As a business owner or financial manager, you're likely familiar with the importance of accurately reporting income and tax information to the IRS. One crucial document for achieving this is the NC 1099 form, which is used to report various types of income and payments to the IRS and the recipient. In this article, we'll delve into the details of the NC 1099 form, its printable template, and provide a comprehensive guide for filing.

The NC 1099 form is used to report income and payments that are not subject to withholding, such as freelance work, rents, and royalty payments. It's essential to understand the different types of 1099 forms, as each serves a specific purpose.

Types of 1099 Forms

There are several types of 1099 forms, each with its own unique purpose. The most common types include:

-

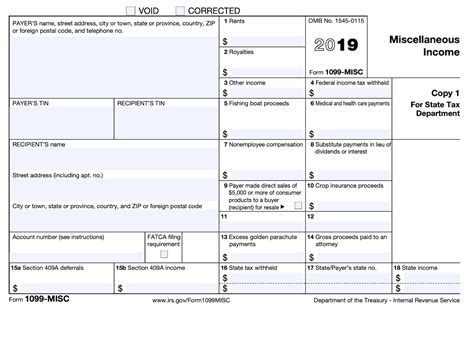

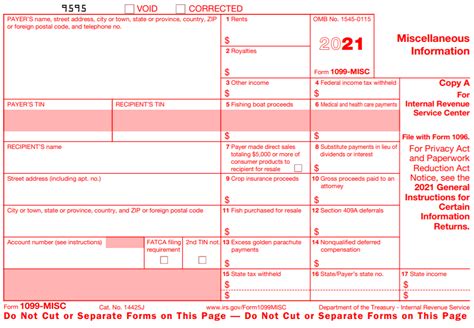

1099-MISC

: Used to report miscellaneous income, such as freelance work, rents, and royalty payments. -

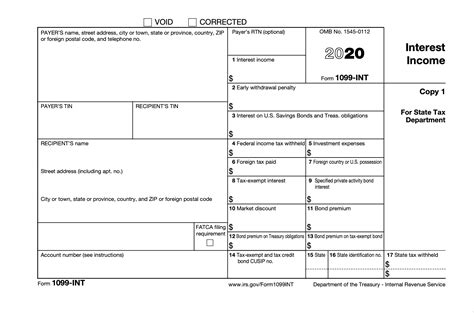

1099-INT

: Used to report interest income, such as interest earned on savings accounts and investments. -

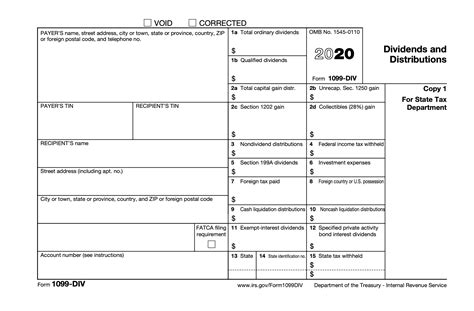

1099-DIV

: Used to report dividend income, such as dividends earned on stocks. -

1099-R

: Used to report distributions from pensions, annuities, and retirement accounts.

