Intro

Learn to trade like institutions with expert strategies and insights, utilizing technical analysis, market sentiment, and risk management to maximize profits and minimize losses in institutional trading.

Institutional traders have long been the backbone of the financial markets, providing liquidity and driving market trends. These professional traders, who work for banks, hedge funds, and other financial institutions, have access to vast resources, advanced technology, and a deep understanding of market dynamics. As a result, they are often able to make more informed investment decisions and achieve higher returns than individual traders. For those looking to improve their trading skills and increase their chances of success, learning how to trade like institutions can be a valuable strategy.

One of the key advantages that institutional traders have is their ability to approach the markets with a clear and disciplined mindset. They are not driven by emotions, such as fear and greed, but instead focus on making objective, data-driven decisions. This allows them to stay calm and rational, even in the face of market volatility, and to avoid making impulsive decisions that can lead to losses. Individual traders, on the other hand, often struggle with emotions and may find themselves making trades based on intuition or instinct, rather than careful analysis and planning.

Another important aspect of institutional trading is the use of advanced technology and trading tools. Professional traders have access to sophisticated software and hardware that enables them to analyze large amounts of data, identify trends and patterns, and execute trades quickly and efficiently. They also have access to real-time market data and news feeds, which helps them stay up-to-date with the latest market developments and make informed decisions. Individual traders, while having access to some of these tools, often lack the resources and expertise to use them effectively.

Understanding Institutional Trading Strategies

Institutional traders employ a variety of strategies to achieve their investment objectives. Some of the most common strategies include trend following, mean reversion, and statistical arbitrage. Trend following involves identifying and following the direction of market trends, with the goal of profiting from the continuation of these trends. Mean reversion, on the other hand, involves identifying overbought or oversold conditions in the market and betting on a return to historical means. Statistical arbitrage involves using advanced statistical models to identify mispricings in the market and profiting from the subsequent correction.

Key Characteristics of Institutional Traders

Institutional traders possess certain key characteristics that set them apart from individual traders. Some of these characteristics include: * A deep understanding of market dynamics and trends * Access to advanced technology and trading tools * A disciplined and objective approach to trading * A focus on risk management and capital preservation * A long-term perspective and a willingness to hold trades for extended periodsThe Importance of Risk Management

Risk management is a critical aspect of institutional trading. Professional traders understand that risk is an inherent part of the trading process and that managing risk is essential to achieving long-term success. They use a variety of techniques to manage risk, including position sizing, stop-loss orders, and portfolio diversification. Position sizing involves determining the optimal size of a trade based on the trader's risk tolerance and investment objectives. Stop-loss orders involve setting a price level at which a trade will be automatically closed if it moves against the trader. Portfolio diversification involves spreading investments across different asset classes and sectors to reduce exposure to any one particular market or industry.

Best Practices for Individual Traders

Individual traders can learn from the strategies and techniques employed by institutional traders. Some best practices for individual traders include: * Developing a clear and disciplined trading plan * Using advanced technology and trading tools to analyze markets and execute trades * Focusing on risk management and capital preservation * Taking a long-term perspective and being willing to hold trades for extended periods * Continuously learning and improving trading skills through education and experienceTrading like Institutions: A Step-by-Step Guide

Trading like institutions requires a combination of knowledge, skills, and experience. Here is a step-by-step guide to help individual traders get started:

- Develop a clear and disciplined trading plan: This involves defining investment objectives, identifying market opportunities, and determining risk management strategies.

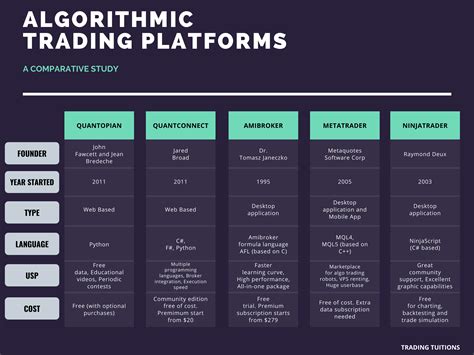

- Choose the right trading platform: This involves selecting a platform that provides advanced technology and trading tools, as well as access to real-time market data and news feeds.

- Learn advanced trading techniques: This involves studying institutional trading strategies, such as trend following, mean reversion, and statistical arbitrage.

- Focus on risk management: This involves using techniques such as position sizing, stop-loss orders, and portfolio diversification to manage risk.

- Continuously learn and improve: This involves staying up-to-date with the latest market developments, attending trading seminars and workshops, and reading trading books and articles.

Common Mistakes to Avoid

Individual traders often make mistakes that can hinder their success. Some common mistakes to avoid include: * Lack of discipline and patience: This involves making impulsive decisions based on emotions, rather than careful analysis and planning. * Inadequate risk management: This involves failing to use techniques such as position sizing, stop-loss orders, and portfolio diversification to manage risk. * Insufficient knowledge and experience: This involves lacking a deep understanding of market dynamics and trends, as well as advanced trading techniques. * Overtrading: This involves making too many trades, which can lead to overexposure to market volatility and increased risk.The Role of Technology in Institutional Trading

Technology plays a critical role in institutional trading. Professional traders use advanced software and hardware to analyze large amounts of data, identify trends and patterns, and execute trades quickly and efficiently. Some of the key technologies used in institutional trading include:

- Algorithmic trading platforms: These platforms use advanced algorithms to analyze markets and execute trades automatically.

- High-frequency trading systems: These systems use advanced technology to execute trades at extremely high speeds, often in fractions of a second.

- Cloud computing: This involves using remote servers and data storage to access and analyze large amounts of data.

- Artificial intelligence and machine learning: These technologies involve using advanced algorithms to analyze data and make predictions about future market trends.

Future of Institutional Trading

The future of institutional trading is likely to be shaped by advances in technology and changes in market dynamics. Some of the key trends that are likely to shape the future of institutional trading include: * Increased use of artificial intelligence and machine learning: These technologies are likely to play an increasingly important role in institutional trading, as they enable traders to analyze large amounts of data and make predictions about future market trends. * Growing importance of cloud computing: Cloud computing is likely to become increasingly important in institutional trading, as it enables traders to access and analyze large amounts of data remotely. * Increased focus on risk management: Risk management is likely to become an increasingly important aspect of institutional trading, as traders seek to manage risk and preserve capital in a rapidly changing market environment.Institutional Trading Image Gallery

In conclusion, trading like institutions requires a combination of knowledge, skills, and experience. By understanding institutional trading strategies, using advanced technology and trading tools, and focusing on risk management, individual traders can improve their chances of success and achieve their investment objectives. Whether you are a seasoned trader or just starting out, learning how to trade like institutions can be a valuable strategy for achieving long-term success in the financial markets. We invite you to share your thoughts and experiences on this topic, and to continue the conversation in the comments section below.