Managing debt can be a daunting task, but with the right tools and strategies, you can take control of your finances and achieve debt freedom. One effective method for paying off debt is the debt snowball approach, popularized by financial expert Dave Ramsey. This article will explore how to use a Google Sheets debt snowball template to simplify your debt repayment journey.

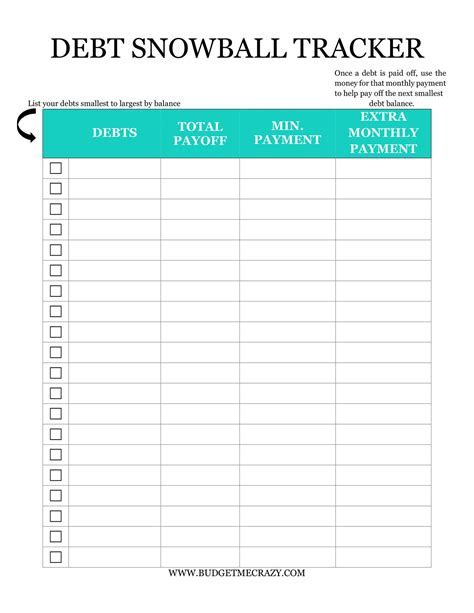

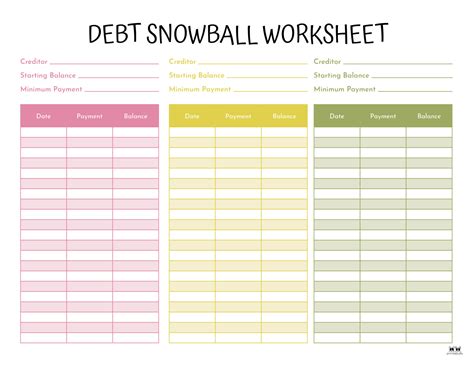

Debt can be overwhelming, but having a clear plan in place can help you stay focused and motivated. The debt snowball method involves listing all your debts, starting with the smallest balance first, and making minimum payments on all debts except the smallest one. You then attack the smallest debt with as much money as possible until it's paid off. Once the smallest debt is eliminated, you move on to the next debt on the list, and so on.

