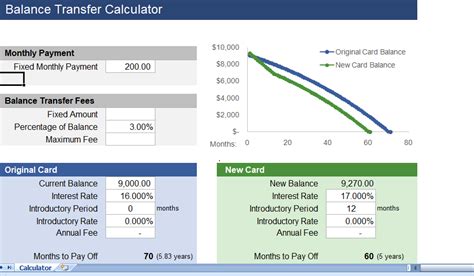

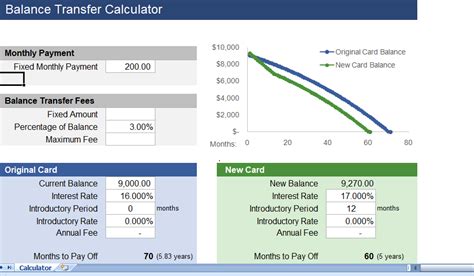

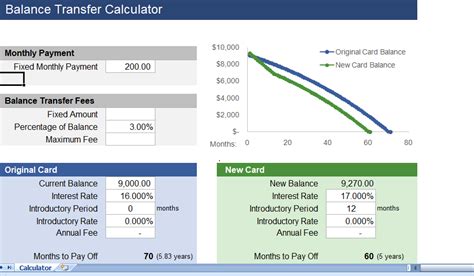

Save money with ease using our Balance Transfer Calculator Excel Template. Simplify your debt consolidation and credit card balance transfers. Calculate interest rates, savings, and payoff periods. Optimize your financial strategy with our intuitive and customizable spreadsheet. Maximize your savings and achieve financial freedom with our expert-designed template.

Are you tired of drowning in credit card debt and looking for a way to take control of your finances? A balance transfer calculator can be a valuable tool to help you make informed decisions about your debt and savings. In this article, we'll explore the benefits of using a balance transfer calculator Excel template and provide a comprehensive guide on how to use it for easy savings.

In today's economy, credit card debt can be overwhelming, with high interest rates and fees making it difficult to pay off balances. However, with the right tools and strategies, you can take charge of your finances and start saving money. A balance transfer calculator Excel template is a powerful tool that can help you navigate the complex world of credit card debt and make smart decisions about your money.

Using a balance transfer calculator Excel template can help you save money in several ways. Firstly, it allows you to compare different credit card offers and choose the best one for your needs. By inputting your current credit card balance, interest rate, and other relevant information, you can calculate the total cost of the transfer and determine whether it's a good deal. Additionally, the template can help you create a budget and stick to it, ensuring that you make timely payments and avoid accumulating more debt.

Benefits of Using a Balance Transfer Calculator Excel Template

There are several benefits to using a balance transfer calculator Excel template. Some of the most significant advantages include:

- Accurate calculations: The template provides accurate calculations of the total cost of the transfer, including interest rates, fees, and other charges.

- Comparative analysis: You can compare different credit card offers and choose the best one for your needs.

- Budgeting: The template helps you create a budget and stick to it, ensuring that you make timely payments and avoid accumulating more debt.

- Savings: By making informed decisions about your credit card debt, you can save money on interest rates and fees.

How to Use a Balance Transfer Calculator Excel Template

Using a balance transfer calculator Excel template is relatively straightforward. Here are the steps to follow:

- Download the template: Download the balance transfer calculator Excel template from a reputable source.

- Input your data: Input your current credit card balance, interest rate, and other relevant information into the template.

- Calculate the total cost: The template will calculate the total cost of the transfer, including interest rates, fees, and other charges.

- Compare offers: Compare different credit card offers and choose the best one for your needs.

- Create a budget: Use the template to create a budget and stick to it, ensuring that you make timely payments and avoid accumulating more debt.

Tips for Maximizing Savings with a Balance Transfer Calculator Excel Template

To maximize your savings with a balance transfer calculator Excel template, follow these tips:

- Choose a low-interest credit card: Choose a credit card with a low-interest rate to minimize the total cost of the transfer.

- Pay off your balance quickly: Pay off your balance as quickly as possible to avoid accumulating more debt.

- Avoid fees: Avoid fees such as balance transfer fees, annual fees, and late payment fees.

- Monitor your credit score: Monitor your credit score to ensure that it's not negatively affected by the balance transfer.

Common Mistakes to Avoid with Balance Transfer Calculator Excel Template

When using a balance transfer calculator Excel template, there are several common mistakes to avoid. Some of the most significant errors include:

- Not comparing offers: Not comparing different credit card offers can lead to choosing a bad deal.

- Not paying off your balance quickly: Not paying off your balance quickly can lead to accumulating more debt.

- Not monitoring your credit score: Not monitoring your credit score can lead to negative effects on your credit history.

Conclusion

In conclusion, a balance transfer calculator Excel template is a powerful tool that can help you navigate the complex world of credit card debt and make smart decisions about your money. By using the template to compare different credit card offers, create a budget, and monitor your credit score, you can save money on interest rates and fees and take control of your finances.

Balance Transfer Calculator Excel Template Image Gallery

We hope this article has provided you with a comprehensive guide to using a balance transfer calculator Excel template for easy savings. By following the tips and avoiding common mistakes, you can take control of your finances and start saving money today.