Intro

Learn how to create a CD ladder in 5 easy steps using Excel. Discover how to maximize returns, minimize risk, and optimize your savings with a certificate of deposit (CD) ladder strategy. This tutorial covers CD ladder benefits, calculations, and expert tips to help you create a customized investment plan.

Creating a CD ladder can be a smart way to manage your savings and earn interest on your money. By staggering the maturity dates of multiple CDs, you can create a steady stream of income and minimize the impact of interest rate changes. In this article, we'll show you how to create a CD ladder in 5 easy steps using Excel.

What is a CD Ladder?

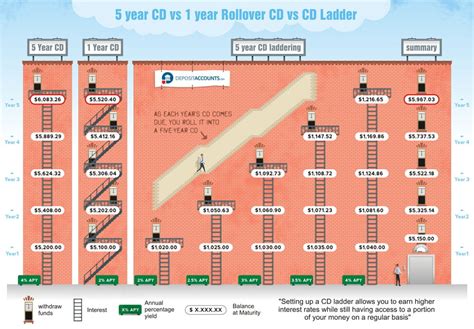

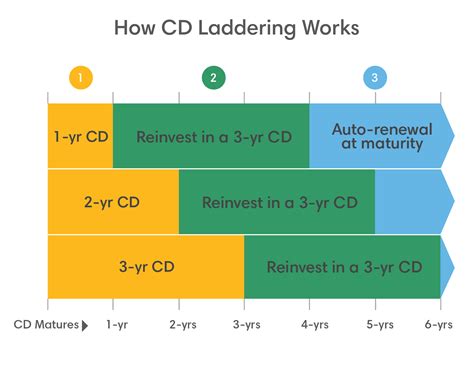

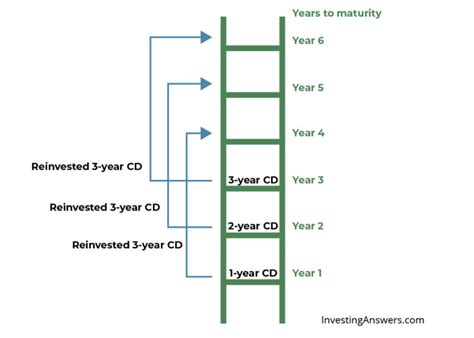

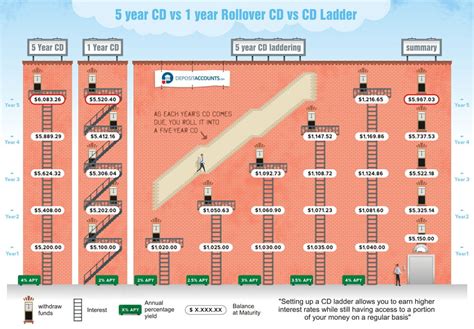

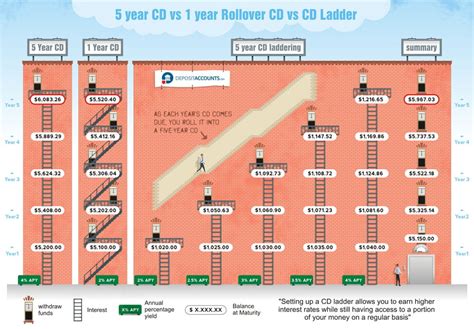

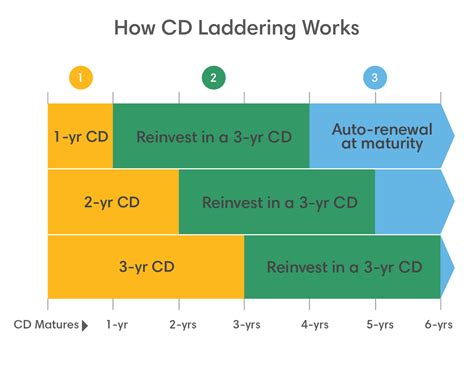

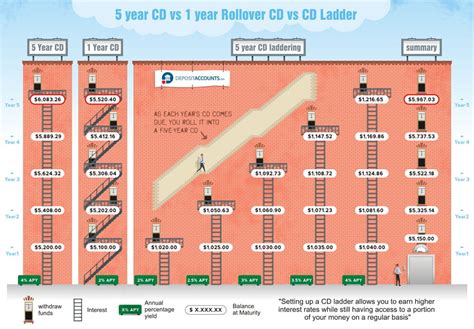

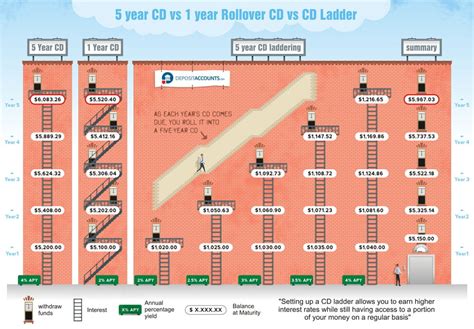

A CD ladder is a type of savings strategy where you invest in multiple CDs with staggered maturity dates. By doing so, you can create a steady stream of income and take advantage of higher interest rates over time. For example, you might invest in a 6-month CD, a 12-month CD, and a 24-month CD, with each CD maturing at a different time. This allows you to reinvest the principal and interest at the end of each term, potentially earning a higher interest rate.