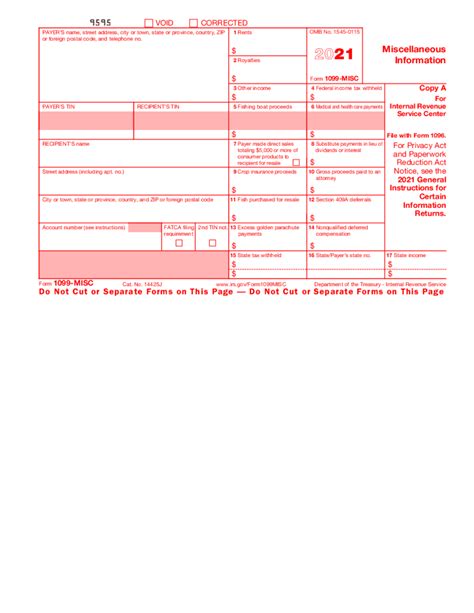

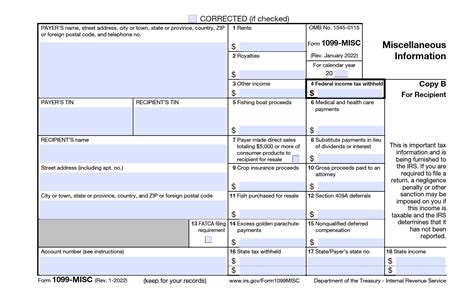

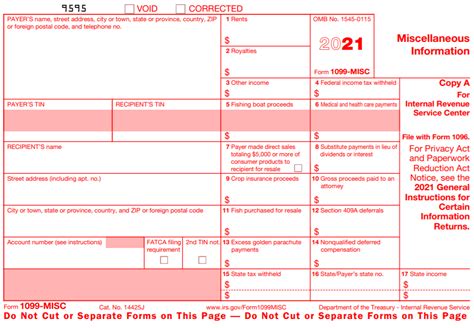

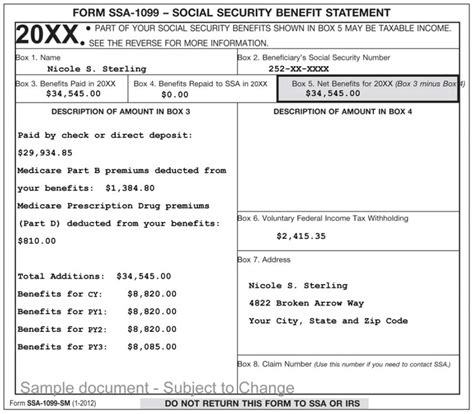

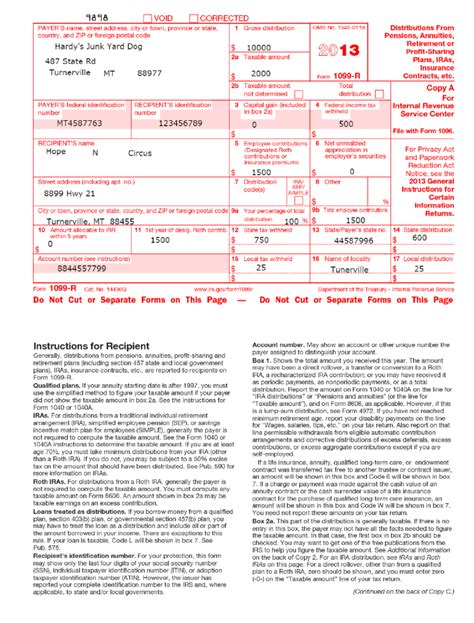

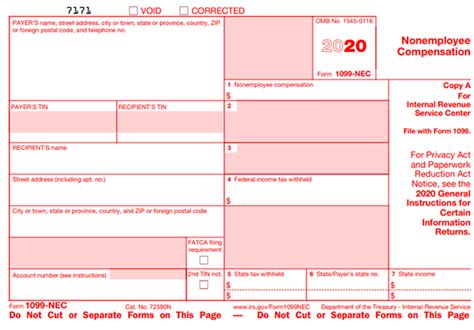

NC 1099 Form Printable Template

The NC 1099 form printable template can be downloaded from the IRS website or obtained from a tax professional. The template typically includes the following information:

-

Payer's Information

: The payer's name, address, and tax identification number (TIN). -

Recipient's Information

: The recipient's name, address, and TIN. -

Payment Information

: The type and amount of payment made to the recipient.

Filing Requirements

The NC 1099 form must be filed with the IRS by January 31st of each year, and a copy must be provided to the recipient by the same date. Failure to file or provide a copy to the recipient can result in penalties and fines.

Filing Options

There are several filing options available for the NC 1099 form, including:

-

E-Filing

: The IRS offers an e-filing option for the NC 1099 form, which can be completed online. -

Paper Filing

: The NC 1099 form can also be filed by mail, using the paper version of the form. -

Third-Party Filing

: Tax professionals and payroll services can also file the NC 1099 form on behalf of the payer.

Penalties for Late Filing

Failure to file the NC 1099 form by the deadline can result in penalties and fines. The IRS imposes penalties for late filing, which can range from $30 to $100 per form, depending on the filing date.

Penalty Structure

The penalty structure for late filing of the NC 1099 form is as follows:

-

$30 per form

: For forms filed within 30 days of the deadline. -

$60 per form

: For forms filed between 31 days and 6 months after the deadline. -

$100 per form

: For forms filed more than 6 months after the deadline.

Conclusion

In conclusion, the NC 1099 form is a critical document for reporting income and payments to the IRS and the recipient. It's essential to understand the different types of 1099 forms, the printable template, and the filing requirements to avoid penalties and fines. By following the guidelines outlined in this article, you can ensure accurate and timely filing of the NC 1099 form.

NC 1099 Form Image Gallery

We hope this article has provided you with a comprehensive understanding of the NC 1099 form, its printable template, and the filing requirements. If you have any further questions or concerns, please don't hesitate to reach out.