Intro

Boost your financial analysis skills with Excels powerful Time Value functions. Master the art of calculating present and future values, net present values, and internal rates of return with ease. Learn 7 expert tips to optimize your workflow, improve accuracy, and make informed investment decisions using Excels TVM functions, PV, FV, NPV, IRR, and more.

Excel time value functions are a crucial part of financial analysis, enabling users to calculate the present and future value of investments, loans, and other financial instruments. Mastering these functions can help you make informed decisions and optimize your financial strategies. In this article, we will explore seven ways to master Excel time value functions, including the PV, FV, PMT, IPMT, PPMT, XNPV, and XIRR functions.

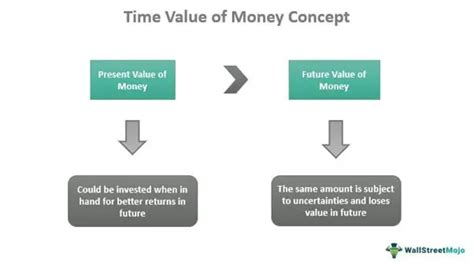

Understanding the Basics of Time Value Functions

Before we dive into the specifics of each function, it's essential to understand the basic concepts of time value functions. These functions are used to calculate the present and future value of a series of cash flows, taking into account the time value of money. The time value of money is the idea that a dollar today is worth more than a dollar in the future, due to the potential to earn interest or returns on investment.

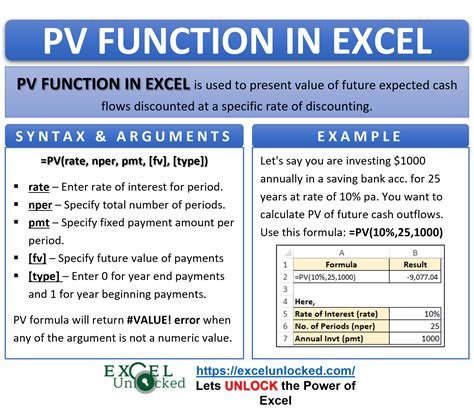

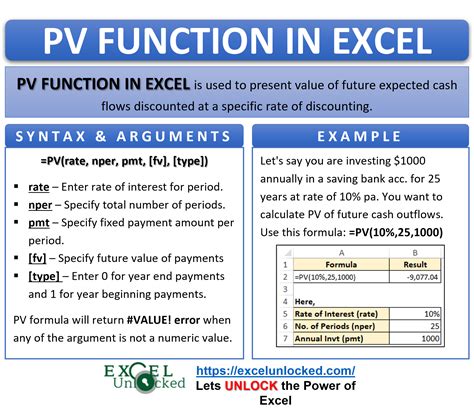

1. PV Function: Calculating Present Value

The PV function is used to calculate the present value of a future cash flow or a series of cash flows. The function takes into account the interest rate, the number of periods, and the amount of the cash flows.

The syntax for the PV function is:

PV(rate, nper, pmt, [fv], [type])

Where:

rateis the interest rate per periodnperis the number of periodspmtis the amount of the cash flows[fv]is the future value (optional)[type]is the type of cash flow (optional)

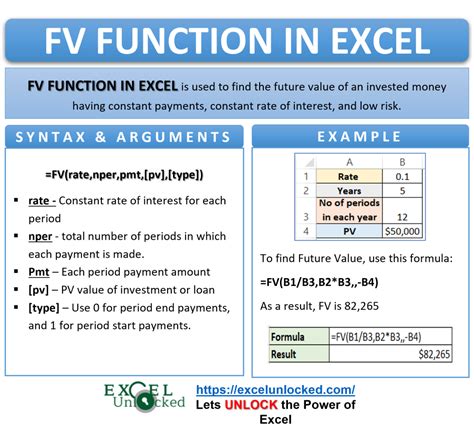

2. FV Function: Calculating Future Value

The FV function is used to calculate the future value of a present cash flow or a series of cash flows. The function takes into account the interest rate, the number of periods, and the amount of the cash flows.