Why Create a CD Ladder?

There are several benefits to creating a CD ladder:

- Increased liquidity: By staggering the maturity dates of your CDs, you can create a steady stream of income and have access to your money when you need it.

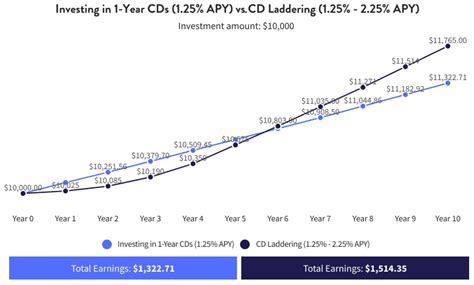

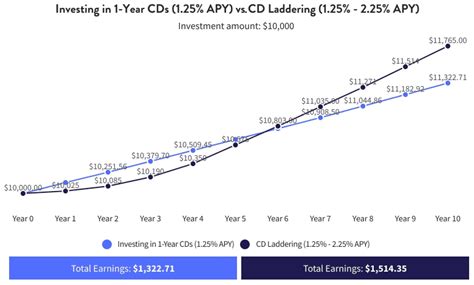

- Higher interest rates: By investing in longer-term CDs, you can potentially earn higher interest rates and increase your overall returns.

- Reduced interest rate risk: By diversifying your CD portfolio across multiple maturity dates, you can reduce the impact of interest rate changes on your investments.

Step 1: Determine Your Investment Goals

Before creating a CD ladder, it's essential to determine your investment goals and risk tolerance. Consider the following:

- How much money do you want to invest?

- What is your desired return on investment?

- How long can you afford to keep your money locked in a CD?

- What is your risk tolerance?

Step 2: Choose Your CDs

Once you've determined your investment goals, it's time to choose your CDs. Consider the following:

- Term lengths: Choose CDs with staggered maturity dates, such as 6 months, 12 months, and 24 months.

- Interest rates: Compare interest rates across different CDs and terms to ensure you're getting the best rate.

- Minimum investment requirements: Make sure you meet the minimum investment requirements for each CD.

Step 3: Create a CD Ladder Spreadsheet

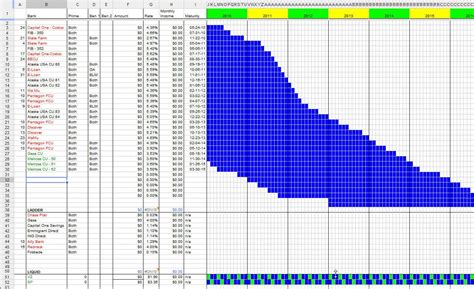

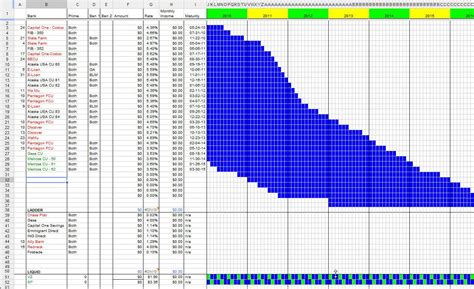

Now it's time to create a CD ladder spreadsheet using Excel. Follow these steps:

- Open Excel and create a new spreadsheet.

- Set up a table with the following columns: CD Term, Interest Rate, Principal, Maturity Date, and Total Value.

- Enter the details for each CD, including the term length, interest rate, principal amount, and maturity date.

Step 4: Calculate Your Returns

Using your CD ladder spreadsheet, calculate your returns for each CD. You can use the following formula:

- Total Value = Principal x (1 + Interest Rate)^Term Length

For example, if you invest $1,000 in a 12-month CD with an interest rate of 2.0%, your total value at maturity would be:

- Total Value = $1,000 x (1 + 0.02)^1 = $1,020

Step 5: Monitor and Adjust Your CD Ladder

Finally, it's essential to monitor and adjust your CD ladder over time. Consider the following:

- Reinvest your principal and interest: At the end of each CD term, reinvest the principal and interest to potentially earn a higher interest rate.

- Adjust your CD ladder: If interest rates change or your investment goals shift, adjust your CD ladder to ensure you're getting the best returns.

Gallery of CD Ladder Images

CD Ladder Image Gallery

Conclusion

Creating a CD ladder in 5 easy steps using Excel can be a smart way to manage your savings and earn interest on your money. By staggering the maturity dates of multiple CDs, you can create a steady stream of income and minimize the impact of interest rate changes. Remember to monitor and adjust your CD ladder over time to ensure you're getting the best returns.