Intro

Boost your savings with our Mini Savings Challenge Free Printable Tracker! This fun and interactive tool helps you set financial goals, track progress, and stay motivated. Perfect for beginners, our mini savings challenge tracker includes daily, weekly, and monthly savings targets, plus space for notes and reflection. Kickstart your savings journey today!

Saving money is an essential aspect of personal finance, but it can be a daunting task, especially for those who are new to budgeting. The mini savings challenge is a great way to start small and develop a habit of saving. In this article, we will explore the benefits of the mini savings challenge, provide a free printable tracker, and offer tips on how to make the most out of this challenge.

The Benefits of the Mini Savings Challenge

The mini savings challenge is a fun and easy way to start saving money. By committing to save a small amount each day or week, you can develop a habit of saving and make progress towards your financial goals. The benefits of the mini savings challenge include:

- Developing a habit of saving: By committing to save a small amount regularly, you can develop a habit of saving that will serve you well in the long run.

- Building momentum: Saving a small amount regularly can help you build momentum and motivate you to continue saving.

- Reducing financial stress: Saving money can help reduce financial stress and anxiety, which can have a positive impact on your overall well-being.

How the Mini Savings Challenge Works

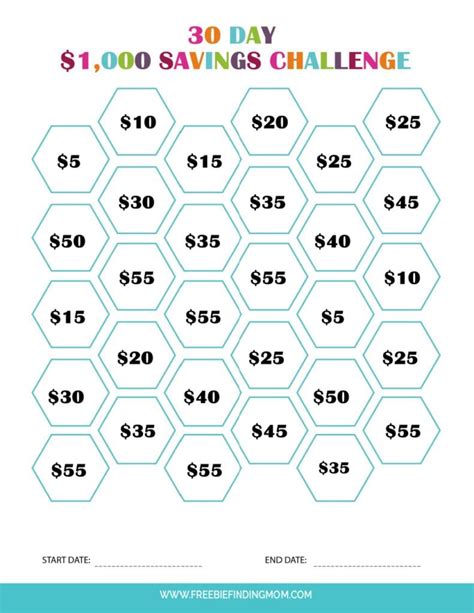

The mini savings challenge is simple. All you need to do is commit to saving a small amount of money each day or week. You can start with as little as $1 per day or $5 per week. The key is to make saving a habit and to be consistent.

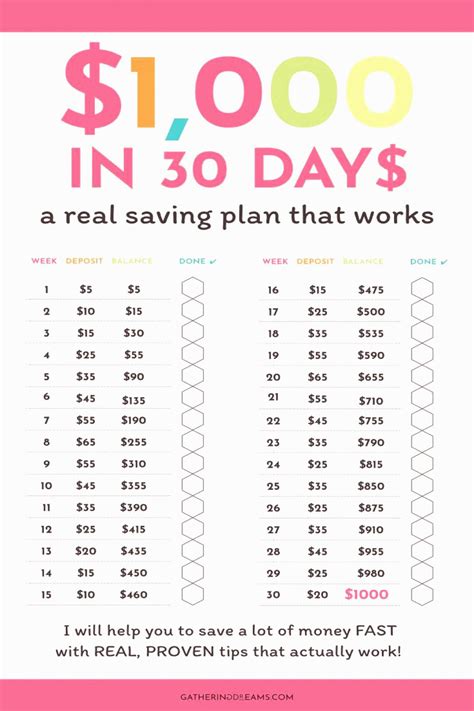

Here's an example of how the mini savings challenge can work:

- Day 1: Save $1

- Day 2: Save $2

- Day 3: Save $3

- And so on...

By the end of the month, you can save a significant amount of money. For example, if you save $1 per day, you can save $30 in a month. If you save $5 per week, you can save $20 in a month.

