Intro

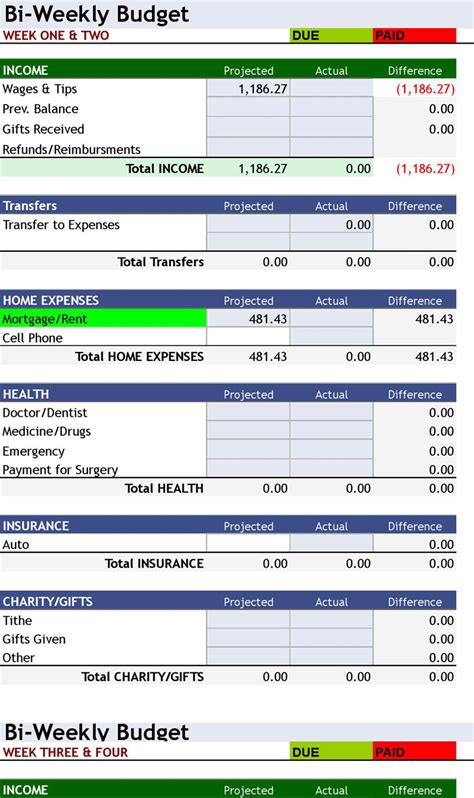

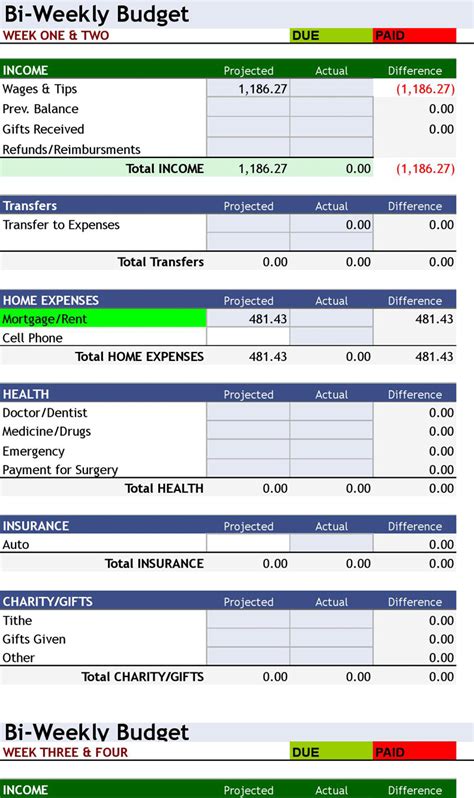

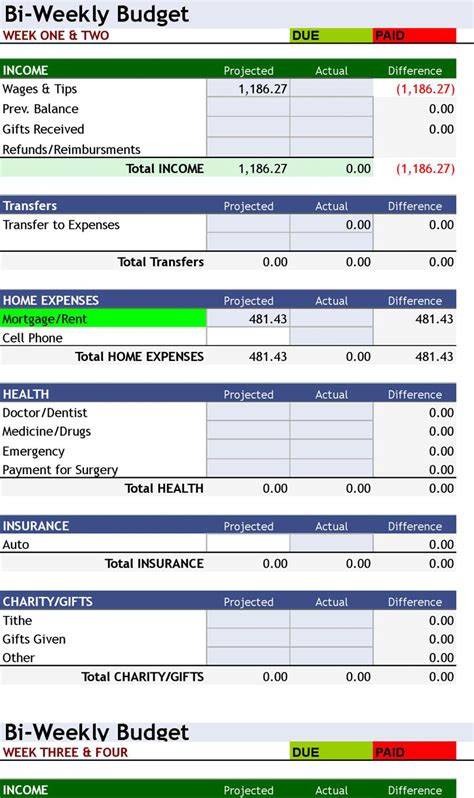

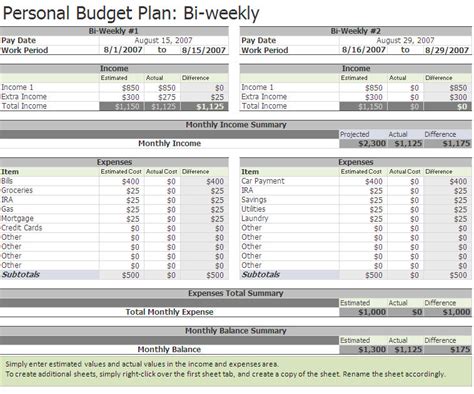

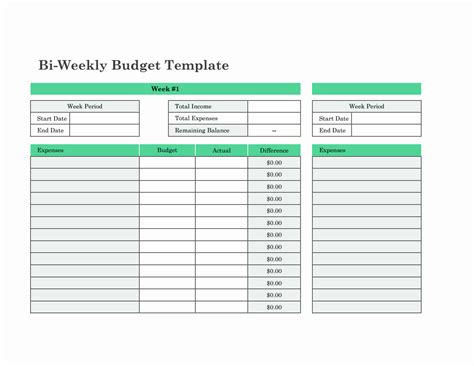

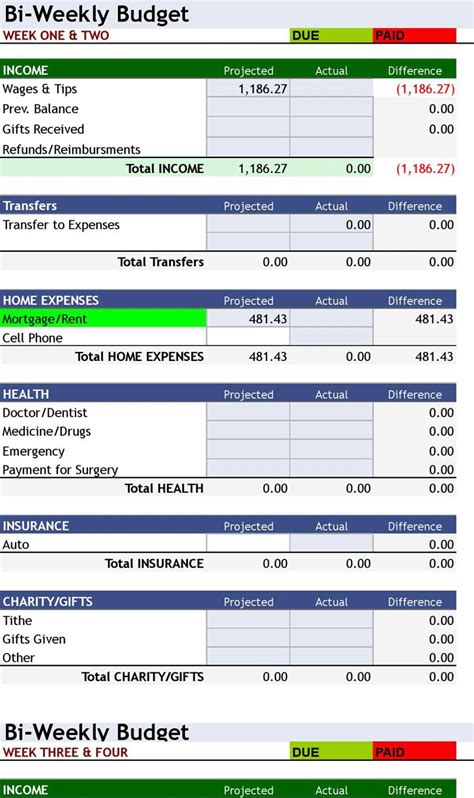

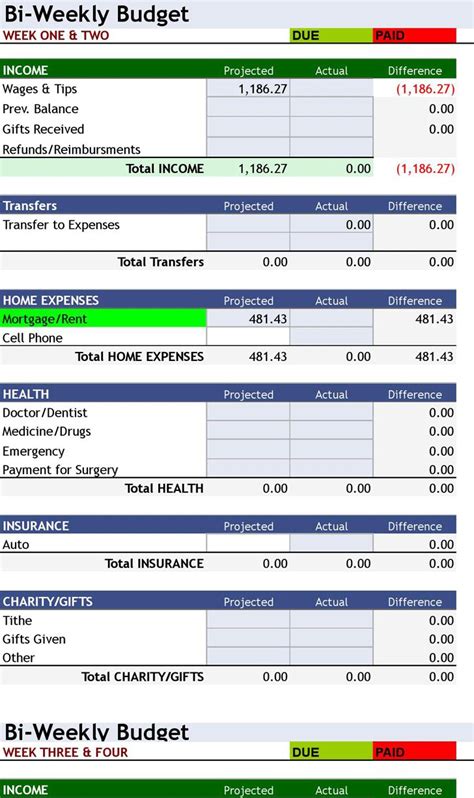

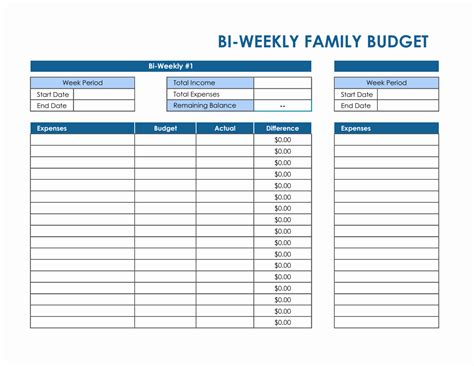

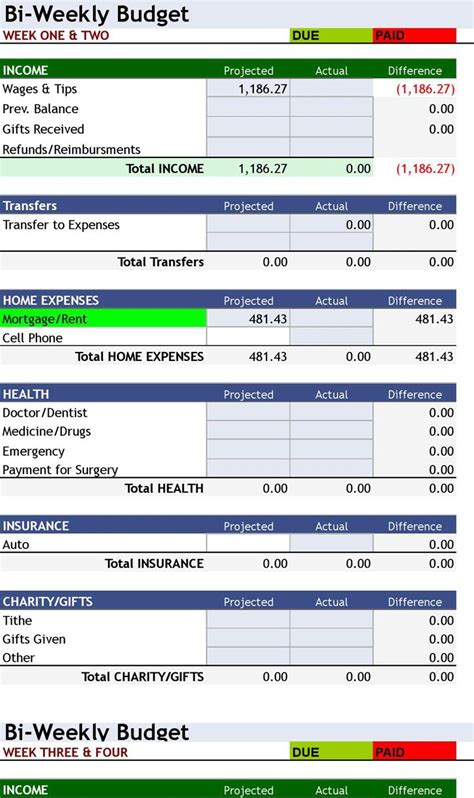

