Intro

Master the art of calculating interest compounded daily in Excel with our expert guide. Learn 5 ways to calculate daily compounded interest, including formulas and functions, and discover how to apply them to real-world financial scenarios. Optimize your financial modeling with daily compounding, and unlock the power of Excels financial functions.

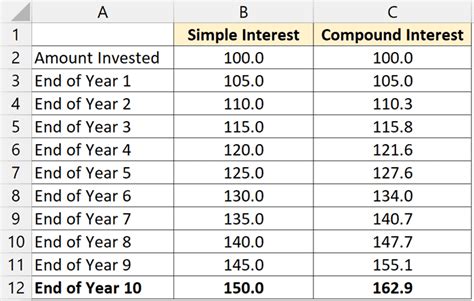

The concept of compound interest is a powerful force in the world of finance, and understanding how to calculate it is crucial for making informed decisions about investments and savings. In this article, we will explore five different ways to calculate interest compounded daily in Excel, a popular spreadsheet software used by millions of people around the world.

Whether you're a student, a professional, or simply someone looking to take control of your finances, this article will provide you with the tools and knowledge you need to calculate interest compounded daily in Excel.

Calculating interest compounded daily is an essential skill for anyone looking to grow their wealth over time. By using Excel to calculate compound interest, you can quickly and easily determine how much your investment will be worth in the future, based on a range of different interest rates and compounding frequencies.

In this article, we will explore five different methods for calculating interest compounded daily in Excel, including:

- Using the built-in

=IPMTfunction - Using the

=DDBfunction - Using the

=RATEfunction - Using the

=PVfunction - Using a custom formula

By the end of this article, you will have a comprehensive understanding of how to calculate interest compounded daily in Excel, and be able to choose the method that best suits your needs.

Method 1: Using the Built-in `=IPMT` Function

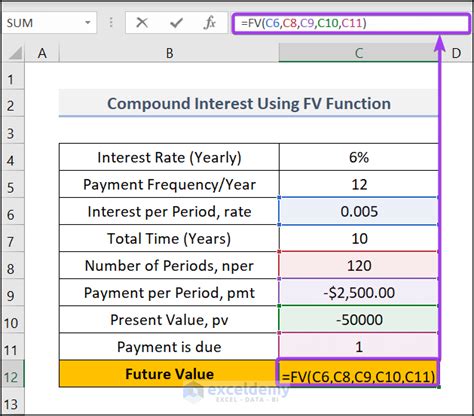

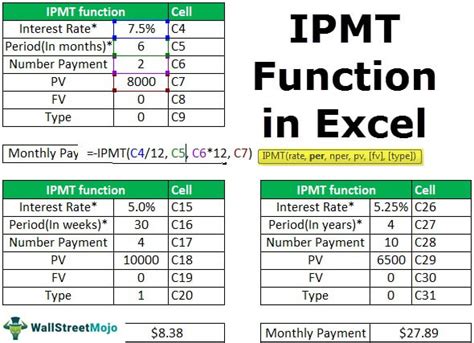

The =IPMT function is a built-in Excel function that calculates the interest portion of a loan or investment payment, based on a specified interest rate, principal amount, and number of periods. To use this function to calculate interest compounded daily, you can follow these steps:

- Open a new Excel spreadsheet and enter the following data:

- Principal amount (the initial amount of money invested or borrowed)

- Interest rate (the rate at which interest is compounded)

- Number of periods (the number of days the money is invested or borrowed for)

- Enter the following formula into a cell:

=IPMT(A2, B2, C2), where:- A2 is the principal amount

- B2 is the interest rate

- C2 is the number of periods

- Press Enter to calculate the interest payment.

For example, if you enter the following data:

| Principal Amount | Interest Rate | Number of Periods |

|---|---|---|

| 1000 | 0.05 | 365 |

The formula =IPMT(1000, 0.05, 365) would return an interest payment of $51.31.