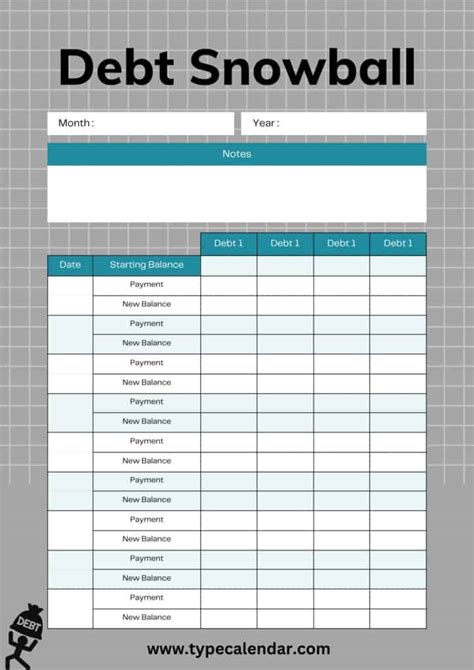

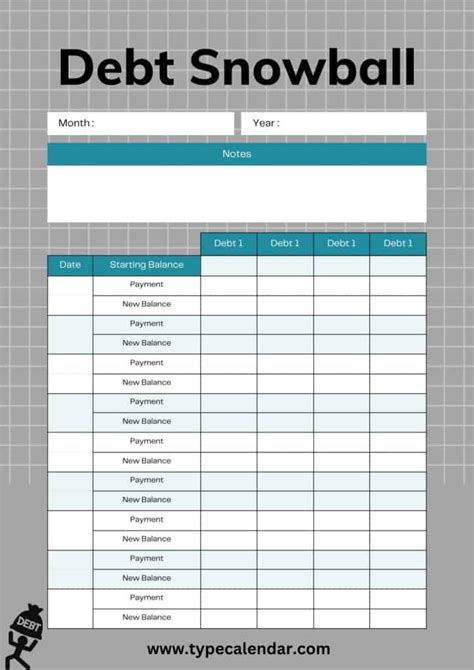

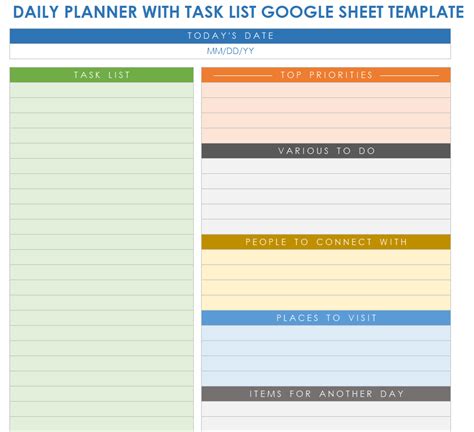

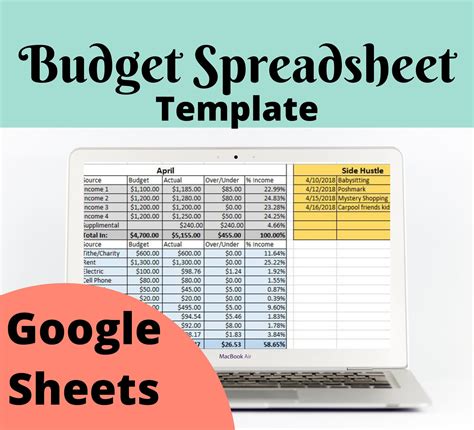

Using a Google Sheets debt snowball template can help you organize your debt, track your progress, and stay on top of your payments. With this template, you can easily visualize your debt, make adjustments to your budget, and celebrate your successes along the way.

How to Create a Google Sheets Debt Snowball Template

To create a Google Sheets debt snowball template, follow these steps:

- Open Google Sheets and create a new spreadsheet.

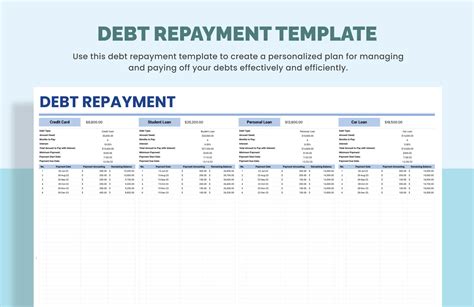

- Set up a table with the following columns:

- Debt Name

- Current Balance

- Minimum Payment

- Interest Rate

- Total Paid

- List all your debts in the table, starting with the smallest balance first.

- Calculate the total amount of debt you owe by adding up the current balances of all your debts.

- Determine how much money you can allocate each month towards debt repayment.

- Set up a formula to calculate the total amount paid towards each debt, based on the minimum payment and any additional payments you make.

Benefits of Using a Google Sheets Debt Snowball Template

Using a Google Sheets debt snowball template can help you in several ways:

- Organizes your debt: By listing all your debts in one place, you can see the big picture and understand where you stand.

- Tracks your progress: You can easily track your payments and see how much progress you've made towards paying off each debt.

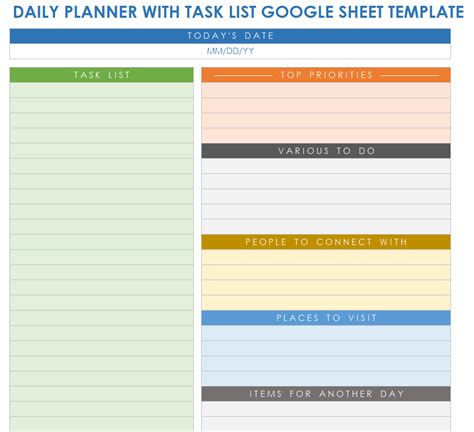

- Helps with budgeting: The template can help you allocate your income towards debt repayment and other expenses.

- Motivates you: Seeing your debt balances decrease can be a powerful motivator to keep you on track.

How to Use a Google Sheets Debt Snowball Template for Easy Debt Repayment

Once you have set up your Google Sheets debt snowball template, follow these steps to use it for easy debt repayment:

- Make minimum payments: Pay the minimum payment on all debts except the smallest one.

- Attack the smallest debt: Allocate as much money as possible towards the smallest debt until it's paid off.

- Move on to the next debt: Once the smallest debt is eliminated, move on to the next debt on the list and repeat the process.

- Celebrate milestones: Celebrate each time you pay off a debt and see the progress you've made.

- Adjust as needed: Adjust your budget and debt repayment plan as needed to stay on track.

Tips for Success with the Debt Snowball Method

Here are some tips to help you succeed with the debt snowball method:

- Stick to the plan: Make a plan and stick to it, even when it's hard.

- Cut expenses: Cut expenses and allocate more money towards debt repayment.

- Consider a side hustle: Consider starting a side hustle to increase your income and put more money towards debt repayment.

- Avoid new debt: Avoid taking on new debt while you're paying off existing debts.

Conclusion and Next Steps

Using a Google Sheets debt snowball template can help you take control of your debt and achieve financial freedom. By following the debt snowball method and using the template to track your progress, you can stay motivated and focused on your goal. Remember to stick to the plan, cut expenses, and avoid new debt to ensure success.

Debt Snowball Template Image Gallery

We hope this article has helped you understand how to use a Google Sheets debt snowball template for easy debt repayment. By following the debt snowball method and using the template to track your progress, you can take control of your debt and achieve financial freedom. Share your thoughts and experiences with us in the comments below!