Intro

Discover how child support affects food stamp eligibility. Learn about the relationship between child support payments and SNAP benefits, including how they impact eligibility and benefit amounts. Understand the role of income, resources, and deductions in determining food stamp eligibility for families receiving child support.

Child support can be a crucial aspect of ensuring that children receive the financial support they need from their parents. However, the relationship between child support and food stamp eligibility can be complex. In this article, we will delve into the details of how child support affects food stamp eligibility and what individuals can expect when navigating these systems.

Importance of Understanding Child Support and Food Stamps

For many families, food stamps are a vital resource for accessing basic necessities like food. However, when child support is involved, the dynamics of food stamp eligibility can shift. Understanding how child support affects food stamp eligibility is crucial for individuals who rely on these programs to make ends meet.

Overview of Child Support and Food Stamps

Child support is a payment made by one parent to support their child's basic needs, including food, clothing, and shelter. Food stamps, on the other hand, are a form of government assistance that helps low-income families purchase food. In the United States, the Supplemental Nutrition Assistance Program (SNAP) is the primary food stamp program.

How Child Support Affects Food Stamp Eligibility

In general, child support payments can affect food stamp eligibility in two ways: income and resources.

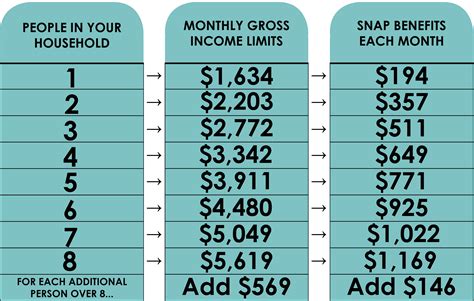

Income: Child support payments are considered income for food stamp purposes. When an individual receives child support, it can increase their gross income, which may affect their eligibility for food stamps. However, not all child support payments are considered income. For example, if an individual receives child support payments through a government agency, those payments may not be considered income for food stamp purposes.

Resources: Child support payments can also affect food stamp eligibility by increasing an individual's resources. For example, if an individual has a large amount of child support payments saved in a bank account, it may be considered a resource that affects their eligibility for food stamps.

Eligibility Requirements for Food Stamps

To be eligible for food stamps, individuals must meet certain requirements, including:

- Gross income: Individuals must have a gross income that is at or below 130% of the federal poverty level.

- Net income: Individuals must have a net income that is at or below 100% of the federal poverty level.

- Resources: Individuals must have resources that are at or below $2,250.

- Work requirements: Able-bodied adults without dependents (ABAWDs) must work at least 20 hours per week or participate in a work program.

Child Support and Food Stamp Eligibility: A Closer Look

When child support is involved, the eligibility requirements for food stamps can become more complex. For example:

- If an individual receives child support payments, it may affect their gross income and eligibility for food stamps.

- If an individual has a large amount of child support payments saved in a bank account, it may be considered a resource that affects their eligibility for food stamps.

Strategies for Navigating Child Support and Food Stamps

For individuals who receive child support and rely on food stamps, navigating these systems can be challenging. Here are some strategies for navigating child support and food stamps:

- Keep accurate records: Keeping accurate records of child support payments and expenses can help individuals demonstrate their eligibility for food stamps.

- Report changes: Individuals must report changes in their income or resources to the food stamp agency.

- Seek assistance: Individuals can seek assistance from a social worker or advocate to help navigate the food stamp system.

Impact of Child Support on Food Stamp Benefits

When an individual receives child support payments, it can affect the amount of food stamp benefits they receive. Here are some ways that child support can impact food stamp benefits:

- Increased benefits: If an individual receives child support payments, it may increase their eligibility for food stamps or the amount of benefits they receive.

- Decreased benefits: On the other hand, if an individual receives a large amount of child support payments, it may decrease their eligibility for food stamps or the amount of benefits they receive.

FAQs About Child Support and Food Stamps

Here are some frequently asked questions about child support and food stamps:

- Q: Does child support affect food stamp eligibility? A: Yes, child support payments can affect food stamp eligibility by increasing an individual's income or resources.

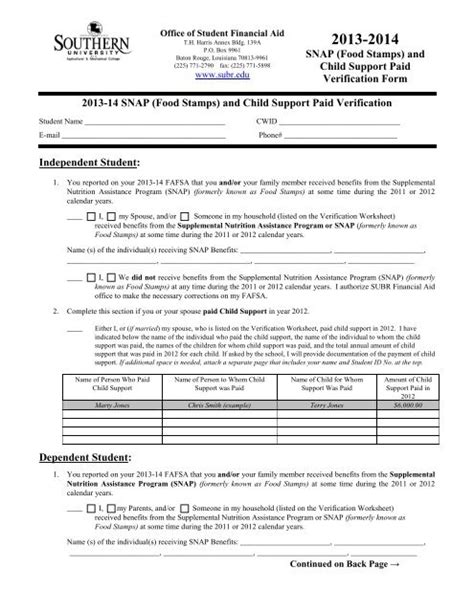

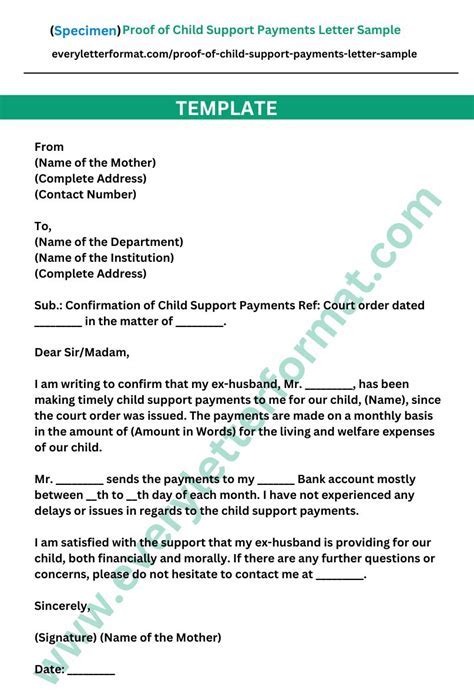

- Q: How do I report child support payments to the food stamp agency? A: Individuals can report child support payments to the food stamp agency by providing documentation, such as a court order or a payment receipt.

- Q: Can I receive food stamps if I receive child support payments? A: Yes, individuals can receive food stamps if they receive child support payments. However, the amount of benefits they receive may be affected.

Child Support and Food Stamps Image Gallery

Conclusion

Navigating child support and food stamps can be complex, but understanding the relationship between these two systems is crucial for individuals who rely on them. By keeping accurate records, reporting changes, and seeking assistance, individuals can ensure that they receive the benefits they need to support themselves and their families.