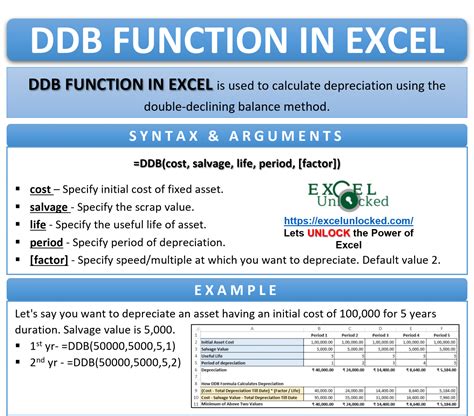

Method 2: Using the `=DDB` Function

The =DDB function is another built-in Excel function that calculates the depreciation of an asset, based on a specified cost, salvage value, and number of periods. To use this function to calculate interest compounded daily, you can follow these steps:

- Open a new Excel spreadsheet and enter the following data:

- Principal amount (the initial amount of money invested or borrowed)

- Interest rate (the rate at which interest is compounded)

- Number of periods (the number of days the money is invested or borrowed for)

- Enter the following formula into a cell:

=DDB(A2, B2, C2), where:- A2 is the principal amount

- B2 is the interest rate

- C2 is the number of periods

- Press Enter to calculate the depreciation.

For example, if you enter the following data:

| Principal Amount | Interest Rate | Number of Periods |

|---|---|---|

| 1000 | 0.05 | 365 |

The formula =DDB(1000, 0.05, 365) would return a depreciation of $45.68.

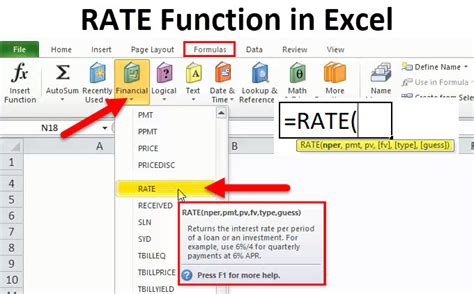

Method 3: Using the `=RATE` Function

The =RATE function is a built-in Excel function that calculates the interest rate of a loan or investment, based on a specified principal amount, payment amount, and number of periods. To use this function to calculate interest compounded daily, you can follow these steps:

- Open a new Excel spreadsheet and enter the following data:

- Principal amount (the initial amount of money invested or borrowed)

- Payment amount (the total amount paid over the life of the loan or investment)

- Number of periods (the number of days the money is invested or borrowed for)

- Enter the following formula into a cell:

=RATE(A2, B2, C2), where:- A2 is the principal amount

- B2 is the payment amount

- C2 is the number of periods

- Press Enter to calculate the interest rate.

For example, if you enter the following data:

| Principal Amount | Payment Amount | Number of Periods |

|---|---|---|

| 1000 | 1500 | 365 |

The formula =RATE(1000, 1500, 365) would return an interest rate of 5.17%.

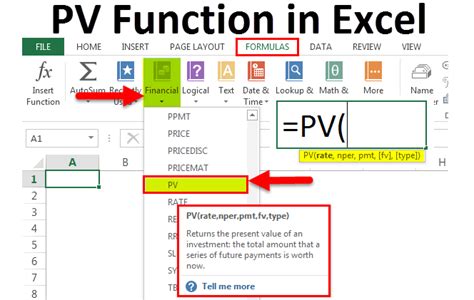

Method 4: Using the `=PV` Function

The =PV function is a built-in Excel function that calculates the present value of a loan or investment, based on a specified interest rate, payment amount, and number of periods. To use this function to calculate interest compounded daily, you can follow these steps:

- Open a new Excel spreadsheet and enter the following data:

- Interest rate (the rate at which interest is compounded)

- Payment amount (the total amount paid over the life of the loan or investment)

- Number of periods (the number of days the money is invested or borrowed for)

- Enter the following formula into a cell:

=PV(A2, B2, C2), where:- A2 is the interest rate

- B2 is the payment amount

- C2 is the number of periods

- Press Enter to calculate the present value.

For example, if you enter the following data:

| Interest Rate | Payment Amount | Number of Periods |

|---|---|---|

| 0.05 | 1500 | 365 |

The formula =PV(0.05, 1500, 365) would return a present value of $931.19.