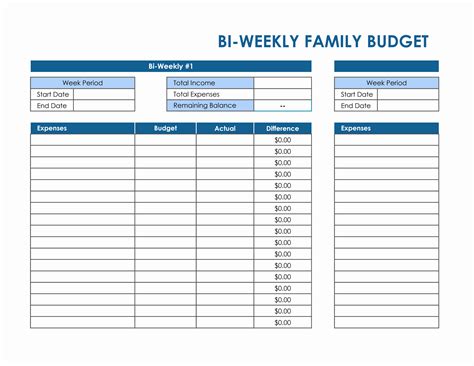

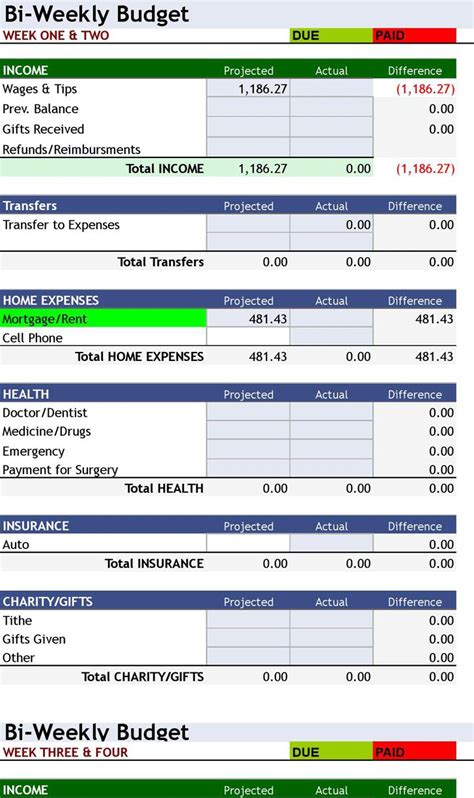

Streamline your finances with our biweekly budget Excel template, designed for easy financial tracking and planning. Simplify your budgeting process and achieve financial stability with this customizable template, featuring automatic calculations and formulas for effortless expense management, savings tracking, and income monitoring.

Creating and managing a budget can be a daunting task, especially for those who are new to personal finance. However, with the right tools and templates, it can be made easier and more efficient. One of the most popular and effective tools for budgeting is Microsoft Excel. In this article, we will explore the benefits of using a biweekly budget Excel template for easy financial tracking.