The syntax for the FV function is:

FV(rate, nper, pmt, [pv], [type])

Where:

rateis the interest rate per periodnperis the number of periodspmtis the amount of the cash flows[pv]is the present value (optional)[type]is the type of cash flow (optional)

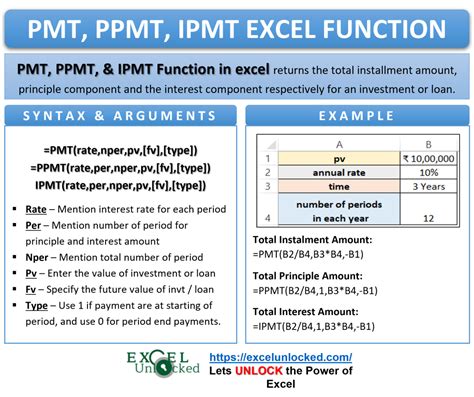

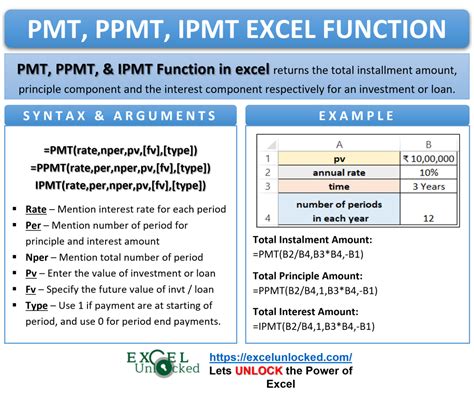

3. PMT Function: Calculating Payment Amount

The PMT function is used to calculate the payment amount for a loan or an investment, given the interest rate, the number of periods, and the present value.

The syntax for the PMT function is:

PMT(rate, nper, pv, [fv], [type])

Where:

rateis the interest rate per periodnperis the number of periodspvis the present value[fv]is the future value (optional)[type]is the type of cash flow (optional)

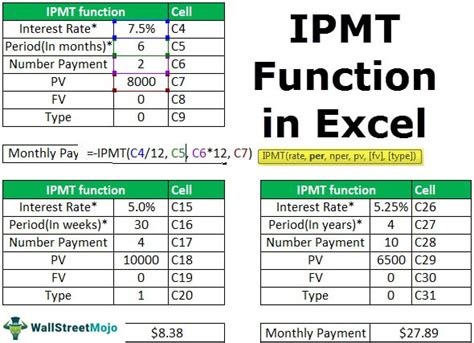

4. IPMT Function: Calculating Interest Payment

The IPMT function is used to calculate the interest payment for a loan or an investment, given the interest rate, the number of periods, and the present value.

The syntax for the IPMT function is:

IPMT(rate, per, nper, pv, [fv], [type])

Where:

rateis the interest rate per periodperis the period for which the interest payment is calculatednperis the number of periodspvis the present value[fv]is the future value (optional)[type]is the type of cash flow (optional)

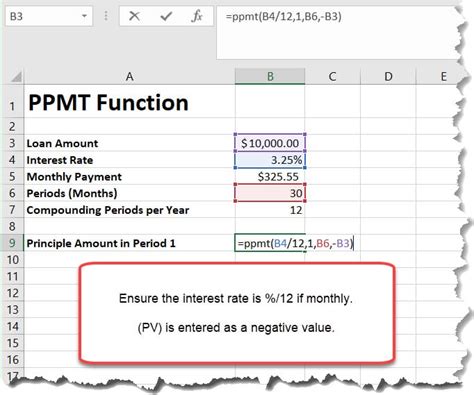

5. PPMT Function: Calculating Principal Payment

The PPMT function is used to calculate the principal payment for a loan or an investment, given the interest rate, the number of periods, and the present value.

The syntax for the PPMT function is:

PPMT(rate, per, nper, pv, [fv], [type])

Where:

rateis the interest rate per periodperis the period for which the principal payment is calculatednperis the number of periodspvis the present value[fv]is the future value (optional)[type]is the type of cash flow (optional)

