Discover Navy Army Credit Union services, offering banking, loans, and financial solutions with online banking, mobile banking, and investment options, providing members with convenient and secure credit union experiences.

The world of finance can be overwhelming, with numerous options available for managing one's money. Among the many choices, credit unions have emerged as a popular alternative to traditional banks. One such institution is the Navy Army Credit Union, which has been serving its members for decades. With a rich history and a commitment to providing exceptional service, Navy Army Credit Union has become a trusted name in the financial industry. In this article, we will delve into the world of Navy Army Credit Union services, exploring the benefits, features, and advantages of choosing this credit union for your financial needs.

The importance of selecting the right financial institution cannot be overstated. With so many options available, it can be challenging to make an informed decision. However, by understanding the services and benefits offered by Navy Army Credit Union, individuals can make a more informed choice. From personal banking to business services, Navy Army Credit Union provides a wide range of options to cater to diverse financial needs. Whether you are looking to save, invest, or borrow, this credit union has the tools and expertise to help you achieve your financial goals.

As a member-owned cooperative, Navy Army Credit Union operates on a not-for-profit basis, which means that its primary focus is on serving its members rather than generating profits for shareholders. This approach enables the credit union to offer more competitive rates and fees, making it an attractive option for those seeking to manage their finances effectively. With a strong commitment to community development and financial education, Navy Army Credit Union is dedicated to empowering its members to take control of their financial lives.

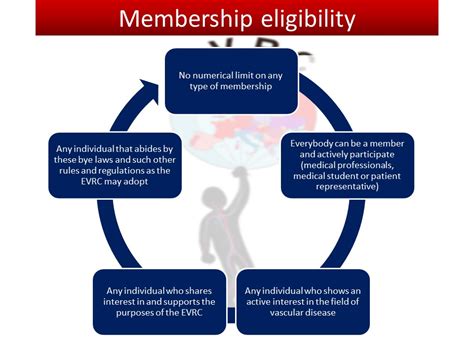

Membership and Eligibility

Benefits of Membership

Some of the key benefits of membership include: * Competitive loan rates and terms * Higher savings rates and dividend payments * Lower fees and charges * Access to exclusive financial products and services * Personalized service and financial guidance * Opportunities for community involvement and financial educationPersonal Banking Services

Account Options

Some of the account options available to members include: * Free checking accounts with no monthly maintenance fees * High-yield savings accounts with competitive interest rates * Money market accounts with tiered interest rates * Certificates of deposit (CDs) with fixed interest rates and terms * Individual retirement accounts (IRAs) with tax benefits and investment optionsBusiness Services

Business Loan Options

Some of the business loan options available include: * Term loans with fixed interest rates and repayment terms * Lines of credit with revolving credit limits and variable interest rates * Commercial mortgages with competitive interest rates and terms * Small Business Administration (SBA) loans with favorable terms and conditions * Equipment financing and leasing optionsInvestment and Insurance Services

Investment Options

Some of the investment options available include: * Stocks and bonds * Mutual funds and exchange-traded funds (ETFs) * Real estate investment trusts (REITs) and real estate crowdfunding * Commodities and futures trading * Cryptocurrency and blockchain investingOnline Banking and Mobile Banking

Mobile Banking Apps

Some of the mobile banking apps available include: * Mobile banking apps for iOS and Android devices * Mobile deposit apps for remote deposit capture * Bill pay apps for payment processing * Budgeting and financial planning apps * Investment and trading appsCommunity Involvement and Financial Education

Financial Education Resources

Some of the financial education resources available include: * Online financial education courses and tutorials * Financial planning and budgeting tools * Investment and retirement planning resources * Credit and debt management resources * Financial literacy and education workshops and seminarsNavy Army Credit Union Image Gallery

In conclusion, Navy Army Credit Union offers a wide range of financial services and benefits to its members, from personal banking to business services, investment and insurance services, and community involvement and financial education. By choosing Navy Army Credit Union, individuals and businesses can access competitive rates and fees, personalized service, and a commitment to community development and financial education. We invite you to share your thoughts and experiences with Navy Army Credit Union in the comments below, and to explore the many services and benefits that this credit union has to offer. Whether you are looking to manage your finances, achieve your financial goals, or simply learn more about the world of finance, Navy Army Credit Union is an excellent choice.