Intro

Protect your investments with a comprehensive Secured Promissory Note Template. Learn about the 10 essential clauses to include, such as loan terms, collateral, payment schedules, and default provisions. Ensure a solid foundation for secured lending with these crucial elements, safeguarding your interests and minimizing risks. Download a customizable template today.

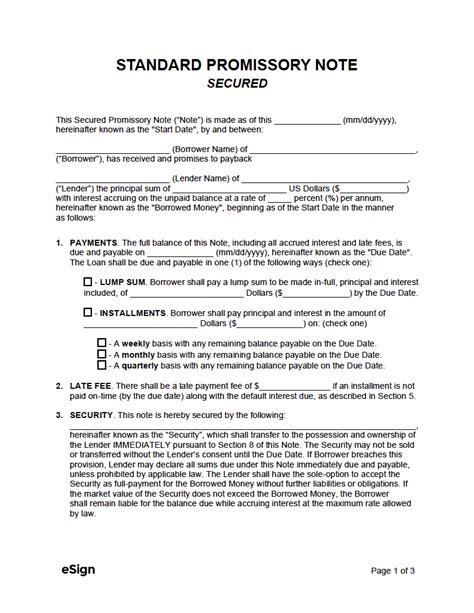

A Secured Promissory Note is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as a promise by the borrower to repay the loan, along with any interest and fees, to the lender. A well-crafted Secured Promissory Note template is crucial to protect the interests of both parties involved. In this article, we will discuss the 10 essential clauses that should be included in a Secured Promissory Note template.

What is a Secured Promissory Note?

A Secured Promissory Note is a type of loan agreement that is secured by collateral, which can be a property, asset, or other valuable item. The collateral serves as a guarantee that the borrower will repay the loan, and if the borrower defaults, the lender can seize the collateral to recover their losses.

10 Essential Clauses for a Secured Promissory Note Template

1. Parties and Contact Information

This clause should clearly identify the lender and borrower, including their names, addresses, and contact information.

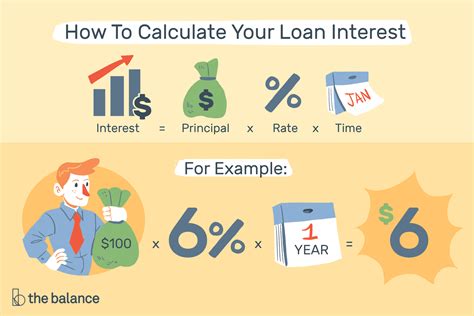

2. Loan Amount and Interest Rate

This clause should specify the amount of the loan, the interest rate, and how the interest will be calculated. The interest rate can be fixed or variable, and the clause should also specify any fees associated with the loan.

3. Repayment Terms

This clause should outline the repayment schedule, including the frequency of payments, the amount of each payment, and the due date for each payment.

4. Collateral

This clause should describe the collateral that secures the loan, including its value, location, and any other relevant details.

5. Default and Acceleration

This clause should specify the events that constitute default, such as failure to make payments or breach of any other term or condition. It should also outline the consequences of default, including acceleration of the loan.

6. Late Payment Fees

This clause should specify the fees that will be charged if the borrower makes late payments.

7. Prepayment

This clause should outline the terms and conditions under which the borrower can prepay the loan, including any prepayment penalties.

8. Amendments and Waivers

This clause should specify how the agreement can be amended or waived, including the requirements for written consent from both parties.

9. Governing Law

This clause should specify the laws of which state or country will govern the agreement.

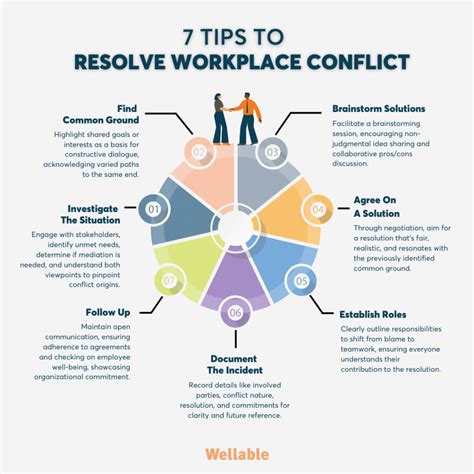

10. Dispute Resolution

This clause should outline the process for resolving disputes between the parties, including arbitration or mediation.