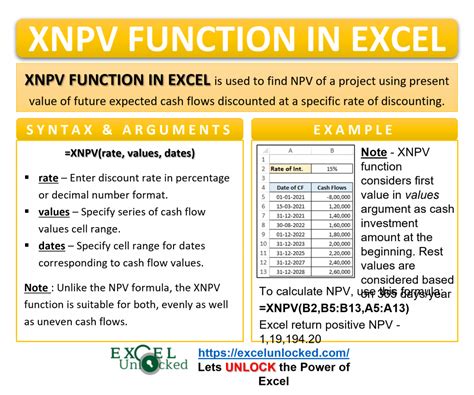

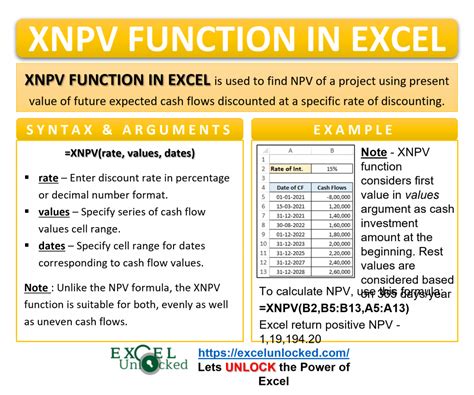

6. XNPV Function: Calculating Net Present Value

The XNPV function is used to calculate the net present value of a series of cash flows, given the dates and amounts of the cash flows.

The syntax for the XNPV function is:

XNPV(rate, dates, cash flows)

Where:

rateis the interest rate per perioddatesis the array of dates for the cash flowscash flowsis the array of cash flows

7. XIRR Function: Calculating Internal Rate of Return

The XIRR function is used to calculate the internal rate of return of a series of cash flows, given the dates and amounts of the cash flows.

The syntax for the XIRR function is:

XIRR(values, dates, [guess])

Where:

valuesis the array of cash flowsdatesis the array of dates for the cash flows[guess]is the initial estimate of the internal rate of return (optional)

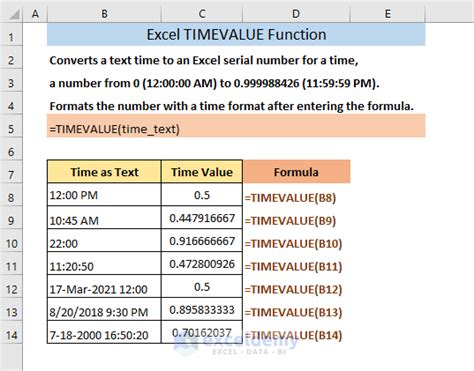

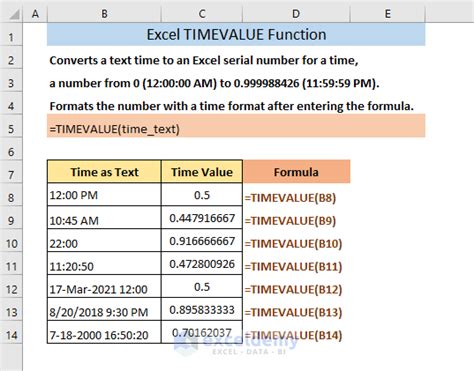

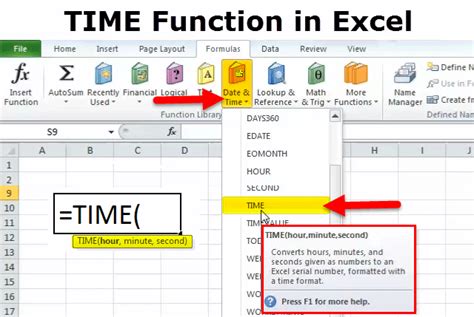

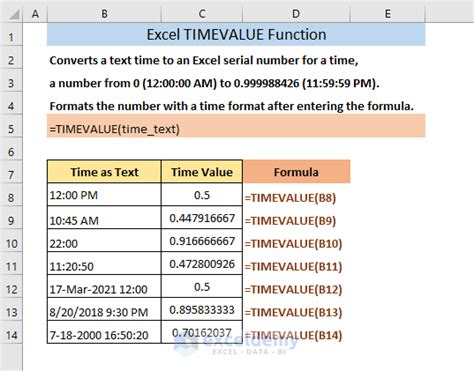

Excel Time Value Functions Image Gallery

Conclusion

Mastering Excel time value functions can help you make informed financial decisions and optimize your investment strategies. By understanding the PV, FV, PMT, IPMT, PPMT, XNPV, and XIRR functions, you can calculate the present and future value of investments, loans, and other financial instruments. Remember to practice using these functions and explore their applications in different financial scenarios. With time and practice, you will become proficient in using Excel time value functions and make more informed financial decisions.

We hope this article has helped you understand the basics of Excel time value functions and how to use them in your financial analysis. If you have any questions or need further clarification, please don't hesitate to ask. Share your thoughts and experiences with using Excel time value functions in the comments section below.