Discover Navy Federal pay dates, including active duty, reserve, and retirement pay schedules, with related information on direct deposit, pay charts, and benefits to help plan finances effectively.

The importance of staying on top of financial schedules cannot be overstated, especially when it comes to receiving payments. For members of the Navy Federal Credit Union, understanding the pay dates is crucial for managing their finances effectively. Navy Federal Credit Union is one of the largest credit unions in the world, serving all branches of the US military, including the Navy, Army, Marine Corps, Air Force, Coast Guard, and Space Force, as well as the National Guard and Department of Defense civilians. Its extensive membership benefits from a wide range of financial services, including savings accounts, loans, credit cards, and investment products.

Navy Federal pay dates are designed to align with the military's pay schedules, ensuring that members receive their paychecks in a timely manner. This synchronization is vital for planning expenses, saving, and investing. The credit union's commitment to meeting the unique financial needs of its members sets it apart from other financial institutions. By offering flexible and convenient services, Navy Federal helps its members navigate the complexities of military life, including the sometimes unpredictable nature of military pay schedules.

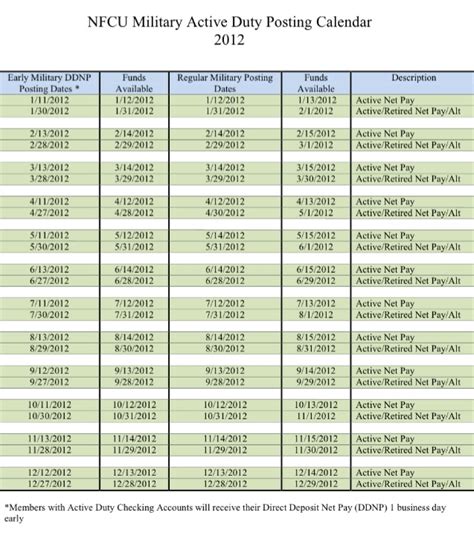

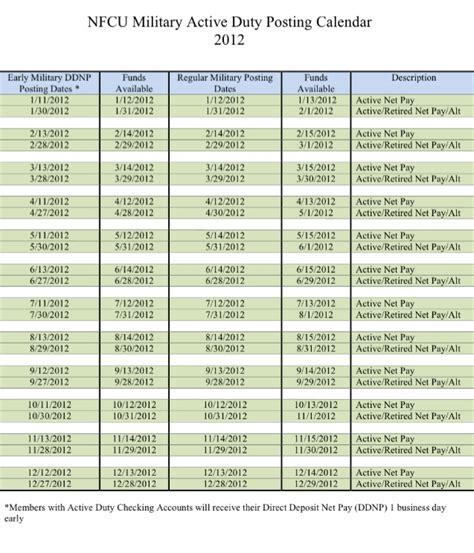

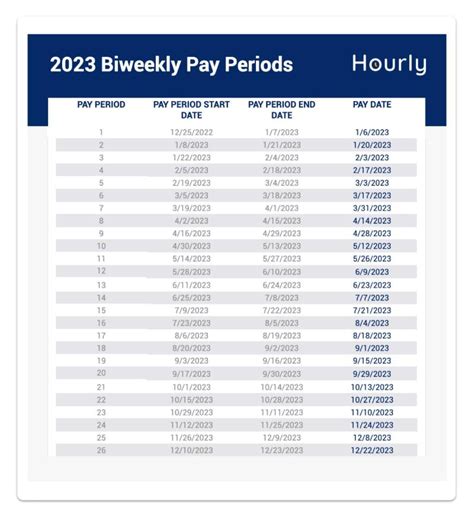

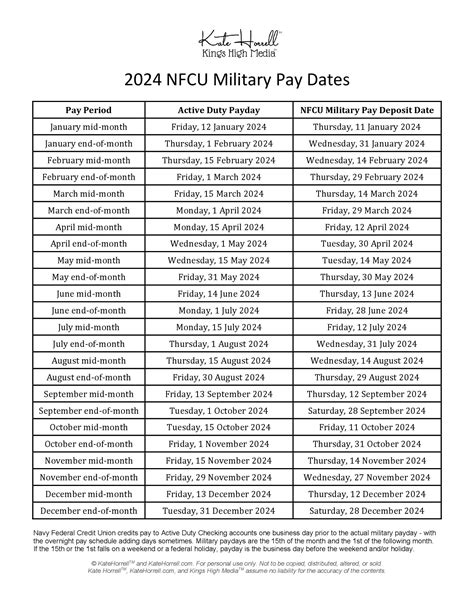

The pay dates for Navy Federal members typically follow the military's pay calendar, which is usually issued at the beginning of each year. This calendar outlines the dates when active duty, reserve, and retired members can expect to receive their pay. It's essential for members to familiarize themselves with these dates to plan their financial activities, such as bill payments, budgeting, and savings. Moreover, understanding the pay schedule can help members avoid overdrafts and late fees, ensuring they maintain a healthy financial standing.

