Intro

Explore the best life insurance options for retired military personnel. Discover how to leverage your military service for affordable coverage, including Veterans Group Life Insurance (VGLI), Survivor Benefit Plan (SBP), and private insurance alternatives. Learn how to choose the right policy for your needs and maximize your benefits as a retired military member.

As a retired military member, you have made sacrifices to serve your country, and it's essential to ensure that you and your loved ones are protected financially. Life insurance can provide a safety net for your family in the event of your passing, helping to cover funeral expenses, pay off debts, and maintain their standard of living. In this article, we will explore five life insurance options available to retired military members.

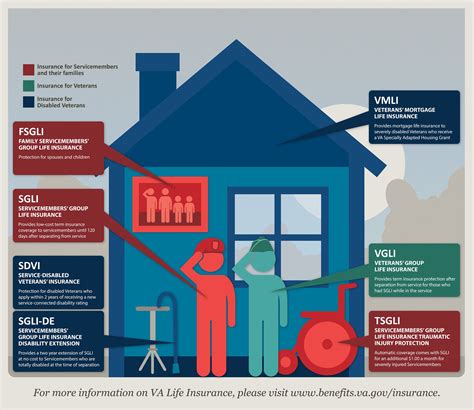

Understanding Your Options

As a retired military member, you have access to several life insurance options, each with its unique features and benefits. Understanding these options can help you make an informed decision that suits your needs and budget.

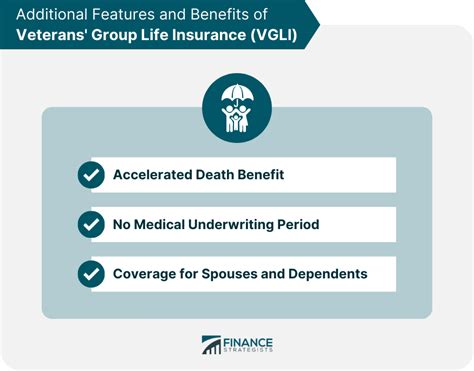

Option 1: Veterans' Group Life Insurance (VGLI)

Veterans' Group Life Insurance (VGLI) is a low-cost term life insurance plan designed specifically for military members. It provides coverage up to $400,000 and is available to eligible veterans. The premium rates are based on your age, and the coverage decreases by 50% at age 70.

Key Benefits:**

- Affordable premiums

- Easy to enroll

- Portable coverage

- Convertible to individual policies

Option 2: Service-Disabled Veterans' Life Insurance (S-DVI)

Service-Disabled Veterans' Life Insurance (S-DVI) is a low-cost life insurance plan designed for military members with service-connected disabilities. It provides coverage up to $10,000 and is available to eligible veterans.

Key Benefits:**

- Low premiums

- Tax-free benefits

- Available to veterans with service-connected disabilities

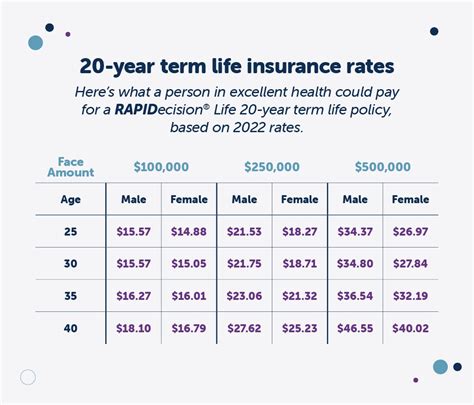

Option 3: Term Life Insurance

Term life insurance provides coverage for a specified period (e.g., 10, 20, or 30 years). If you pass away during the term, your beneficiaries receive the death benefit. If you outlive the term, the coverage ends, and you can choose to renew or convert to a permanent policy.

Key Benefits:**

- Affordable premiums

- Flexibility in term length

- Convertible to permanent policies

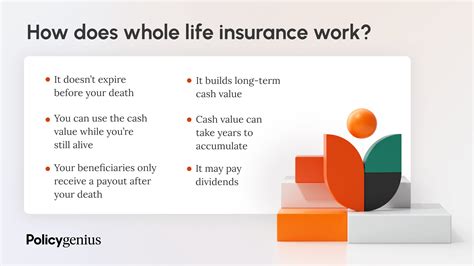

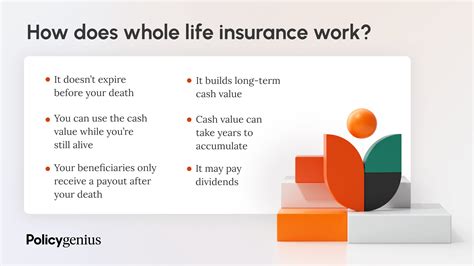

Option 4: Whole Life Insurance

Whole life insurance provides lifetime coverage and a guaranteed death benefit. It also accumulates a cash value over time, which you can borrow against or withdraw. Whole life insurance is more expensive than term life insurance but provides a guaranteed death benefit and cash value accumulation.

Key Benefits:**

- Lifetime coverage

- Guaranteed death benefit

- Cash value accumulation

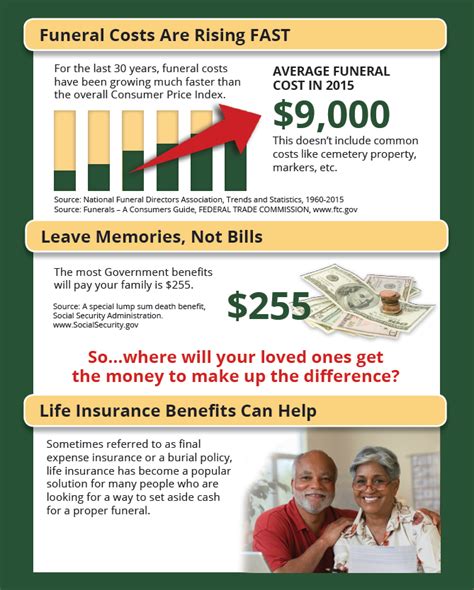

Option 5: Final Expense Life Insurance

Final expense life insurance is designed to cover funeral expenses, medical bills, and other final costs. It typically provides coverage up to $25,000 and is available to seniors. Final expense life insurance is often more expensive than other options but provides a guaranteed death benefit to cover final expenses.

Key Benefits:**

- Guaranteed death benefit

- Covers final expenses

- Simplified underwriting process

Comparison of Life Insurance Options

| Option | Coverage | Premiums | Benefits |

|---|---|---|---|

| VGLI | Up to $400,000 | Low | Portable coverage, convertible to individual policies |

| S-DVI | Up to $10,000 | Low | Tax-free benefits, available to veterans with service-connected disabilities |

| Term Life | Up to $500,000 | Affordable | Flexible term length, convertible to permanent policies |

| Whole Life | Lifetime | High | Guaranteed death benefit, cash value accumulation |

| Final Expense | Up to $25,000 | High | Guaranteed death benefit, covers final expenses |

Gallery of Life Insurance Options for Retired Military

Life Insurance Options for Retired Military Image Gallery

Get the Right Life Insurance for Your Needs

Choosing the right life insurance option can be overwhelming, but it's essential to ensure that you and your loved ones are protected financially. Consider your budget, coverage needs, and benefits when selecting a life insurance policy. Don't hesitate to reach out to a licensed insurance professional to help you navigate the process.

Share Your Thoughts

Have you considered life insurance as a retired military member? What options have you explored, and what factors have influenced your decision? Share your thoughts and experiences in the comments below.

Remember, life insurance is an essential part of planning for your future and protecting your loved ones. Don't wait until it's too late – explore your options today and find the right coverage for your needs.