A biweekly budget Excel template is a pre-designed spreadsheet that allows users to track their income and expenses on a biweekly basis. This type of template is ideal for individuals who receive their paychecks every other week, which is a common pay schedule for many employees. By using a biweekly budget template, users can easily track their income and expenses, make adjustments as needed, and stay on top of their finances.

Benefits of Using a Biweekly Budget Excel Template

1. Easy to Use

One of the biggest advantages of using a biweekly budget Excel template is that it is easy to use. The template is pre-designed, so users don't have to worry about creating a budget from scratch. All they need to do is plug in their income and expenses, and the template will do the rest.

2. Customizable

Another benefit of using a biweekly budget Excel template is that it is customizable. Users can adjust the template to fit their specific financial needs and goals. For example, they can add or remove categories, change the layout, and even add formulas to make calculations easier.

3. Helps with Financial Tracking

A biweekly budget Excel template helps users track their income and expenses on a regular basis. By doing so, they can identify areas where they can cut back, make adjustments, and stay on top of their finances.

4. Reduces Stress

Budgeting can be stressful, especially for those who are new to personal finance. However, using a biweekly budget Excel template can reduce stress and make budgeting easier and more manageable.

How to Create a Biweekly Budget Excel Template

Creating a biweekly budget Excel template is easy. Here are the steps to follow:

1. Open Excel

Open Microsoft Excel on your computer.

2. Create a New Spreadsheet

Create a new spreadsheet by clicking on the "File" tab and selecting "New."

3. Set up the Template

Set up the template by creating columns for income, fixed expenses, variable expenses, and savings. Users can also add rows for each biweekly pay period.

4. Add Formulas

Add formulas to make calculations easier. For example, users can add a formula to calculate the total income, total expenses, and savings.

5. Customize the Template

Customize the template to fit specific financial needs and goals. Users can add or remove categories, change the layout, and even add charts and graphs to visualize their financial data.

Tips for Using a Biweekly Budget Excel Template

Here are some tips for using a biweekly budget Excel template:

1. Track Income and Expenses

Track income and expenses on a regular basis. This will help users stay on top of their finances and make adjustments as needed.

2. Review and Adjust

Review and adjust the budget regularly. This will help users stay on track and make sure they are meeting their financial goals.

3. Use Formulas

Use formulas to make calculations easier. This will save time and reduce errors.

4. Customize the Template

Customize the template to fit specific financial needs and goals. This will help users get the most out of the template and achieve their financial goals.

Common Mistakes to Avoid When Using a Biweekly Budget Excel Template

Here are some common mistakes to avoid when using a biweekly budget Excel template:

1. Not Tracking Income and Expenses

Not tracking income and expenses is one of the biggest mistakes users can make when using a biweekly budget Excel template. This can lead to errors and make it difficult to stay on top of finances.

2. Not Reviewing and Adjusting

Not reviewing and adjusting the budget regularly is another common mistake. This can lead to stagnation and make it difficult to achieve financial goals.

3. Not Using Formulas

Not using formulas can make calculations more difficult and prone to errors.

4. Not Customizing the Template

Not customizing the template can lead to a generic budget that doesn't meet specific financial needs and goals.

Gallery of Biweekly Budget Excel Templates

Biweekly Budget Excel Template Gallery

Conclusion

In conclusion, a biweekly budget Excel template is a powerful tool for managing finances and achieving financial goals. By using a pre-designed template, users can easily track their income and expenses, make adjustments as needed, and stay on top of their finances. With its ease of use, customizability, and ability to reduce stress, a biweekly budget Excel template is an essential tool for anyone looking to take control of their finances.

We hope this article has been helpful in explaining the benefits and uses of a biweekly budget Excel template. If you have any questions or comments, please feel free to share them below.