Navy Federal Pay Schedule

The Navy Federal pay schedule is generally released by the Defense Finance and Accounting Service (DFAS) and is available on the official Navy Federal Credit Union website. Members can access this information to plan their financial transactions accordingly. The pay schedule typically includes dates for both active duty and reserve components, ensuring that all members have the information they need to manage their finances effectively. It's worth noting that pay dates can sometimes be affected by federal holidays or other factors, so members should always check the latest information from reliable sources.

Understanding Pay Cycles

The military pay cycle is usually bi-weekly, with paydays occurring every other week. However, the exact dates can vary from year to year due to factors like weekends and federal holidays. For instance, if a pay date falls on a weekend or a holiday, the pay will typically be deposited into accounts on the preceding Friday. Understanding these pay cycles is crucial for budgeting and financial planning, as it helps members anticipate when they will receive their funds.Benefits of Navy Federal Pay Dates

One of the significant benefits of Navy Federal pay dates is the predictability they offer. By knowing exactly when they will receive their pay, members can better manage their finances, avoid debt, and work towards long-term financial goals. This predictability also allows for more effective budgeting, as members can allocate their income into different categories such as savings, investments, and expenses.

Financial Planning Tools

Navy Federal Credit Union provides its members with a range of financial planning tools and resources. These include budgeting worksheets, savings calculators, and investment advice, all designed to help members make the most of their pay. By utilizing these tools, members can create personalized financial plans that align with their pay schedules, ensuring they are always on top of their financial obligations and goals.Managing Finances Effectively

Effective financial management is about more than just knowing when you'll get paid. It involves creating a comprehensive financial plan that covers all aspects of your financial life, from saving and investing to spending and borrowing. Navy Federal members have access to a variety of products and services designed to help them achieve financial stability and success. This includes low-interest loans, high-yield savings accounts, and credit cards with competitive rates and rewards.

Financial Education

Education is key to making informed financial decisions. Navy Federal Credit Union offers its members a range of educational resources, including workshops, webinars, and online tutorials. These resources cover topics such as budgeting, saving, investing, and managing debt, providing members with the knowledge they need to navigate the complexities of personal finance. By empowering its members with financial knowledge, Navy Federal helps them make the most of their pay and work towards a more secure financial future.Navy Federal Pay Dates and Holidays

It's essential to note that federal holidays can impact Navy Federal pay dates. When a pay date falls on a holiday, the pay is typically processed on the preceding business day. This ensures that members receive their pay as soon as possible, even when the usual pay date is not a business day. Understanding how holidays affect pay dates is crucial for planning and can help members avoid any potential financial disruptions.

Impact on Financial Planning

The impact of holidays on pay dates should be factored into financial planning. Members should adjust their budgets and financial schedules accordingly, taking into account any changes in pay dates due to holidays. This might involve adjusting bill payments, savings contributions, or investment schedules to align with the altered pay dates. By doing so, members can maintain their financial stability and continue working towards their long-term financial goals without interruption.Conclusion and Next Steps

In conclusion, Navy Federal pay dates play a crucial role in the financial planning and management of Navy Federal Credit Union members. By understanding the pay schedule and how it might be affected by holidays or other factors, members can better manage their finances, achieve financial stability, and work towards their long-term financial goals. Whether you're looking to save, invest, or simply manage your day-to-day expenses more effectively, knowing your pay dates is the first step towards financial success.

Final Thoughts

As a final thought, it's essential for Navy Federal members to stay informed about their pay dates and any changes that might occur. This includes regularly checking the Navy Federal Credit Union website for updates, utilizing financial planning tools, and seeking advice from financial experts when needed. By taking these steps, members can ensure they are always on top of their finances, ready to face any challenges that come their way.Navy Federal Pay Dates Image Gallery

We invite you to share your thoughts and experiences with Navy Federal pay dates and how they impact your financial planning. Your insights can be invaluable to others who are looking to manage their finances more effectively. Feel free to comment below, and don't forget to share this article with anyone who might benefit from understanding more about Navy Federal pay dates and their role in achieving financial stability and success.