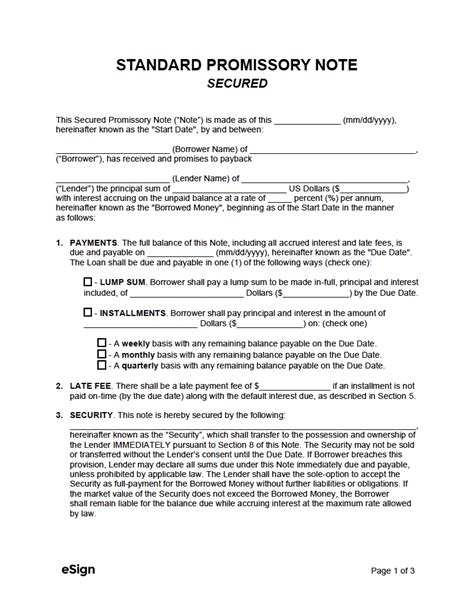

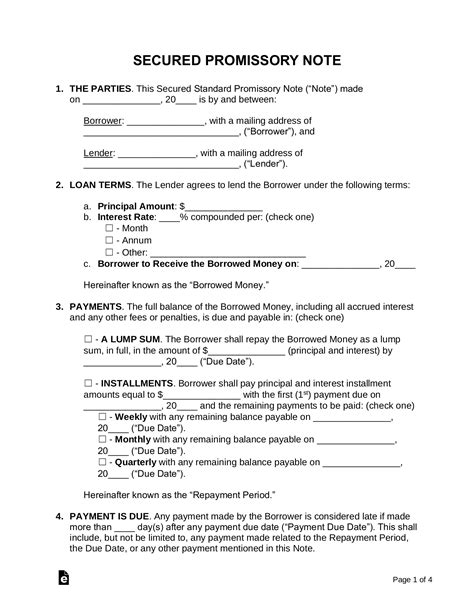

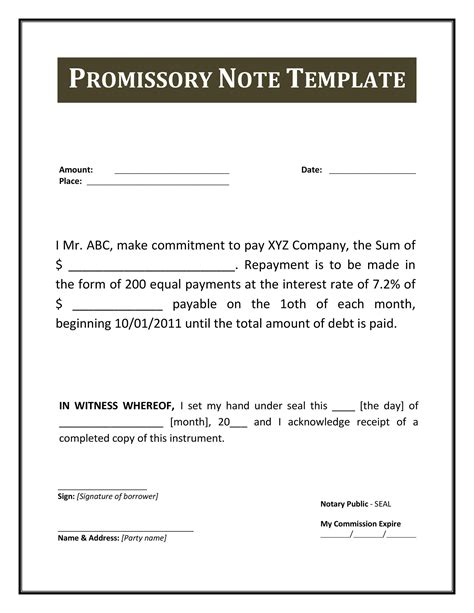

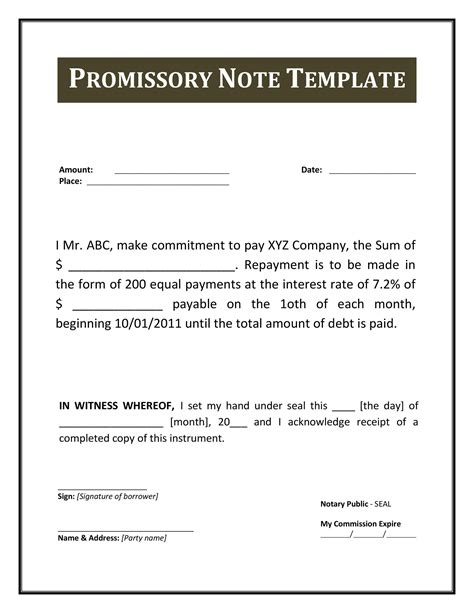

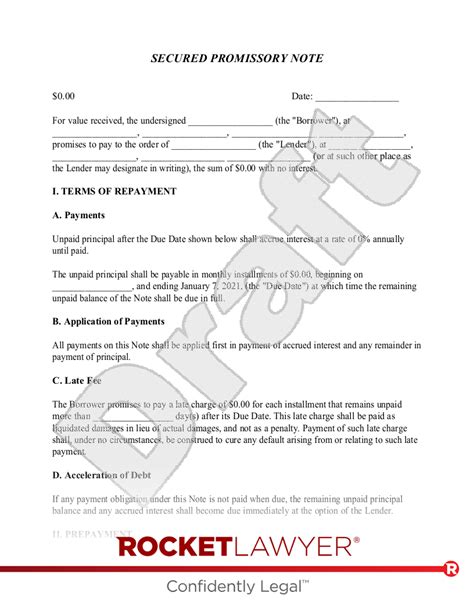

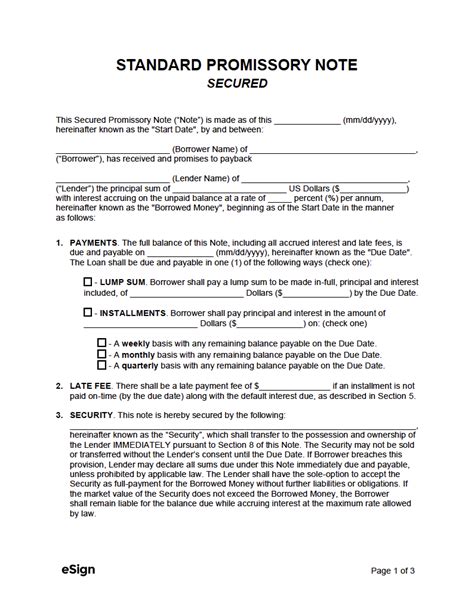

Gallery of Secured Promissory Note Templates

Secured Promissory Note Templates

Frequently Asked Questions

Q: What is the purpose of a Secured Promissory Note? A: The purpose of a Secured Promissory Note is to provide a written agreement between a lender and a borrower that outlines the terms and conditions of a loan.

Q: What are the essential clauses of a Secured Promissory Note template? A: The essential clauses of a Secured Promissory Note template include parties and contact information, loan amount and interest rate, repayment terms, collateral, default and acceleration, late payment fees, prepayment, amendments and waivers, governing law, and dispute resolution.

Q: Can a Secured Promissory Note be used for personal loans? A: Yes, a Secured Promissory Note can be used for personal loans, such as loans between family members or friends.

Conclusion

A well-crafted Secured Promissory Note template is essential to protect the interests of both the lender and the borrower. The 10 essential clauses outlined in this article provide a comprehensive framework for creating a secure and enforceable loan agreement. By including these clauses, parties can ensure that their loan agreement is clear, concise, and legally binding.