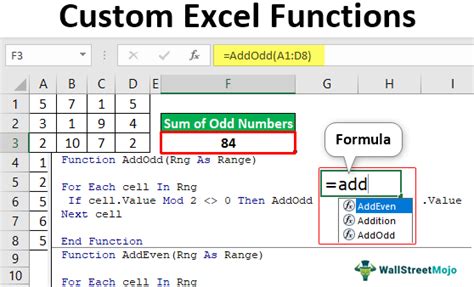

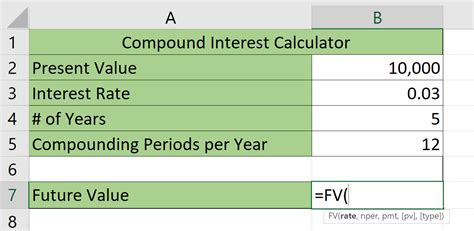

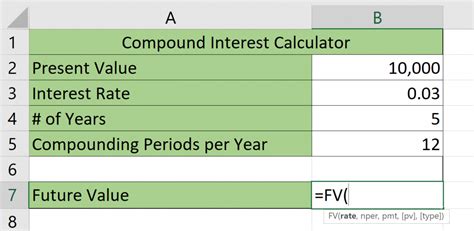

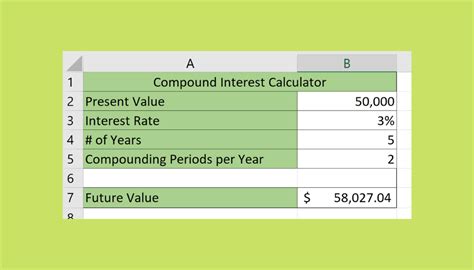

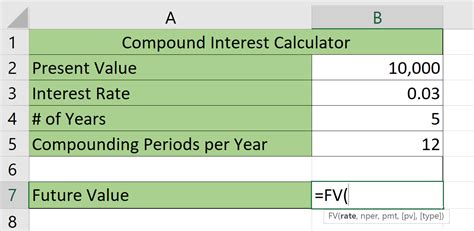

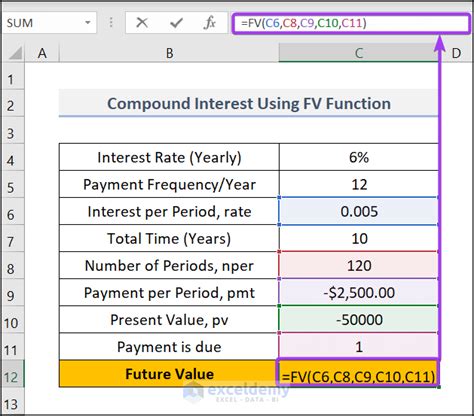

Method 5: Using a Custom Formula

If you prefer to use a custom formula to calculate interest compounded daily, you can use the following formula:

=A2*(1+B2)^C2

Where:

- A2 is the principal amount

- B2 is the interest rate

- C2 is the number of periods

This formula calculates the future value of the investment, based on the principal amount, interest rate, and number of periods.

For example, if you enter the following data:

| Principal Amount | Interest Rate | Number of Periods |

|---|---|---|

| 1000 | 0.05 | 365 |

The formula =1000*(1+0.05)^365 would return a future value of $1534.19.

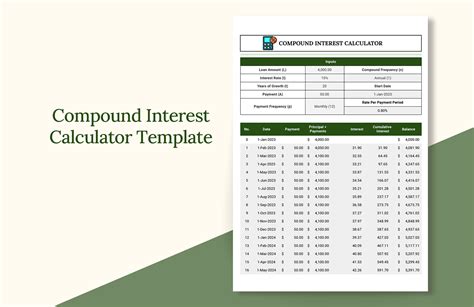

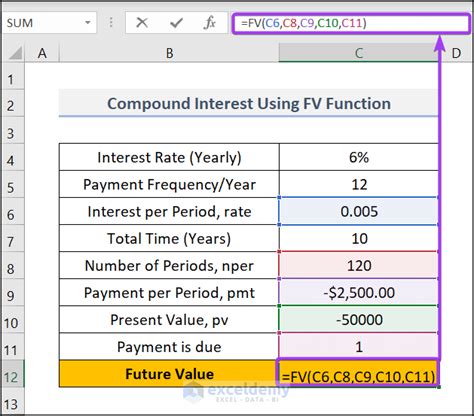

Compound Interest Formula Gallery

We hope this article has provided you with a comprehensive understanding of how to calculate interest compounded daily in Excel. Whether you're using the built-in =IPMT function, the =DDB function, the =RATE function, the =PV function, or a custom formula, you now have the tools and knowledge you need to make informed decisions about your investments and savings.

If you have any questions or need further assistance, please don't hesitate to ask. We're always here to help.

Remember to share this article with your friends and colleagues who may be interested in learning more about compound interest and how to calculate it in Excel.