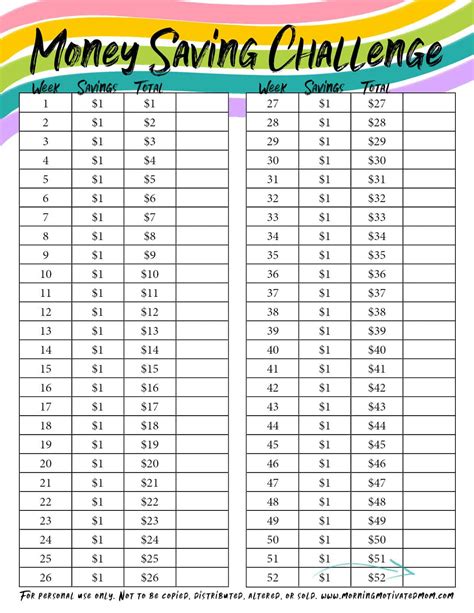

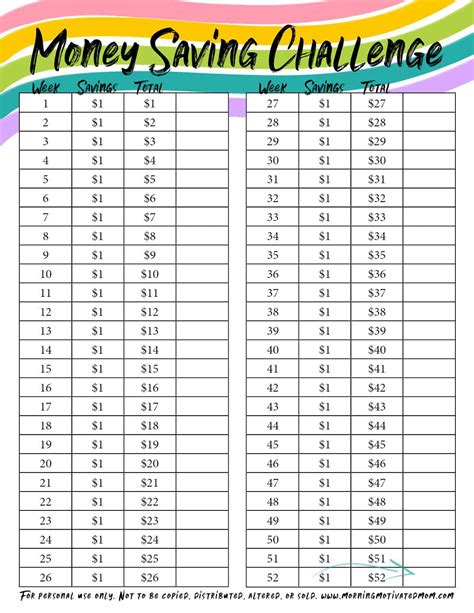

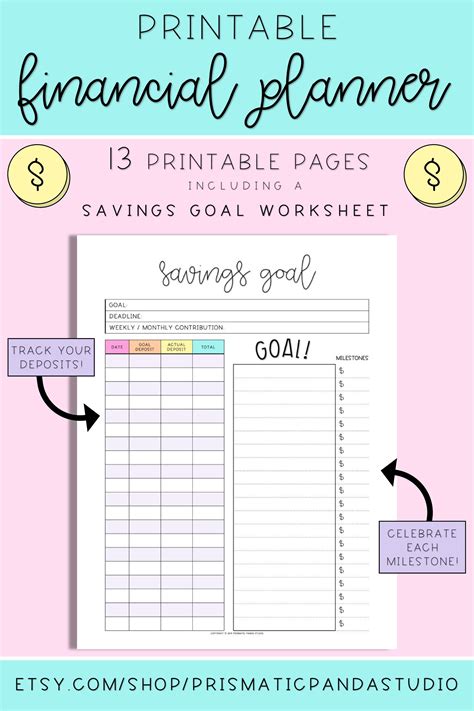

Free Printable Tracker

To help you stay on track with your mini savings challenge, we have created a free printable tracker. This tracker allows you to track your progress and see how much you have saved over time.

Tips for Making the Most Out of the Mini Savings Challenge

To make the most out of the mini savings challenge, here are some tips to keep in mind:

- Start small: Don't try to save too much too soon. Start with a small amount and gradually increase it over time.

- Be consistent: Make saving a habit by committing to save a small amount regularly.

- Track your progress: Use a tracker or spreadsheet to track your progress and see how much you have saved over time.

- Make it automatic: Set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

- Avoid dipping into your savings: Try to avoid dipping into your savings for non-essential purchases. Treat your savings like a separate account that you cannot access easily.

Overcoming Common Challenges

One of the common challenges people face when trying to save money is the temptation to spend. Here are some tips for overcoming this challenge:

- Identify your spending triggers: Be aware of what triggers your spending habits and find ways to avoid or manage them.

- Find free alternatives: Find free alternatives to expensive activities or hobbies.

- Use the 50/30/20 rule: Allocate 50% of your income towards essential expenses, 30% towards non-essential expenses, and 20% towards saving and debt repayment.

Common Mistakes to Avoid

When it comes to saving money, there are several common mistakes to avoid. Here are some of them:

- Not having a clear goal: Not having a clear goal can make it difficult to stay motivated and focused on saving.

- Not tracking progress: Not tracking progress can make it difficult to see how much you have saved and stay motivated.

- Dipping into savings: Dipping into savings for non-essential purchases can undermine your savings efforts and make it difficult to reach your goals.

Conclusion

The mini savings challenge is a great way to start small and develop a habit of saving. By committing to save a small amount regularly, you can build momentum and make progress towards your financial goals. Remember to start small, be consistent, and track your progress. With the right mindset and strategy, you can overcome common challenges and achieve your savings goals.

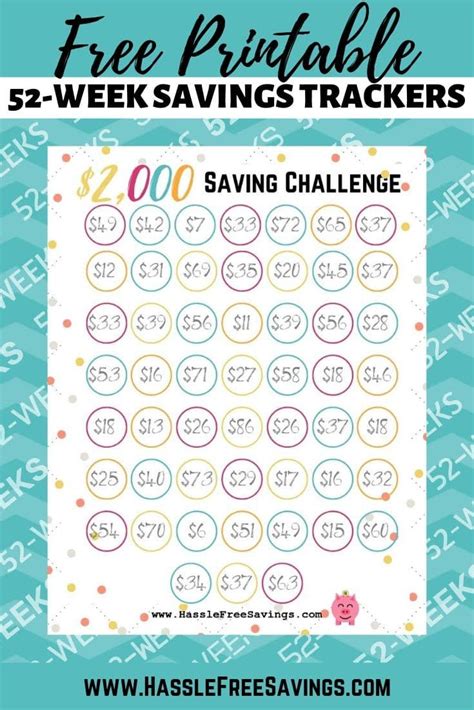

Gallery of Mini Savings Challenge Printables

Mini Savings Challenge Printables